Decrease in Individual Investors' Share in KOSDAQ and Increase in KOSPI This Year

Decline in KOSDAQ Trading Volume Due to Individual Investor Withdrawal

This Year's Stock Price Rise Momentum Focused on Large Caps Like AI and Value-Up

Relative Weakness of KOSDAQ Causes Individual Investor Exit

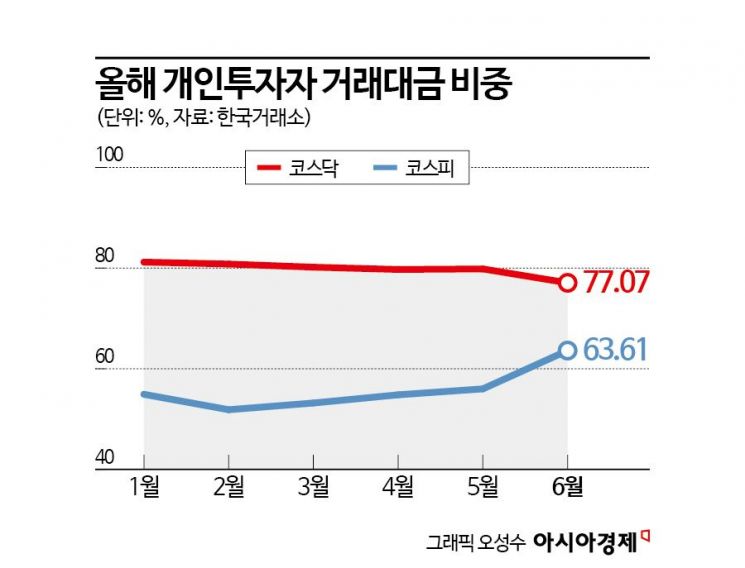

Individual investors are leaving the KOSDAQ and moving to the KOSPI market. This is because the KOSPI has shown relatively better performance compared to the KOSDAQ this year. As a result, the proportion of individual investors in KOSDAQ market trading volume has continuously decreased, while their share in the KOSPI market has increased.

According to the Korea Exchange on the 5th, the proportion of individual investors in KOSDAQ trading volume has been steadily declining this year. The individual share, which was 81.19% in January, dropped to the 80% range in February, fell to 79% in April, and has decreased further to the 77% range this month. This is the lowest level since October last year, when the stock market was undergoing a correction, at 76.12%, which was the all-time lowest level.

On the other hand, the proportion of individual investors in the KOSPI market is on the rise. From the mid-50% range at the beginning of the year, it expanded to 56% last month and has risen to 63% this month. The individual share in KOSPI trading volume exceeding 60% is the first time since April last year. During the COVID-19 period, the individual share expanded to 70%, but it has steadily decreased since then, moving within the 45-60% range last year.

The change in individual investor proportions has also affected the total trading volume in both markets. Due to the outflow of individual investors, the KOSDAQ market's trading volume has shown a declining trend this year. The average daily trading volume rose from the 10 trillion won range in January to the 11 trillion won range in February and March but dropped to the 8 trillion won range in April. It rose back to the 9 trillion won range last month but is moving again in the 8 trillion won range this month. Conversely, the KOSPI market's trading volume was in the 8 trillion won range in January, lower than KOSDAQ, but has consistently maintained the 11 trillion won range since February and has risen to the 12 trillion won range this month.

The reason individual investors are leaving the KOSDAQ and moving to the KOSPI market is attributed to stock prices. This year, the domestic stock market has underperformed compared to major global markets, but the KOSPI's performance has been relatively better than the KOSDAQ. The KOSPI rose 0.26% through June 3, while the KOSDAQ fell 2.39%.

The outflow of individual investors from the KOSDAQ was particularly noticeable last month. On a monthly basis, individual investors, who had maintained a net buying trend in the KOSDAQ this year, turned to net selling last month, with net sales of 120.5 billion won in the KOSDAQ market. Conversely, they made net purchases of 757 billion won in the KOSPI market last month.

The relative underperformance of the KOSDAQ compared to the KOSPI is attributed to the fact that the stock price momentum this year, driven by the strength of artificial intelligence (AI) semiconductors and corporate value-up programs, was concentrated in large-cap stocks. The AI boom led by Nvidia benefited large-cap stocks such as SK Hynix, which supplies high-bandwidth memory (HBM) to Nvidia. The value-up programs acted as a stock price momentum for large-cap stocks that are active in shareholder returns, such as automotive, finance, insurance, and holding companies. In particular, it is expected that the benefits of value-up will gradually expand to small and mid-cap stocks in the KOSPI. Lee Woong-chan, a researcher at Hi Investment & Securities, said, "Foreign buying related to value-up policies has concentrated on large-cap stocks, but if the policy continues, small and mid-cap stocks will also be affected."

The high proportion of growth stocks, which are sensitive to interest rate changes, also contributed to the KOSDAQ's underperformance. There are opinions that a decline in interest rates is necessary for the KOSDAQ's stock price recovery. Kim Byung-yeon, a researcher at NH Investment & Securities, explained, "The market capitalization ranking by sector in the KOSDAQ is in the order of healthcare, semiconductors, IT home appliances (secondary batteries), IT hardware, and software, with a high proportion of growth stocks, so the KOSDAQ valuation is higher than in the past." He added, "For the KOSDAQ to outperform, either the earnings of major KOSDAQ sectors such as healthcare and secondary batteries need to improve faster, or interest rates need to fall significantly." He also added, "Whether the short-selling ban is lifted will also have a significant impact on the KOSDAQ market's supply and demand, so the KOSDAQ is likely to remain in a box range in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.