Status of Overseas Real Estate Alternative Investments as of the End of 2023

Increase of 1.2 Trillion Compared to Q3... Some Sites Face Loss of Benefit of Term

North American Real Estate Accounts for 60%... 10.6 Trillion Maturing by Year-End

As of the end of last year, the scale of overseas real estate alternative investments by domestic financial companies increased by 1.2 trillion KRW compared to the end of the third quarter, and it was confirmed that among the 35.1 trillion KRW invested in single projects (real estate), 2.41 trillion KRW had reasons for loss of benefit of term (EOD).

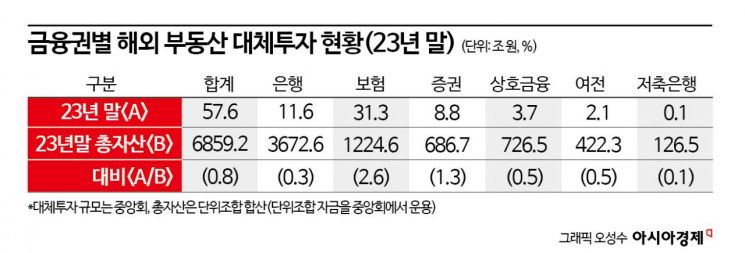

According to the Financial Supervisory Service on the 5th, as of the end of 2023, the balance of alternative investments by financial companies was recorded at 57.6 trillion KRW, an increase of 1.2 trillion KRW from the previous quarter. This accounts for about 0.8% of the total assets in the financial sector. Insurance accounted for 31.3 trillion KRW, representing 54.4% of the total investment scale. Following insurance, banks invested 11.6 trillion KRW (20.2%), securities 8.8 trillion KRW (15.2%), mutual finance 3.7 trillion KRW (6.4%), and credit finance 2.1 trillion KRW (3.6%) in overseas real estate.

By region, North American real estate had the largest share. North American real estate investment was recorded at 34.8 trillion KRW (60.3%), followed by Europe at 11.5 trillion KRW (20.0%), and Asia at 4.2 trillion KRW (7.3%).

Overseas real estate investments maturing by the end of this year amount to 10.6 trillion KRW, accounting for 18.3% of the total balance. By the end of 2026, 16.5 trillion KRW, and by the end of 2028, 12.6 trillion KRW are expected to mature, with 78% of the total alternative investments maturing by 2030.

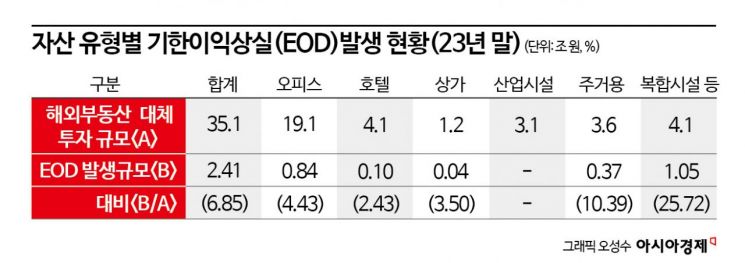

It was also confirmed that projects with EOD reasons based on single project investments accounted for 6.7% of the total. According to the Financial Supervisory Service, among the 35.1 trillion KRW invested in single real estate projects by financial companies, 2.41 trillion KRW had such reasons. The largest EOD scale occurred in complex facilities at 1.05 trillion KRW, with offices and residential properties also confirming EOD reasons of 840 billion KRW and 370 billion KRW respectively.

The Financial Supervisory Service forecasted that although the decline in commercial real estate price indices in the US and Europe is slowing, it is difficult to rule out the risk of further price declines. Accordingly, they plan to strengthen rapid reporting systems and periodic monitoring, as well as review the alternative investment processes of financial companies to enhance internal controls.

Jo Jaehyun, head of the supervision division at the Financial Supervisory Service, explained, "The impact of overseas real estate investment losses on the domestic financial system is limited," but added, "We will induce appropriate loss recognition and sufficient loss absorption capacity for financial companies' overseas real estate alternative investments and also enhance the financial companies' own risk management capabilities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.