Q1 Food Manufacturing Employment 304,559

Regular Worker Ratio 92.0%...Down 0.2%P YoY

Q2 Food Industry Outlook Expected to Improve Due to Environmental Factors and Business Expansion

Despite challenging conditions such as the global economic recession, the number of employees in the domestic food manufacturing industry in the first quarter of this year slightly increased, marking the highest level in the past five years.

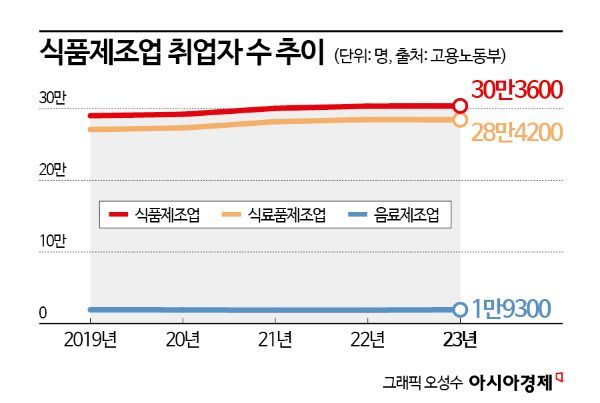

According to the Ministry of Employment and Labor on the 5th, the number of employees in the food manufacturing industry in the first quarter of this year was 304,559, a 0.7% increase compared to the same period last year, recording the highest figure among the first quarters of the past five years (2020?2024). Among them, the number of employees in the food manufacturing sector was 261,600, up 0.6% from the same period last year, and the number of employees in the beverage manufacturing sector was 19,500, up 2.3% from the same period last year.

The Korea Consumer Agency announced that, as a result of investigating shrinkflation in processed foods managed by Chamgagyeok and products mentioned in media reports, the volume of 37 products across 9 categories has actually decreased over the past year. The photo shows two packs of Baeksul Grill Vienna displayed at Hanaro Mart Yangjae branch in Seocho-gu, Seoul, on the 13th. Photo by Jinhyung Kang aymsdream@

The Korea Consumer Agency announced that, as a result of investigating shrinkflation in processed foods managed by Chamgagyeok and products mentioned in media reports, the volume of 37 products across 9 categories has actually decreased over the past year. The photo shows two packs of Baeksul Grill Vienna displayed at Hanaro Mart Yangjae branch in Seocho-gu, Seoul, on the 13th. Photo by Jinhyung Kang aymsdream@

The number of employees in the food manufacturing industry has shown an increase of around 1% annually since surpassing 300,000 in 2021 with a 3.1 percentage point increase from the previous year. Last year, the average number of employees was 303,600, slightly up from 303,300 a year earlier. The number of employees in the food manufacturing sector decreased by 0.1% to 284,200 compared to the previous year, while the beverage manufacturing sector saw a 3.1% increase to 19,300 employees.

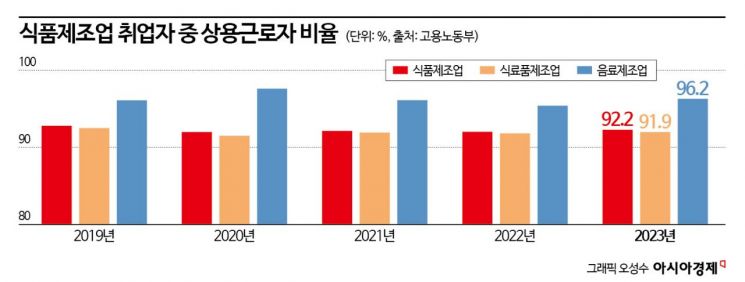

Despite the increase in the number of employees in the food manufacturing industry in the first quarter, the proportion of regular workers fell by 0.2 percentage points to 92.0% compared to the end of last year. Both the food manufacturing and beverage manufacturing sectors saw a decrease in the proportion of regular workers; the food manufacturing sector’s regular worker ratio dropped by 0.1 percentage points to 91.8%, and the beverage manufacturing sector’s ratio fell by 0.2 percentage points to 96.0% compared to the previous year.

The Producer Price Index, which can affect companies’ cost increases, showed a rise compared to the same period last year. In the first quarter of this year, the Producer Price Index for the food manufacturing and beverage manufacturing sectors increased by 1.1% and 2.8%, respectively, compared to the same period last year. The Producer Price Index for the food manufacturing sector was 123.0, showing a slight increase of 1.1% from 121.6 in the same period last year, while the beverage manufacturing sector’s index rose 3.0% from 110.5 to 113.8.

However, along with the strong performance of the food industry in the first quarter and the forecast for economic improvement in the second quarter, there are expectations that the growth trend in the number of employees in the industry will improve compared to before. According to the Food Industry Business Condition Index survey, the economic outlook index for the second quarter of this year is 104.9, indicating an expected improvement in the economy compared to the previous quarter. Although the overall economic status index for the first quarter of this year was 92.4, slightly improved from 88.3 in the previous quarter, many companies still felt the economic downturn. Nevertheless, the economic outlook index for the second quarter was 104.9, showing that many companies expect the economy to improve in the next quarter.

In the first quarter of this year, sectors such as noodle-like products, fermented liquor, non-alcoholic beverages, and lunch boxes were diagnosed with favorable economic conditions due to increased sales including exports. However, most sectors such as distilled liquor, oil manufacturing, and other food products experienced somewhat worsened economic conditions due to economic recession factors like rising prices, interest rates, exchange rates, and difficulties in raw material supply. Nevertheless, the second quarter is expected to see economic improvement in most sectors due to increased transactions and consumption driven by environmental factors such as raw material crop conditions, climate, and weather, as well as business expansion through new product launches and market development.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.