April Cumulative Processed Food Exports Reach $2.63 Billion

Up 8.6% YoY... Growth Driven by Increased Awareness and Expanded Export Regions

Rice Processed Food Exports Surge 42%... Strong Performance in the United States

Exports of K-food continue to sail smoothly. From ramen to gimbap, tteokbokki, and instant rice, global awareness and preference for K-food are steadily rising, leading to new records in processed food exports this year as well.

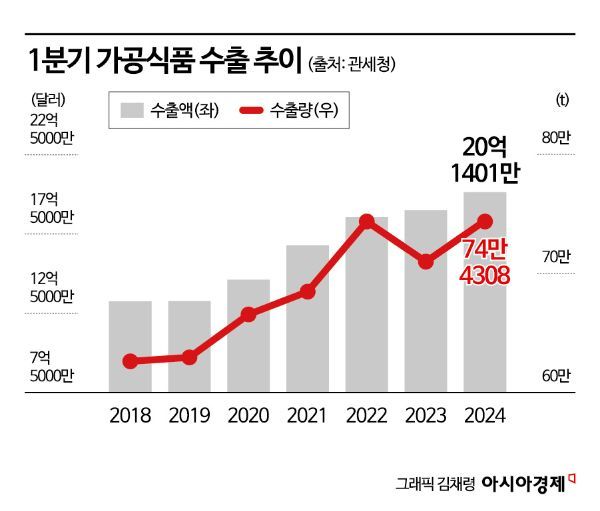

According to customs export-import trade statistics on the 4th, the export value of processed foods in the first quarter of this year was $2.01401 billion (approximately 2.78 trillion KRW), a 6.0% increase compared to the same period last year ($1.902 billion). The first-quarter export value of processed foods, which was around $1.32734 billion in 2019, surpassed $1.4 billion the following year, continued strong growth with $1.67973 billion in 2021 and $1.85788 billion in 2022, and exceeded $2 billion for the first time this year.

Based on the first quarter of this year, processed food items with the largest export growth compared to the same period last year were rice processed products including gimbap (61.3%), ramen (30.0%), gim (seaweed) (18.9%), and canned tuna (15.8%). Riding on the popularity of K-content, the recognition and status of K-food have also risen. Recently, frozen gimbap and rice processed products have gained significant popularity through word of mouth on social networking services (SNS), which is believed to have influenced this trend. Additionally, the easing of the European Union (EU)'s import restrictions on Korean ramen last year also contributed to the export growth.

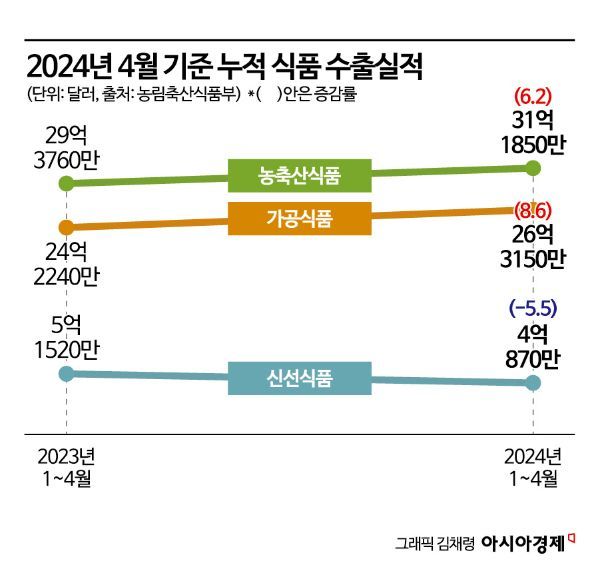

K-food exports continue to sail smoothly into the second quarter. As of April this year, the cumulative export value of agricultural and food products was $3.1185 billion (approximately 4.3 trillion KRW), a 6.2% increase compared to the same period last year ($2.9376 billion). Fresh food exports decreased by 5.5%, from $515.2 million to $487 million, but processed food exports led the growth, rising 8.6% from $2.4224 billion to $2.6315 billion.

Looking at individual items, ramen maintained a fierce momentum. As of April this year, ramen export value was $378.9 million (approximately 520 billion KRW), a 34.4% increase compared to the same period last year ($281.8 million). Younghoon Joo, a researcher at NH Investment & Securities, analyzed, “It is judged that foreigners’ preference for ramen itself is increasing. Since ramen has started to be stocked in local retail stores not only in Asia and the U.S. but also in Europe, the growth trend is unlikely to slow down for the time being.” Despite the high growth last year, ramen continues to grow rapidly, with sales generated through overseas local subsidiaries also steadily increasing, not just exports.

Besides ramen, exports of snacks increased by 9.9% to $227.4 million (approximately 310 billion KRW) compared to the same period last year, and beverages also rose 15.9% to $211.7 million (approximately 300 billion KRW). Additionally, exports of rice processed foods such as tteokbokki and gimbap increased by 42.1% to $88 million (approximately 110 billion KRW), recording a high growth rate despite the relatively small scale.

Regionally, the U.S. showed remarkable progress. As of April this year, exports of Korean agricultural and food products to the U.S. amounted to $478.7 million, a 15.9% increase compared to the same period last year ($413.1 million). In contrast, exports to China decreased by 1.8% to $439.9 million. Over the past three years, processed food exports to the U.S. have grown at an average annual rate of 12%, while exports to China increased by only 7% during the same period. China was the most important export market in 2016, accounting for 23% of processed food exports, but its share began to decline after the deployment conflict over the Terminal High Altitude Area Defense (THAAD), dropping to 18% last year. Meanwhile, the U.S. export share rose significantly from 12% in 2016 to 18% last year.

Meanwhile, the import value of processed foods in the first quarter of this year was $4.18 billion, a 5.8% decrease compared to the same period last year ($4.43 billion). By product group, imports of dairy products (-30.7%), edible oils (-22.6%), and flour milling products (-20.8%) decreased, leading to the overall decline in imports. This is believed to be mainly due to the price drop of international grains such as soybeans and wheat.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)