Korea Insurance Research Institute Report on 'Analysis of Recent Factors Affecting Automobile Insurance Loss Ratios'

A study has found that the loss ratio of automobile insurance for insurance companies is likely to worsen in the future regardless of company size. There are calls to strengthen the differentiated application of insurance premiums based on risk levels, as this could lead to future premium increases.

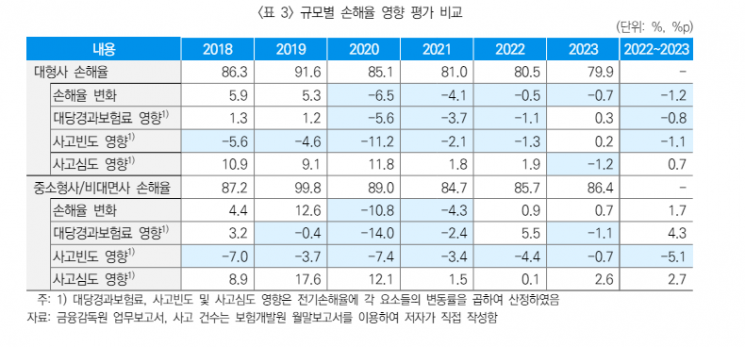

According to the report "Analysis of Recent Factors Affecting Automobile Insurance Loss Ratios" by the Korea Insurance Research Institute on the 12th, large companies have shown slight improvement in performance along with an expansion of market share recently, while small and medium-sized companies and non-face-to-face companies have experienced some deterioration, showing differing trends. Specifically, the loss ratio for large companies decreased by 1.2 percentage points in 2023 compared to 2021, whereas for small and medium-sized companies and non-face-to-face companies, it increased by 1.7 percentage points.

Evaluation and Comparison of Loss Ratio Impact by Insurance Company Size. Source: Korea Insurance Research Institute

Evaluation and Comparison of Loss Ratio Impact by Insurance Company Size. Source: Korea Insurance Research Institute

For overall automobile insurance, from 2022 to 2023, the elapsed premium per vehicle and accident severity were factors that worsened the loss ratio, while accident frequency mainly acted as a factor improving the loss ratio.

Due to premium reductions for two consecutive years recently, the elapsed premium per vehicle has somewhat increased the loss ratio, and the effect of premium reductions is expected to be gradually reflected this year as well. The accident occurrence rate has shown a steady decline due to advancements in vehicle technology and increased traffic safety awareness, and it is highly likely to continue improving in the future.

When looking at insurance companies by size, these factors appear to be differentiated. From 2022 to 2023, large companies saw a decrease in loss ratio due to the effects of elapsed premium per vehicle and accident frequency, whereas small and medium-sized companies experienced deterioration, leading to an expanded loss ratio. Additionally, although the accident occurrence rate decreased, the combined effect of increased accident severity and premium reductions resulted in worsening loss ratios for small and medium-sized companies and non-face-to-face companies.

Researchers Ji-yeon Cheon and Seok-hee Lim, who authored the report, analyzed, "The recent premium reductions were mainly implemented for personal automobile insurance, so small and medium-sized companies with a relatively high proportion of personal insurance appear to have been more significantly affected in terms of loss ratio."

According to the report, if the effects of premium reductions are gradually reflected and the trend of increasing accident severity continues, the overall loss ratio of non-life insurance companies is likely to rise.

Researchers Ji-yeon Cheon and Seok-hee Lim suggested, "Since the worsening of automobile insurance loss ratios could lead to future premium increases, it will be necessary to have environmental and institutional support for applying insurance rates that reflect risk, inducing accident reduction, and suppressing insurance leakage. Strengthening differentiated premium application for low-risk and high-risk drivers, and improving payment systems that could cause moral hazard, are needed to prevent increased insurance payouts from being passed on to honest consumers. Continuous efforts for institutional improvements will be required going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)