Q1 Domestic Banks' Non-Performing Loan Ratio at 0.5%... Up 0.03%p from Previous Quarter

Personal Business Owners' Non-Performing Loan Ratio Surpasses 0.4% for First Time Since Q3 2017

The non-performing loan (NPL) ratio for individual business owners at domestic banks in the first quarter of this year exceeded 0.4% for the first time in six and a half years since the third quarter of 2017. As more self-employed individuals fail to repay their loans, attention is focused on whether this will become a new risk factor for the banking sector.

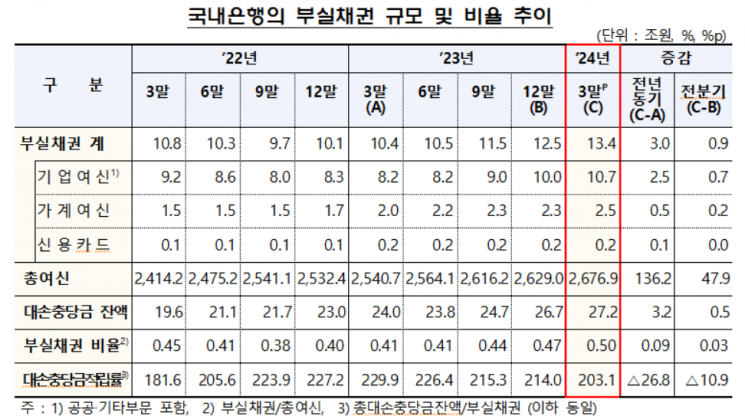

According to the "Status of Non-Performing Loans at Domestic Banks" released by the Financial Supervisory Service on the 31st, the NPL ratio of domestic banks in the first quarter of this year was 0.5%, up 0.03 percentage points from the previous quarter (0.47%). Compared to the first quarter of last year (0.41%), it rose by 0.09 percentage points.

Looking at the NPL ratio by sector, corporate loans rose 0.02 percentage points from the previous quarter to 0.61%. Among them, large corporate loans decreased by 0.02 percentage points to 0.48%, but small and medium-sized enterprise (SME) loans increased by 0.05 percentage points to 0.69%. Within SME loans, loans to individual business owners rose 0.07 percentage points from the previous quarter to 0.41%. This is the first time since the third quarter of 2017 (0.42%) that the NPL ratio for individual business owner loans has exceeded 0.4%. Loans to small and medium-sized corporations increased by 0.04 percentage points to 0.89%.

The NPL ratio for household loans was 0.27%, up 0.02 percentage points from the previous quarter (0.25%). During the same period, mortgage loans rose 0.02 percentage points to 0.18%, and other credit loans increased by 0.06 percentage points to 0.47%.

The NPL ratio for credit card receivables rose 0.25 percentage points from the previous quarter (1.36%) to 1.61%.

Newly generated NPLs in the first quarter amounted to 4.5 trillion won, down 1.2 trillion won from the previous quarter (5.7 trillion won). Compared to the first quarter of last year (3 trillion won), it increased by 1.5 trillion won. New corporate loan NPLs were 3.1 trillion won, down 1.3 trillion won from the previous quarter (4.4 trillion won). Among these, large corporations accounted for 300 billion won, a decrease of 800 billion won, and SMEs accounted for 2.8 trillion won, down 400 billion won. New household loan NPLs were 1.2 trillion won, similar to the previous quarter (1.1 trillion won).

The scale of NPL disposals in the first quarter was 3.5 trillion won, down 1.2 trillion won from the previous quarter (4.7 trillion won). Compared to the same period last year (2.7 trillion won), it increased by 800 billion won.

An official from the Financial Supervisory Service explained, "The increase in the NPL ratio of domestic banks in the first quarter is due to a decrease in the scale of NPL disposals despite a reduction in new NPLs," adding, "The NPL ratio has been rising since hitting a low of 0.38% in September 2022 amid the global low-interest-rate environment caused by COVID-19, but it remains significantly lower compared to the end of 2019 (0.77%)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.