Poor Performance for 5 Months After KOSDAQ Listing in November Last Year

Stock Price Rebounds 61% This Month

Benefiting from Production of UV Protection Materials

As the global sunscreen market is expected to grow rapidly, related stocks are showing strong performance. The stock prices of sunscreen cosmetic manufacturers such as Sunjin Beauty Science and Englewood Lab have risen by about 60-70% since the beginning of this month. Aestek, which was listed in November last year, had been on a downward trend for five months after hitting its highest price on the first day of listing, but has rebounded this month. It is interpreted that the company is benefiting from the market growth by producing sunscreen raw materials.

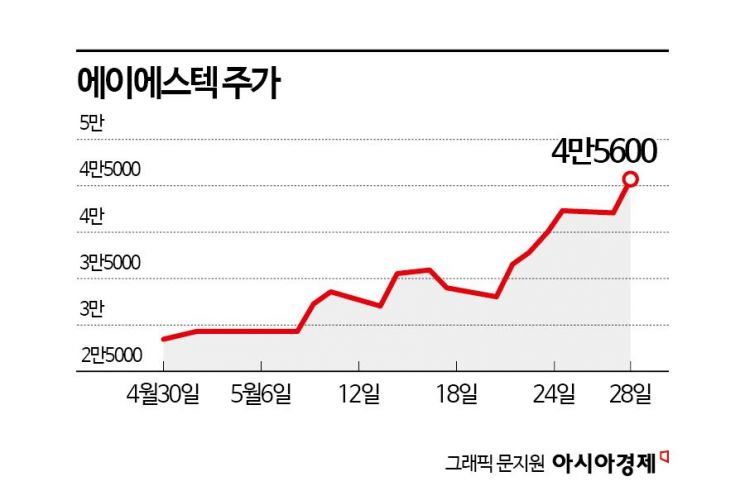

According to the financial investment industry on the 29th, Aestek's stock price has risen 61.4% since the beginning of this month. Its market capitalization has exceeded 250 billion KRW.

Aestek entered the KOSDAQ market on November 28 last year with a public offering price of 28,000 KRW. On the first day of listing, the price rose to 96,500 KRW but closed at 70,100 KRW. Afterward, the stock price declined and fell to 27,000 KRW on the 23rd of last month. The stock price has continued to be sluggish, but as domestic cosmetic companies' stock prices rose due to expectations of growth in the sunscreen market, Aestek's stock price is also rebounding.

Founded in 2005, Aestek is a company that produces sunscreen raw materials. Recognized for its performance, it has secured top-tier companies in the sunscreen raw material market as clients. In November last year, it signed a five-year exclusive supply contract with the global chemical company DSM. It can produce 12 million tons annually and is investing in capacity expansion.

The company produces organic compounds such as DHHB, used as a UV filter, and TDSA, used as a photostable UV filter. These are used in sunblock formulations and have antioxidant properties that help protect the skin. They are stable and highly efficient, mainly included in high-priced sunscreens. Although TDSA itself has not yet received approval from the U.S. Food and Drug Administration (FDA), it is a sunscreen ingredient that can be prescribed as an over-the-counter (OTC) ingredient in sunscreen formulations. Besides its UV filtering properties, TDSA is known to have antioxidant effects, helping to protect the skin from damage caused by reactive oxygen species.

According to market research firm Research And Market, the sunscreen material market is expected to grow from $11.4 billion in 2021 to $17.6 billion in 2027, with a compound annual growth rate of 7.5%. As the sunscreen material market grows, Aestek's sales are also increasing. Last year, the company recorded sales of 47.3 billion KRW and operating profit of 9.2 billion KRW. Compared to the previous year, sales increased by 47% and operating profit by 103%. The company explained that sales and operating profit increased as outdoor activities became more active after the COVID-19 pandemic.

Jodaehyung, a researcher at DS Investment & Securities, said, "With the full-scale supply to DSM starting, sales this year are expected to exceed 60 billion KRW," adding, "We also expect an improvement in profit margins through production internalization by expanding production capacity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)