Financial Supervisory Service Grants Voluntary Correction Period Until July

Kim, an insurance planner affiliated with corporate insurance agency (GA) Company A, experienced financial difficulties due to poor sales performance. As a result, Kim and nine other planners used the names of family members and acquaintances to enter into 493 false or fabricated contracts over three years starting in 2018. Their actions were uncovered during an inspection by the Financial Supervisory Service (FSS), leading to cancellation of registration, fines, and suspension of business. Company A was also fined 100 million won.

The FSS announced on the 27th that from 2020 to last year, over four years, it detected violations of contract prohibition by GAs and imposed fines totaling 5.55 billion won and business suspensions ranging from 30 to 60 days. Affiliated employees and planners faced measures including cancellation of registration, fines ranging from 500,000 to 35 million won, and business suspensions from 30 to 180 days.

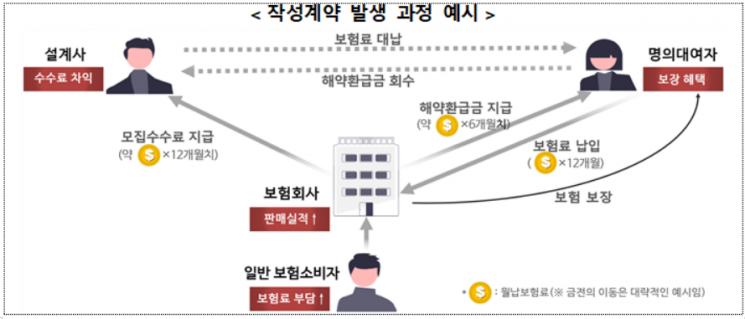

A fabricated contract refers to an insurance contract made by borrowing the name of another person (the named individual), such as family or acquaintances, during the insurance solicitation and contracting process, or a false or fabricated insurance contract made without the consent of the named individual. The Insurance Business Act strictly prohibits such fabricated contracts as illegal acts.

Fabricated contracts mainly arise from GAs and planners pursuing short-term performance and commission-centered product sales practices. Through fabricated contracts, GAs and planners gain recruitment commission profits, and insurance companies see increased sales performance. The named individuals (policyholders) enjoy insurance benefits without paying premiums themselves. However, the unfair benefits gained through fabricated contracts are passed on as factors causing premium increases for general insurance consumers who are unrelated to the illegal acts.

The financial authorities impose monetary sanctions (fines) or institutional and status sanctions (such as cancellation of registration) on fabricated contract solicitation activities, considering the degree of illegality and impropriety. Under the Insurance Business Act, a fine of up to 10 million won can be imposed per violation of fabricated contracts. Cancellation of registration and business suspension of up to six months can also be imposed.

The FSS plans to operate a voluntary correction period until July to allow the insurance industry to self-inspect and rectify illegal activities. After the voluntary correction period, fabricated contract allegations detected will be strictly sanctioned, considering the seriousness of the illegal acts.

An FSS official stated, "We plan to focus inspection capabilities more on eradicating unhealthy and illegal acts such as fabricated contracts in the future," adding, "We will establish a special inspection team to check serious market-disturbing acts that undermine sound insurance solicitation order and the interests of insurance consumers, thereby restoring market order."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.