Record High Performance of Top 5 Non-Life Insurers in Q1 This Year

Behind Strong Results: Increasing Initial Amortization Rate of CSM

Financial Authorities Begin Improvements on Discount Rates and More

In the first quarter of this year, all five major domestic non-life insurance companies posted record quarterly earnings, sparking controversy over the method of calculating the insurance contract service margin (CSM) amortization rate. There are concerns that the amortization rate, which is applied to the CSM recorded as a liability in accounting and amortized (converted) into profit over several years, can be front-loaded to inflate initial earnings by using a higher rate early on and a lower rate later. Financial authorities have begun reviewing reasonable methods for calculating the amortization rate.

CSM: A Key Profit Indicator under the IFRS17 System

CSM refers to the present value of the unrealized profits that an insurer is expected to earn in the future from its insurance contracts. It is calculated based on various assumptions such as loss ratio, lapse rate, and discount rate. Since the adoption of the new International Financial Reporting Standard (IFRS17) last year, it has been recognized as a major long-term profitability indicator for insurers.

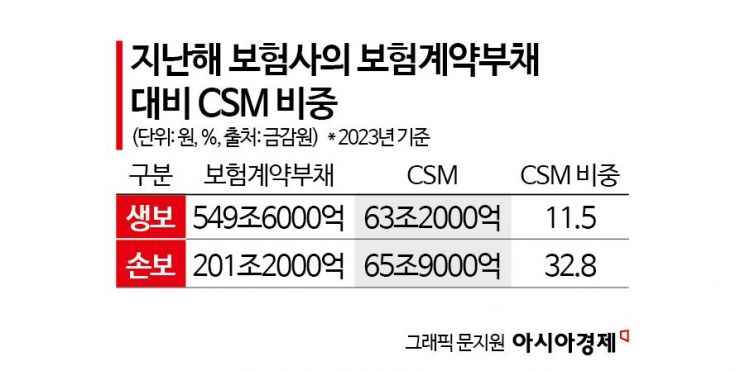

The CSM secured by insurers through selling insurance is initially recorded as a liability in accounting. Then, each quarter, an amortization rate is applied to convert it into profit. Insurers' profits are broadly divided into underwriting profit and investment profit, with most underwriting profit generated through CSM amortization. Last year, the amortization amount of CSM for life and non-life insurers was KRW 12.7 trillion, accounting for 78.3% of pre-tax profit (KRW 16.2 trillion).

The CSM amortization rate varies by insurer because each company has different product contract structures. Large insurers generally have rates between 8% and 13%. The Financial Supervisory Service (FSS) projected this year’s annualized CSM amortization rates at 8.5% for life insurers and 9.8% for non-life insurers. The amortization rate is also related to the maturity of insurance products. For example, if a specific insurance product has a CSM of 100 and an average amortization rate of 10%, it means the CSM will be fully amortized within 10 years. Under the same conditions, an average amortization rate of 5% means amortization will occur over 20 years.

Discount Rate Causes Amortization Rate Imbalance... Burdening Future Management with Earnings

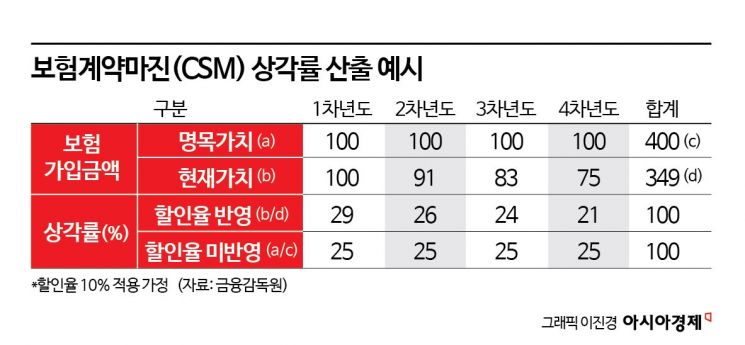

The problem is that the discount rate applied when insurers amortize CSM tends to increase the initial amortization rate. The discount rate is the rate used to convert future cash inflows into present value. For example, if a CSM of 100 is amortized over four years applying an annual discount rate of 10%, the amortization proportions could be 29% in the current year, 26% in 2025, 24% in 2026, and 21% in 2027. Without applying the discount rate, the amortization would be evenly distributed at 25% each year over four years. Under IFRS17 regulations, whether to apply the discount rate is at the insurer’s discretion.

From a management perspective, executives prefer better performance during their tenure. By recognizing profits early, they can increase bonuses and dividends, gaining approval from employees and shareholders and being regarded as successful managers. However, this fundamentally causes company profits to trend downward, shifting the burden to future executives and employees. If new contracts increase to offset the declining profits, it might be manageable, but failure to do so could quickly destabilize earnings.

This also leads to product concentration. To raise the CSM amortization rate in the short term, insurers tend to sell products with short premium payment periods and long coverage periods. The overheated competition in refund rates for short-term payment whole life insurance at the beginning of this year was due to this reason. Insurers gave high incentives to agents who sold many such products, and agents recommended similar products to customers. If this situation repeats, consumers’ choices narrow and the possibility of mis-selling inevitably increases. Professor Han Seung-yeop of Ewha Womans University pointed out, "The excessive discount rate and early amortization of CSM structurally overstate insurers’ financial performance in the early stages of IFRS17 implementation," adding, "Excessive cash outflows should be avoided based on performance indicators that rely heavily on estimates."

Financial Authorities Review Improvements to CSM Amortization Rate

Financial authorities have started efforts to improve the method of calculating the amortization rate. They are pursuing a plan to gradually lower the high discount rate, which causes amortization rate imbalance, by 2027. The discount rate proposed by the FSS this year is 4.55% (long-term forward rate), still higher than the 3.32% yield on 30-year government bonds. An industry insider explained, "If the discount rate is higher than the market’s real interest rate, insurance liabilities decrease significantly and capital increases, which can inflate the CSM," adding, "The European Union (EU) had a long-term forward rate of 4.2% before 2017, but it has recently dropped to 3.45%."

Financial authorities are also considering the option of not applying the discount rate at all to achieve even amortization if the CSM amortization rate issue worsens. Regarding this, an insurance company official said, "Since the time value of money differs, it is natural to apply a discount rate when reflecting future value into present value," adding, "If the discount rate is not applied, it could conflict with other accounting treatments such as asset valuation, causing problems." However, some argue that regardless of whether the discount rate is applied, the total profit of insurers remains the same, calling it a 'shell game.' Researcher Lim Hee-yeon of Shinhan Investment Corp. said, "Even if the accounting method changes to reduce initial CSM amortization profit, the ultimate CSM size and intrinsic corporate value will have limited variation," explaining, "The total insurance profit and loss over the entire insurance period remains unchanged, and only the timing of amortization rates changes, so the actual profit impact is a shell game." Researcher Kim Do-ha of Hanwha Investment & Securities also said, "Whether the discount rate is applied or not, the CSM balance does not change, so total profit over the period is the same," adding, "Even if the discount rate is removed, the impact will differ depending on whether it is applied uniformly or gradually."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.