Curacle Hits Lower Limit After Receiving Notice to Return Technology Transfer Rights

Concerns Over Worsening Investor Sentiment Due to Curacle's Negative News Following HLB

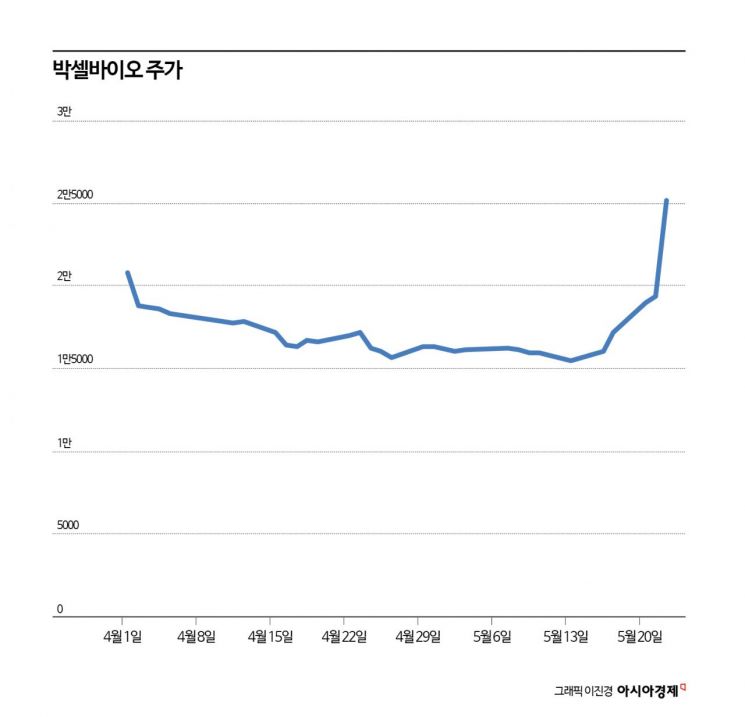

VaxcellBio Hits Upper Limit on Hepatocellular Carcinoma Treatment Effectiveness

Despite HLB's new drug approval failure, the bio sector in the domestic stock market continues to attract investors' attention. Curacle's stock price plummeted after receiving a notice of intention to return rights for technology transfer, while Bacsellbio surged following the release of clinical phase 2a results for its hepatocellular carcinoma treatment. As various issues emerged among bio companies, the fortunes of individual stocks diverged.

According to the financial investment industry on the 23rd, Curacle's stock price fell to the daily limit the previous day.

Curacle received a notice of intention to return rights for the retinal vascular disease treatment (CU06) technology transfer from Thea Open Innovation. CU06 is a vascular endothelial dysfunction blocker being developed for diabetic macular edema and wet age-related macular degeneration. In October 2021, overseas rights excluding Asia were transferred to the French ophthalmology specialist company Thea Open Innovation.

Curacle plans to continue subsequent clinical trials regardless of the rights return. A company official stated, "The clinical phase 2a trial of CU06 confirmed vision improvement effects and safety."

Seogeunhee, a researcher at Samsung Securities, analyzed, "CU06 is an oral product with higher dosing convenience compared to competing products," adding, "Although the reason for contract return was not mentioned, considering the R&D costs to be incurred in the future, the maximum corrected visual acuity change by dosage is somewhat disappointing compared to competing drugs." He further added, "It is expected that the lack of improvement in the primary endpoint was also a disappointing factor."

Following HLB, the news of Curacle's rights return raised concerns about a contraction in investment sentiment toward the bio sector. Meanwhile, after Bacsellbio announced its phase 2a clinical results the previous afternoon, responses varied according to individual stock issues.

On the previous day at around 1:47 PM, Bacsellbio disclosed the results of the "Clinical phase 2a study of combined natural killer cell and hepatic arterial infusion chemotherapy treatment in patients with advanced hepatocellular carcinoma" through a public announcement. The clinical trial was conducted from October 2019 to September last year, and the final clinical phase 2a report (CSR) is planned to be submitted to the Ministry of Food and Drug Safety. Bacsellbio's stock price surged to the daily limit.

Bacsellbio's hepatocellular carcinoma treatment, combining autologous NK cell therapy and HAIC chemotherapy, was tested in a clinical trial involving 17 patients with advanced hepatocellular carcinoma unresponsive to existing treatments. Among the analyzed patients, 3 (18.75%) showed complete response, and 8 (50.00%) showed partial response, resulting in a disease control rate of 100%.

There was also an extension effect on progression-free survival (PFS), the period during which cancer does not recur. The average PFS with existing treatments was 8.8 months, but Bacsellbio's treatment approximately doubled this duration. Based on these encouraging clinical results, Bacsellbio plans to continue research and development to expand indications to other cancer types such as small cell lung cancer and pancreatic cancer.

Appclon’s stock also surged more than 10% after obtaining a U.S. patent for its Affibody zipper switch substance. The Affibody zipper switch is used in the switchable CAR-T (zCAR-T) platform to regulate CAR-T cell activation. A company official introduced, "Affibody is a substance used in Appclon's bispecific antibody platform AffiMap," adding, "It is stable in vivo and has high productivity." He further added, "It is a core technology independently developed by Appclon to overcome the limitations of existing CAR-T cell therapies in treating solid tumors."

A financial investment industry official explained, "Investor fortunes in the bio sector are diverging," adding, "As active selection is underway across the sector, it is necessary to check individual issues when investing." He further added, "It is difficult to predict clinical or approval results," and "Investors should adjust their portfolio weights considering risk factors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)