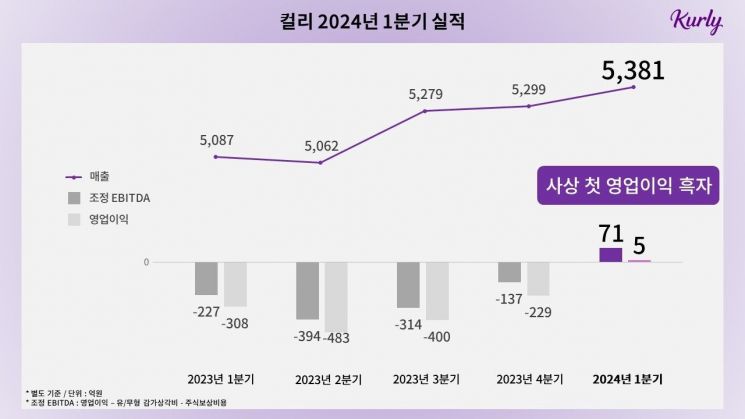

Q1 Operating Profit 500 Million KRW, Sales 538.1 Billion KRW

Operating Profit Turns Positive... 31.4 Billion KRW Improvement

"Plan to Re-pursue IPO at a Good Timing"

Kurly announced on the 21st that it recorded a quarterly operating profit surplus for the first time in its history in the first quarter of this year. Sales also reached an all-time high on a quarterly basis.

According to Kurly's quarterly report disclosed on the same day, Kurly's standalone operating profit for the first quarter of this year was 525.7 million KRW. This is the first time Kurly has recorded a quarterly operating profit surplus since its establishment in 2015, marking nine years. Compared to the same period last year, operating profit improved by 31.4 billion KRW, turning positive.

Sales during the same period also reached a record high of 538.1 billion KRW, representing a 6% increase compared to the same period last year.

On a consolidated basis, Kurly significantly reduced its operating loss. The consolidated operating loss, including subsidiaries, was 187.6 million KRW in the first quarter of this year, down 99.4% from 30.545 billion KRW last year. Consolidated sales during the same period were 539.2 billion KRW, a 5.8% increase from 509.6 billion KRW in the first quarter of last year.

Kurly explained that achieving this operating profit surplus was possible due to improvements in the profit and loss structure. Since last year, Kurly has focused on diversifying revenue sources and reducing transportation and commission costs. In fact, costs including transportation and commissions amounted to 63.8 billion KRW in the first quarter of this year, a 6% decrease compared to the same period last year. The proportion of transportation and related costs in total sales also fell by 1.5 percentage points to 11.9% during this period.

Kurly also benefited from improved logistics efficiency through the Changwon and Pyeongtaek centers opened last year. The introduction of the latest automation equipment led to increased productivity, delivery efficiency, and stabilization. Additionally, the withdrawal from the Songpa logistics center, whose contract expired during this period, eliminated inefficient costs, positively impacting performance.

In terms of revenue diversification, Kurly focused on commission-based seller delivery (3P), Kurly Members, and logistics agency businesses. Notably, 3P grew fivefold in the first quarter compared to the same period last year. During the same period, Beauty Kurly also grew by 34%. As a result, Kurly's total transaction volume (GMV) in the first quarter of this year reached 736.2 billion KRW, a 13% increase from the same period last year.

Kurly also achieved its first quarterly profit in adjusted EBITDA, an indicator of cash generation from operating activities. Kurly's EBITDA for the first quarter of this year was 7.1 billion KRW, improving by 29.7 billion KRW compared to the first quarter of last year. Kurly recorded its first-ever monthly EBITDA surplus in December last year, and now has achieved a quarterly EBITDA surplus.

Kurly plans to focus on strengthening growth based on its own cash generation capabilities and securing future growth engines this year. While maintaining a similar overall approach to last year, the strategy is to maintain the breakeven point in cash flow rather than maximizing profitability. The cash inflow will be used for investments aimed at growth.

Through this, Kurly aims to drive sustainable sales growth, including expanding market share. Specifically, it plans to invest in enhancing customer shopping convenience and activity. Additionally, it will continue to pursue new business development and expand the Saetbyeol Delivery service areas.

A Kurly representative said, "We were able to record our first quarterly operating profit surplus through revenue diversification and structural improvements," adding, "Regarding the frequently mentioned initial public offering (IPO) in the market recently, nothing has been concretely decided yet, but we plan to closely consult with underwriters and relaunch it at a good timing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.