Providing Information in the 'Balgyeon' Section... Customized Features Planned for the Future

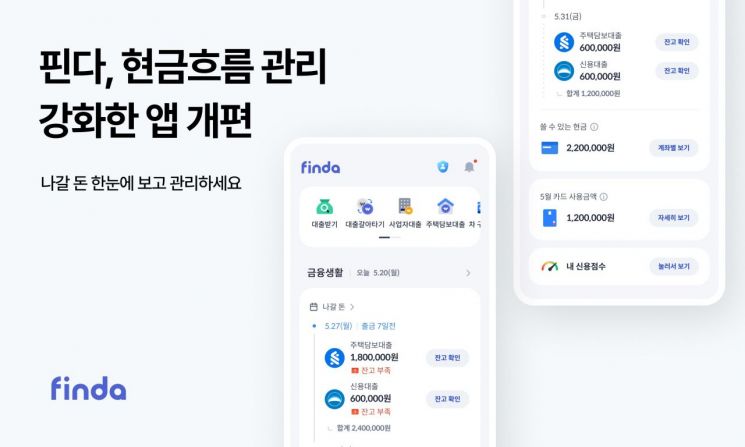

Loan brokerage fintech company Finda has revamped its home screen to help users manage their cash flow.

According to Finda on the 21st, the user-friendly interface (UI) and experience (UX) within the Finda application have been improved to allow users to conveniently identify their 'outgoing money.' Finda displays the fastest outgoing expenses at the top of the home screen, presenting the financial costs that users should prioritize managing. It also enables users to check the balance status of withdrawal accounts, considering card payments and loan interest.

If the balance of the withdrawal account is insufficient, a 'low balance' notification appears on the home screen. Users can easily check the balance status of the account by pressing the 'Check Balance' button. Additionally, through the 'Available Cash' feature, users can view the amount they can draw from other accounts. Available cash refers to the total amount of money in all of the user's deposit and withdrawal accounts, excluding savings and time deposit accounts.

Finda has also placed a 'Discovery' section at the bottom of the home screen where users can naturally find the information they need. In the future, the Discovery section will be personalized to provide customized information.

With this revamp, Finda is expected to serve as a financial assistant that helps users avoid delinquencies and facilitates convenient financial management. Park Hongmin, co-CEO of Finda, said, “Users who hold multiple loans and cards can now intuitively grasp their outgoing money and balances at a glance without having to check each linked account individually. With the upcoming launch of remittance and transfer services scheduled for later this year, Finda will establish itself as a more complete cash flow management solution app.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.