Bank of Korea Announces 'May Consumer Sentiment Survey Results'

Consumer Sentiment Index (CCSI) Falls to 98.4 from Previous Month

Expected Inflation Rate Rises to 3.2% from Previous Month

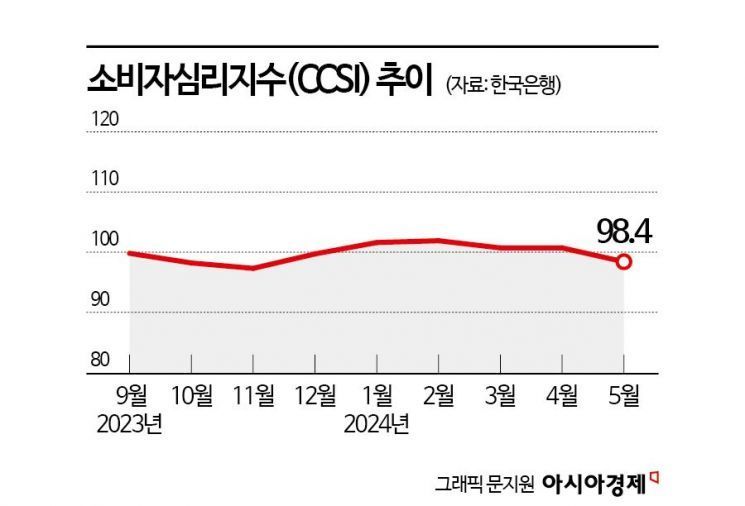

Despite strong export performance, concerns over the four highs?high inflation, high interest rates, high exchange rates, and high oil prices?continued, causing the Consumer Confidence Index (CCSI) to fall below 100 for the first time this year compared to the previous month. It is the first time in five months since December last year (99.7) that the CCSI has dropped below 100. The general public's expected inflation rate, which forecasts the consumer price increase over the next year, also rose by 0.1 percentage points from the previous month to 3.2%, reflecting high perceived inflation.

According to the 'May Consumer Sentiment Survey Results' released by the Bank of Korea on the 21st, the CCSI for this month was 98.4, down 2.3 points from the previous month.

The CCSI is a sentiment indicator calculated using six major indices that make up the Consumer Sentiment Index (CSI): current living conditions, outlook on living conditions, household income outlook, consumption expenditure outlook, current economic conditions, and future economic outlook. A value above 100 indicates consumer sentiment is more optimistic than the long-term average (2003?2023), while a value below 100 indicates pessimism.

The CCSI maintained an optimistic trend by staying above 100 for four consecutive months this year?January (101.6), February (101.9), March (100.7), and April (100.7). However, it showed a slight decline or remained flat from March and fell below 100 for the first time this month. This is the first time in five months since December last year (99.7) that the CCSI has dropped below 100.

Hwang Hee-jin, team leader of the Statistical Survey Team at the Bank of Korea's Economic Statistics Bureau, explained, "Despite strong export performance, concerns over high inflation, interest rates, exchange rates, and oil prices have continued, leading to the decline in the index."

The expected inflation rate, which shows the forecast for the inflation rate over the next year, rose by 0.1 percentage points from the previous month to 3.2%. The inflation perception, which reflects the consumer price increase over the past year, remained unchanged at 3.8%.

Team leader Hwang said, "Overall Consumer Price Index (CPI) is slowing down," but added, "Since perceived inflation, such as food and public utility charges, remains high, the expected inflation rate is formed at a level above 3%, higher than the CPI."

The interest rate outlook rose by 4 points from the previous month to 104. This was due to the rise in market interest rates caused by the delayed policy rate cuts by the U.S. Federal Reserve (Fed). Compared to January (99), February (100), March (98), and April (100), this is the highest figure this year.

The housing price outlook remained unchanged at 101. This is due to continued expectations of a rebound in apartment sale prices despite the burden of high interest rates.

The price level outlook rose by 2 points from the previous month to 147. This is because perceived inflation, such as agricultural products and dining-out services, remains at a high level. The price level outlook has consistently shown high figures in the 140s since recording 151 in October last year.

The major items expected to affect consumer price increases over the next year were agricultural, livestock, and fishery products (62%), public utility charges (48.2%), and petroleum products (36.3%). Compared to the previous month, the response rates for public utility charges (up 0.9 percentage points) and personal services (up 0.8 percentage points) increased, while the share for agricultural, livestock, and fishery products decreased by 2.1 percentage points.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.