Samyang Foods, Binggrae, Pulmuone Surge

K-Food Territory Expands with Gimbap, Tteokbokki

Ongoing Monitoring Needed for Home Meal Preferences and Cost Improvements

The food and beverage sector is showing strength, supported by increased overseas sales, prolonged preference for home dining, and improved cost ratios. Positive evaluations such as 'Falling for K-Food' and 'Crazy Surprise' are pouring in from the securities industry. There is a forecast that profitability recovery of food and beverage companies could further appear due to the recovery of domestic and international sales volume and the downward stabilization of grain prices through the second half of this year.

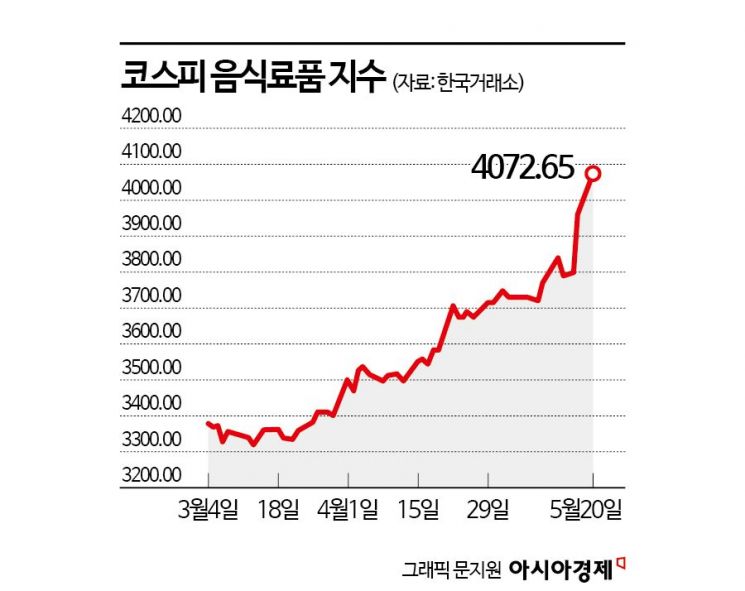

According to the Korea Exchange on the 21st, the KOSPI Food and Beverage Index rose 13.85% over the past month as of the closing price on the 20th. This significantly outperformed the overall KOSPI increase of 4.08% during the same period. In particular, Samyang Foods recorded the largest earnings surprise in the food and beverage sector in the first quarter, soaring 86.96%, leading the rise in the food and beverage sector.

Experts agree that the recent strength of food and beverage companies is due to the continued popularity of various K-Food items overseas, not only ramen but also dumplings and gimbap, contributing to their performance. Jang Ji-hye, a researcher at DS Investment & Securities, analyzed, "In the first quarter of this year, the U.S. sales of CJ CheilJedang, Daesang, and Pulmuone led the overall growth in overseas performance," adding, "Key K-Food items are entering the mainstream in each country and increasing SKUs (Stock Keeping Units), resulting in sales growth for processed food companies." She further noted, "Attention should be paid to CJ CheilJedang, which has the largest overseas sales scale and is expected to improve profitability in its non-food division, and Pulmuone, which is expected to turn its overseas business division profitable this year."

Additionally, home dining demand, which had been sluggish due to food inflation, is expected to show gradual recovery toward the second half of the year. Cho Sang-hoon, a researcher at Shinhan Investment Corp., explained, "Household consumption capacity has been constrained due to rising prices and interest cost burdens," adding, "At the same time, demand for entertainment, culture, and overseas travel has increased, making consumers reluctant to spend on essential consumer goods." He continued, "The price hike phase over the past three years is coming to an end, and consumers are gradually adapting, so price resistance will ease progressively," forecasting, "Moreover, as dining-out prices rise more steeply, the price competitiveness of processed foods will be highlighted, and companies will seek to recover sales of cost-effective products and products that can convert dining-out demand into home dining."

Furthermore, the significant decline in major grain prices since the beginning of the year is also positive. Shim Eun-joo, a researcher at Hana Securities, said, "Grain input costs are expected to fall by more than 20% compared to last year," adding, "Raw sugar prices will also decrease starting in the second half." She pointed out, "Food and beverage companies have a large proportion of costs, so a strong Korean won is advantageous; thus, the recent high exchange rate was unfavorable, but even considering this, the decline in grain prices is meaningful in terms of net profit sensitivity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)