100 Billion Won-Class NewSpace Fund No.2 GP Recruitment

Private-Led Space Development Gains Momentum with Space Aviation Cheong Launch on 27th

As the 'New Space' era approaches, expanding the core of space industry development from the government to the private sector, venture capitalists (VCs) looking to invest in related companies are increasing. The government also plans to support the venture investment industry to foster the New Space industry.

According to the Korea Venture Investment Corp. (KVIC) on the 21st, the recruitment of general partners (GPs) for the New Space Investment Support Fund, led by the Ministry of Science and ICT (MSIT), is ongoing until the 31st. A total of 5 billion KRW will be invested from the mother fund (MSIT account), and with additional private investor funds, a fund exceeding 10 billion KRW is expected to be formed. Eligible applicants include venture investment associations, new technology business investment associations, and institution-exclusive private equity funds.

New Space Fund Raised Over 10 Billion KRW Following Last Year... Plans to Raise 50 Billion KRW by 2027

The New Space Investment Support Fund is a fund that invests at least 60% of its committed capital in small and venture companies related to the space industry and associated sectors. It invests in businesses involved in the manufacturing and operation of space equipment such as launch vehicles and satellites, as well as the development and supply of products and services utilizing space-related information. At least 20% of the committed capital must be invested in companies located in regional space industry clusters.

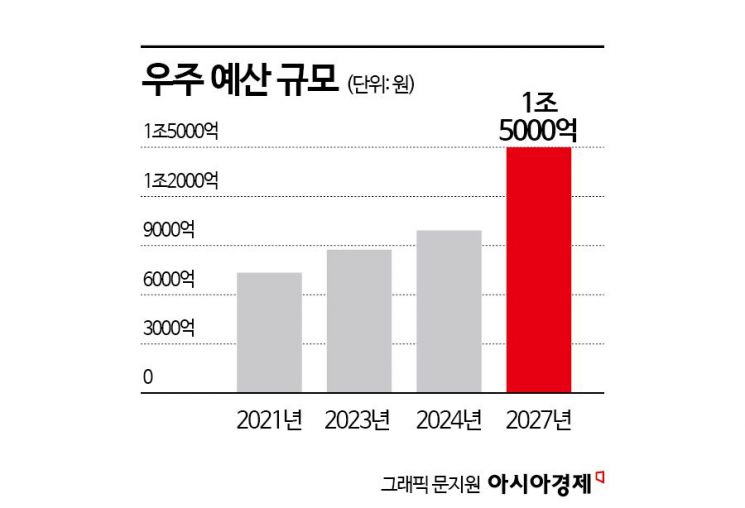

The government plans to raise New Space-related funds totaling over 50 billion KRW by 2027. Last year, the New Space Investment Support Fund was also raised at a scale of over 10 billion KRW. Medici Investment was selected as the GP for this fund, and Space Solution, which participated in the development of the Nuri rocket thrust system, received investments exceeding 8 billion KRW through the New Space Fund and Scale-up Fund.

The space industry sector has also avoided the government's trend of reducing research and development (R&D) budgets. President Yoon Suk-yeol stated at the launch event of the Korea Aerospace Industries (KAI) 'Space Industry Cluster' in March, "We will expand the space development budget to over 1.5 trillion KRW by 2027," and added, "We aim to attract 100 trillion KRW in private investment and create more than 250,000 quality jobs by 2045."

"The Role of VC and PE in the Space Industry Will Expand"

The Korea Aerospace Agency (KASA), the 'Korean NASA,' launching on the 27th, is also expected to accelerate the New Space trend. KB Securities researcher Hainhwan Ha said, "Amid the global growing interest in the space sector, the government's policy support is evident in the increased budget," adding, "The expanded budget will become research and investment funds for government agencies and government-funded research institutes, with the space agency leading the way."

He explained, "As private companies participate in the research and investment processes of institutions, they will benefit. In particular, we can see the budget for satellite manufacturing and the Korean satellite navigation system expanding," and added, "Although the budget size is not large, another rapidly growing area is space exploration."

A VC industry insider said, "With the high-interest-rate environment causing both the startup and venture investment markets to freeze simultaneously, the space industry is receiving significant attention," explaining, "The space industry requires astronomical funds, and the government is actively supporting it."

Space launch vehicle startup 'Innospace' is also in the process of listing on KOSDAQ. Institutional demand forecasting is scheduled from the 23rd to the 29th, followed by a general subscription on the 3rd and 4th of next month. The public offering amount is expected to be around 48 billion to 60 billion KRW. FuturePlay, IMM Investment, Company K Partners, and Shinhan Venture Investment reportedly invested a total of about 70 billion KRW. Private space rocket launch companies such as Perigee Aerospace and small satellite companies like Nara Space Technology also aim to go public this year.

An IMM Investment manager in charge of space industry investments said, "Although the company is currently more recognized overseas than domestically," he added, "I am confident that it will become the most important company in the long-term private-led development of the national space industry." He continued, "While other industries expand beyond national borders, industries with critical technologies for national development, like the space industry, are becoming increasingly closed. In the past, economic growth centered on large corporations saw cooperation between industry and academia playing a key role in the growth of national core technologies, but in the recent structure where venture companies play a major role, the importance of capital centered on VC and private equity (PE) firms, along with industry-academia-research cooperation, has greatly increased. I believe the space industry is a prime example of this," he added.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)