"Self-Sufficiency in Raw Materials for Automotive MLCC"

Challenges Beyond Smartphones: Automotive, AI, and Servers

Samsung Electro-Mechanics announced that it has established a system to independently procure raw materials for automotive electronic equipment Multi-Layer Ceramic Capacitors (MLCC) at its Busan factory, enhancing supply chain stability. The system involves self-procurement of raw materials at the Busan research and development (R&D) and production base, and production at the next-generation MLCC manufacturing plant in Tianjin, China. Based on IT-based technology and automotive electronics technology, the company plans to create markets not only for automotive MLCCs but also for future artificial intelligence (AI) and server MLCCs. It has also set a goal to achieve sales of 1 trillion KRW from automotive MLCCs this year.

Kim Wiheon, Executive Director and Head of the MLCC Development Group at Samsung Electro-Mechanics, is introducing MLCCs at the 'Automotive MLCC Product Briefing' held on the 17th.

Kim Wiheon, Executive Director and Head of the MLCC Development Group at Samsung Electro-Mechanics, is introducing MLCCs at the 'Automotive MLCC Product Briefing' held on the 17th. [Photo by Samsung Electro-Mechanics]

On the 17th, Kim Wiheon, Executive Director and Head of the MLCC Product Development Group at Samsung Electro-Mechanics, explained at the automotive MLCC product briefing, "The strength of Samsung Electro-Mechanics MLCC lies in independently producing and procuring core MLCC raw materials to manage the supply chain stably."

Samsung Electro-Mechanics has announced plans to more than double its production capacity of core MLCC raw materials such as ceramic powder and metal powders (nickel, copper) by next year compared to last year. The company is accelerating the internalization of raw materials for ultra-small, high-capacity, high-end automotive MLCC products. As of September last year, the internalization rate was approximately 50%.

MLCCs are components that store electricity and supply it stably as needed by semiconductors and other parts, ensuring smooth semiconductor operation. They also eliminate signal interference (noise) within electronic devices. MLCCs are used in most products containing semiconductors and electronic circuits, including smartphones, TVs, home appliances, and electric vehicles.

Automotive MLCCs are divided into four categories: in-vehicle infotainment (IVI), advanced driver-assistance systems (ADAS), powertrain, and body & chassis, with ADAS and powertrain being Samsung Electro-Mechanics' main businesses. The company expects the ADAS sector to grow by 69% and the powertrain sector by 138% over the five years from 2023 to 2028. The overall MLCC market is estimated to be $13.1 billion (approximately 17.8 trillion KRW) this year, with a compound annual growth rate (CAGR) of 8% expected through 2028. The expected CAGR for the automotive MLCC sector is 12%, higher than the overall MLCC forecast.

Executive Director Kim said, "Powertrain faces increasingly challenging environmental conditions as the engine temperature of electric vehicles rises, making it difficult to manufacture MLCCs, and ADAS demand is increasing due to safety concerns. Considering the growth of electric and autonomous vehicles, we are focusing on the ADAS and powertrain sectors."

Samsung Electro-Mechanics is accelerating business expansion by launching new automotive MLCC products. On the 22nd of last month, it became the first in the world to release a high-capacity ADAS MLCC (16V) sized 0402 (0.4 mm x 0.2 mm). The 0402 MLCC is one-fifteenth the size of a grain of rice (6 mm). The company also introduced high-voltage products (1KV) and high-temperature products (150℃) related to electric vehicles. The Busan factory handles R&D, while the Tianjin factory is responsible for production. The Tianjin plant is the largest single MLCC factory in the industry, covering an area equivalent to 37 soccer fields.

Samsung Electro-Mechanics stated that its goal is to achieve 1 trillion KRW in sales from automotive MLCCs this year. It did not disclose its market share in the automotive MLCC sector. According to its quarterly report, the overall MLCC market share was 22% as of the first quarter. Executive Director Kim said, "Our goal is to achieve 1 trillion KRW in automotive MLCC sales this year and 2 trillion KRW in total automotive-related business sales, including MLCCs, cameras, and semiconductor packages, by next year. Although the electric vehicle market growth has slowed somewhat, hybrid vehicles are growing, so related MLCC growth will continue."

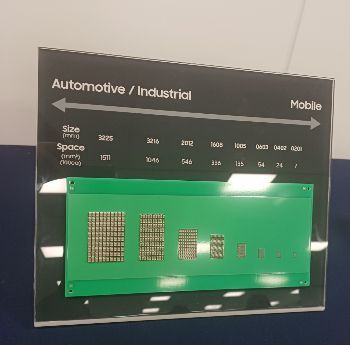

Samsung Electro-Mechanics MLCC products covering mobile, automotive electronics, and more.

Samsung Electro-Mechanics MLCC products covering mobile, automotive electronics, and more. [Photo by Moon Chae-seok]

Samsung Electro-Mechanics views its capability in raw material supply management as having a positive impact on future new businesses such as AI and server MLCCs. The company is accelerating its automotive MLCC business beyond smartphone MLCCs. It plans to expand its business to AI, server MLCCs, as well as humanoid, aerospace, and energy MLCCs in the future.

Executive Director Kim said, "AI servers contain many central processing units (CPUs) and graphics processing units (GPUs), requiring significant power and capacity. Like automotive ADAS, the usage of MLCCs for AI servers is bound to increase sharply in the future." He added, "If the global AI server MLCC market expands, we have the capability to create new markets by combining our IT-based technology with automotive electronics technology."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.