High-Margin Overseas Exports Increase ↑

Raw Material Prices for Somac and Others Decline

Brokerage Firms Raise Target Stock Prices Uniformly

The stock price trend of Samyang Foods is unusual. It is interpreted that the stock price is rising sharply as the performance supports it. The securities industry has unanimously raised the target price.

Rapper Cardi B posted a video on TikTok trying Samyang Foods' Carbo Buldak Bokkeummyeon.

Rapper Cardi B posted a video on TikTok trying Samyang Foods' Carbo Buldak Bokkeummyeon. [Photo by TikTok]

According to the Korea Exchange on the 18th, Samyang Foods' stock price surged 71.4% from 260,500 won to 446,500 won over the past month (April 17 to May 17). In particular, after the first quarter earnings announcement, it hit the upper limit (+29.99%) and reached a new high.

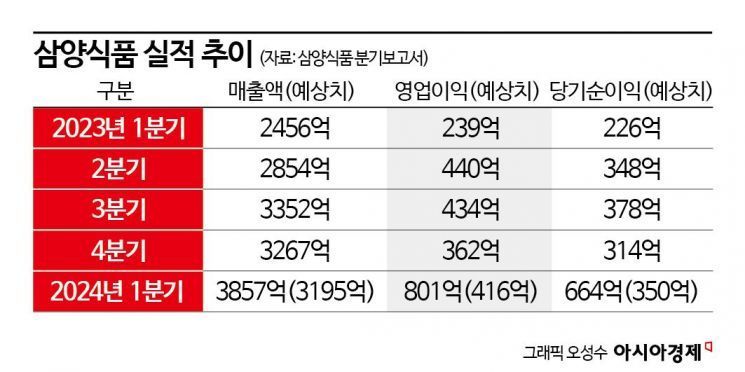

The background of the sharp rise in stock price is record-breaking performance. On the 16th, Samyang Foods announced that its first-quarter sales increased by 57% year-on-year to 385.7 billion won. Operating profit jumped 85% to 80.1 billion won. These figures greatly exceeded market expectations of 319.5 billion won and 41.6 billion won, respectively.

The trend of operating profit is remarkable. It was recorded as 23.9 billion won in Q1 2023, 44.0 billion won in Q2, and 43.4 billion won in Q3. It showed a gradual increasing trend, but this year's first-quarter performance exceeded everyone's expectations.

The improvement in both quantity and quality is noticeable. The proportion of overseas sales expanded from 64% in Q1 last year to 75% in Q1 this year. It is interpreted that performance grew by actively responding to global demand in the US, China, Southeast Asia, and Europe. Overseas ramen exports have high margins. Because of this, the profit margin also improved from 9.7% to 20.8%. In particular, the sales in the large markets China and the US recorded 93.4 billion won and 75.0 billion won, respectively. These amounts increased by 186% and 223% year-on-year, respectively.

Jang Ji-hye, a researcher at Korea Investment & Securities, explained, "In China, the effect of new channel entry such as expanding coverage by online and offline sales routes and regional bases appeared, and in the US, expansion of entry into major distribution channels such as Walmart and Costco, and the popularity of Carbo Buldak Bokkeummyeon are translating into performance."

While sales increased, the burden of fixed costs decreased. This is due to the decline in prices of major raw materials such as wheat flour. Moreover, the operating rate of the Miryang factory increased by 14.8 percentage points from 48.8% in Q1 last year to 71.5% in Q1 this year.

Jang Ji-hye, a researcher at DS Investment & Securities, analyzed, "Contrary to the initial concerns about CAPA shortage, it is being defended by improving line efficiency and reducing domestic volume," adding, "The annual overseas sales ratio in 2024 is expected to rise to 73% compared to 68% last year, and annual operating profit is expected to reach 300 billion won."

Jeong Han-sol, a researcher at Daishin Securities, predicted, "Although the base effect in the second half will increase, making it inevitable for sales growth to slow compared to the first half, sales growth will be possible through efficient high-profit overseas sales like in Q1," and added, "Due to the decline in major grain prices, cost burden will be alleviated, and high profitability is expected to be maintained through expansion of high-margin overseas sales."

Meanwhile, the securities industry raised the target price for Samyang Foods by revising upward the operating profit estimates. Hanwha Investment & Securities raised it to 600,000 won, Daishin Securities to 500,000 won, DS Investment & Securities to 500,000 won, and Ebest Investment & Securities to 450,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.