iM Bank Name Change... Need for Rebranding

Building Sales Network and Strengthening Non-Face-to-Face Services

Lack of Commercial Bank Features in Asset and Loan Portfolio

DGB Daegu Bank, established as the first regional bank in Korea, has become the first regional bank to transition into a commercial bank and the first new commercial bank in 32 years. Analysts suggest that to truly transform into a commercial bank, it must enhance its presence through rebranding strategies and expanding its branch network. Improving its loan portfolio is also another challenge.

On the 16th, the Financial Services Commission approved the banking license for Daegu Bank's transition to a commercial bank at its regular meeting. This marks the launch of a new commercial bank for the first time in 32 years since the licensing of Peace Bank in 1992. The Financial Services Commission stated that the transition of Daegu Bank to a commercial bank is expected to promote competition among banks, especially in newly entered business areas, thereby increasing consumer welfare. It also announced plans to expand credit for medium-credit small and medium enterprises (SMEs) and individual business owners, as well as increase funding for companies in Daegu and Gyeongbuk, contributing to regional economic revitalization.

Daegu Bank faces many challenges to become a genuine commercial bank. First, rebranding is necessary. Since it originated as a regional bank, the name "Daegu" may pose difficulties when operating outside the Daegu and Gyeongbuk regions. To reduce regional connotations, Daegu Bank will change its corporate name. The current mobile banking application (app) will be renamed iM Bank. Affiliates including DGB Financial Group may also join this effort. Starting with iM Financial Group, iM Life (DGB Life Insurance), iM Investment & Securities (Hi Investment & Securities), and iM Capital (DGB Capital) were registered with the Korean Intellectual Property Office last year. However, in Daegu and Gyeongbuk, the name Daegu Bank will be used alongside iM Bank.

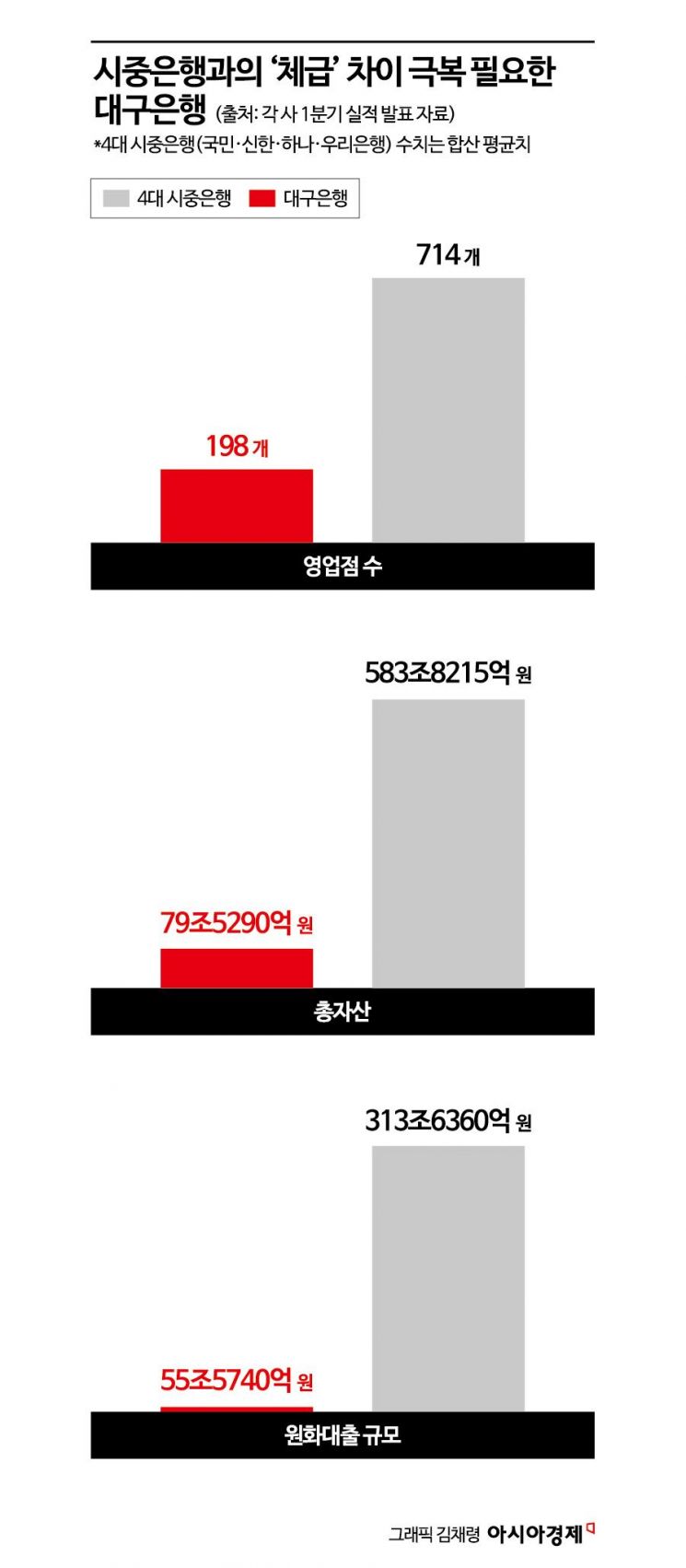

Besides changing the corporate name, a strategy to build a branch network is also needed. As of the end of March, Daegu Bank has 198 domestic branches (including sub-branches). Especially as a former regional bank, 179 branches are concentrated in Daegu and Gyeongbuk. The Seoul metropolitan area (Seoul, Gyeonggi, Incheon) has 9 branches, and there are no branches in Honam, Chungcheong, or Gangwon regions. Among the four major commercial banks (Kookmin, Shinhan, Hana, and Woori Banks), Kookmin Bank has the most branches with 797, followed by Shinhan Bank (748), Woori Bank (711), and Hana Bank (598).

Asset growth and diversification of the loan portfolio are also necessary. As of the first quarter of this year, Daegu Bank's total assets stand at KRW 79.629 trillion. The four major commercial banks have assets ranging from KRW 538 trillion to 643 trillion, creating a gap of about seven times. The scale of won-denominated loans (KRW 55.574 trillion) is only about 16% of Kookmin Bank's (KRW 343.7 trillion), which is the industry leader.

Regarding the loan portfolio, the proportion of loans to highly creditworthy large corporations is small. Among Daegu Bank's won-denominated loans, loans to large corporations account for 8.7%. This is even lower than Hana Bank's 9.4%, which is the lowest among the four major banks. Woori Bank has the highest proportion of large corporate loans at 15%. On the other hand, Daegu Bank's loans to SMEs account for 52%, higher than the four major banks' average of 43%.

Daegu Bank plans to open 14 new branches over the next three years. These will be regional hub branches established at the provincial level. The first hub branch will be opened in Wonju, Gangwon Province. Subsequently, branches will be opened sequentially in Chungcheong, Honam, and Jeju regions. Additionally, the bank has plans to strengthen branch marketing and create branch environments to retain and expand its high-value customers. This includes establishing dedicated consultation counters for key customers, designing layouts to maximize customer lifetime value and support cross-selling, upgrading facilities, and operating flexible business hours.

Corporate banking will also be strengthened around these hub branches. These branches will not have counters for general customers but will be staffed by a single branch manager and a corporate banking specialist (PRM). The branch manager will be selected through an internal competition within the bank, while PRMs will be recruited from external experienced professionals. In new branch locations, PRMs familiar with the region will be assigned, while in existing business areas, single branch managers will operate the hub branches to attract corporate clients. In February, Daegu Bank recruited PRMs from retired branch managers and department heads of commercial banks, hiring 50 new PRMs, which accounts for 76% of last year's total PRM staff of 66. A financial industry official commented, "While brand power is important for corporate loans, much depends on the sales capabilities of the responsible staff. The strategy appears to be to increase corporate banking relatively quickly through PRMs who have strong local ties."

Since it is difficult to increase the number of branches to the level of existing commercial banks, Daegu Bank will also focus on strengthening non-face-to-face services. Last month, Daegu Bank conducted large-scale recruitment of experienced professionals, focusing on digital marketing, UX (user experience) design, and platform areas.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)