Q1 KOSPI Net Profit Exceeds Estimates by 14.3%

Q2 Net Profit Forecasts Also Sharply Upward

Strong Earnings Momentum Expected to Support Stock Performance

As the earnings season approaches its final stages, it has been revealed that companies recorded solid results in the first quarter of this year, surpassing market expectations. The strong first-quarter performance is also raising expectations for second-quarter earnings. These favorable results are expected to have a positive impact on stock prices.

According to Shinhan Investment Corp. on the 17th, the first-quarter net income of KOSPI companies (based on 188 companies with consensus and controlling shareholder net income) was 35.9 trillion KRW, exceeding the forecast of 31.4 trillion KRW by 14.3%. Sales increased by 3.3% year-on-year, surpassing expectations, and the net profit margin was 5.3%, in line with the consensus (average securities firm forecasts).

By industry, sectors with lowered earnings expectations and low anticipation recorded many earnings surprises. The chemical sector's first-quarter net income exceeded consensus by 234.9%, the highest profit achievement rate among KOSPI sectors. Additionally, sectors such as hotel & leisure, construction, IT hardware, and software, which had downward revisions in profit consensus, announced earnings that surpassed expectations. Laborngil, a researcher at Shinhan Investment Corp., explained, "The consensus for the chemical sector's net income was continuously revised downward until just before the earnings announcement," adding, "Since the expectations were initially very low, it can be interpreted as a surprise."

The IT sector's consensus achievement rate was high at 30.9%. Within the IT sector, all industries except secondary batteries posted solid results. IT hardware and semiconductors exceeded expectations significantly, with consensus achievement rates of 64.8% and 33.0%, respectively.

Choi Changmin, a researcher at Yuanta Securities, said, "Operating profit for the first quarter is currently expected to be about 54 trillion KRW, which is the fourth highest quarterly figure and the second highest quarterly profit when considering only the first quarter," adding, "The year-on-year growth rate based on the currently expected first-quarter operating profit is projected to reach 59.6%. This level nearly recovers the operating profit level from two years ago."

With excellent first-quarter results, expectations for second-quarter and subsequent earnings are also growing. Researcher Noh said, "The change rate of net income for the second quarter is sharply increasing," explaining, "It is fluctuating around 29.7 trillion KRW, a 13% increase from the mid-February bottom. Although the second-quarter net income estimates were revised downward due to the shock from last year's fourth-quarter earnings announced in January and February, the sentiment has changed."

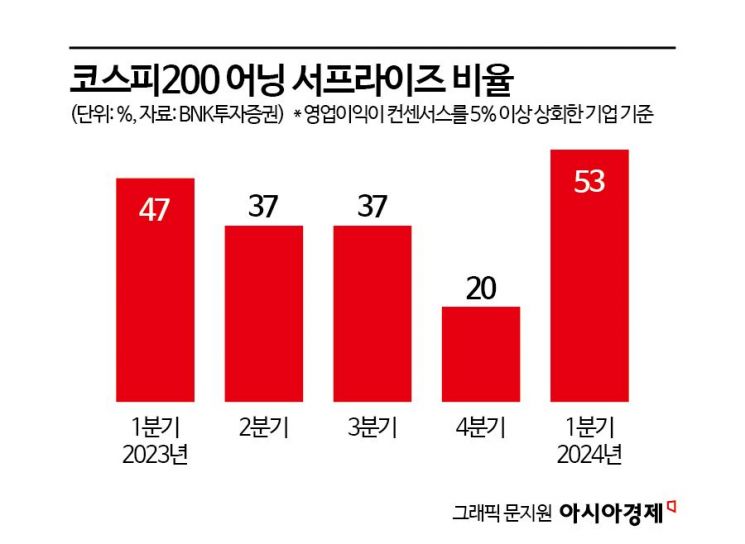

Kim Seongno, a researcher at BNK Investment & Securities, stated, "The 12-month forward earnings per share (EPS) of KOSPI 200 has risen to 38.5 points, continuing a clear improvement trend," adding, "At the current pace, it is expected to surpass the all-time high of 39.9 points recorded in April 2022 by June or July. If it exceeds the record high, it is likely to act as a strong earnings momentum."

The solid earnings are expected to have a positive effect on stock prices. Researcher Cho said, "Expectations for recovered profits are reflected in the forecasts for the second to fourth quarters of this year. The experience of the stock market remaining resilient during phases when earnings expectations recovered through past earnings season surprises can be interpreted as a positive signal." In the case of the first quarter of 2016, after a sluggish trend in forecasts following the fourth quarter of 2015, upward revisions of forecasts and earnings surprises were confirmed during the first-quarter earnings season, and the stock market showed a resilient trend as forecasts for subsequent quarters were also revised upward. Researcher Cho added, "Since we have confirmed 'expectation decline + earnings surprise + upward revision of subsequent quarter forecasts,' this situation can raise expectations for stock market gains," and forecasted, "The stock market will also maintain a resilient trend following the first-quarter earnings season."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)