Following the victory of the brothers, the management dispute within the Hanmi Pharmaceutical Group owner family, which seemed to be resolved through joint management between mother and son, has reignited. Concerns are emerging that the conflict's resurgence amid the urgent need to secure essential funds such as inheritance tax could lead to a vicious cycle of further financial strain.

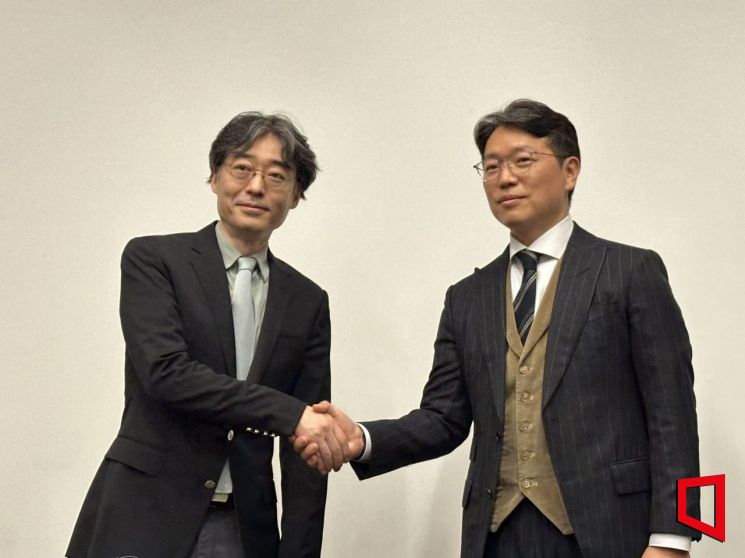

Jong-yoon Lim, Director of Hanmi Science (left), and Jong-hoon Lim, CEO of Hanmi Science, are shaking hands at a press conference held after the regular shareholders' meeting in March.

Jong-yoon Lim, Director of Hanmi Science (left), and Jong-hoon Lim, CEO of Hanmi Science, are shaking hands at a press conference held after the regular shareholders' meeting in March. [Photo by Chunhee Lee]

Hanmi Science, the holding company of Hanmi Pharmaceutical Group, held an extraordinary board meeting on the morning of the 14th and proposed the dismissal of co-CEO Song Young-sook (Chairman of Hanmi Pharmaceutical Group). The board's decision is expected to be announced in the afternoon. After brothers Lim Jong-yoon and Jong-hoon took control of Hanmi Science's board and adopted a co-CEO system between mother Song Young-sook and son Lim Jong-hoon, there was speculation that family harmony might be achieved, but this board meeting confirmed it was only a 'temporary truce.' If Chairman Song is dismissed as CEO, Hanmi Science, the group's holding company, will be led solely by CEO Lim Jong-hoon. Decisions that previously required agreement between mother and son will then be made solely by CEO Lim.

The direct cause of the renewed conflict is reported to be Chairman Song's refusal to approve key executive replacements pushed by the brothers. However, underlying this is the unresolved issue of raising funds to pay inheritance taxes. Currently, the funds needed exceed 800 billion KRW, including unpaid inheritance tax of 264.4 billion KRW and repayment of stock-collateralized loans amounting to 537.9 billion KRW, which were previously taken to inject capital. Since the death of founder Lim Sung-ki, the unresolved inheritance tax issue of 540 billion KRW has continuously hindered them. The reason Song Young-sook and her daughter Lim Joo-hyun proposed a merger with OCI Group earlier this year was also to secure funds for the inheritance tax.

However, the brothers opposed the merger with OCI, gained support from minority shareholders at the general meeting, and took control of management. They are now exploring funding options with major private equity funds. It is known that the brothers are discussing a plan to transfer a significant portion of their shares in exchange for capital now, with the family repurchasing the shares at a higher price once the financial issues are resolved in a few years. Shin Dong-guk, chairman of Hanyang Precision and the largest individual shareholder who sided with the brothers during the family dispute, is also pushing to dispose of shares in this process. However, as the family members have differing interests, disagreements continue, leading CEO Lim Jong-hoon to attempt to remove his mother, Chairman Song, from management to facilitate smoother share transactions.

The recurrence of family conflicts is expected to make fundraising even more difficult. Currently, the brothers hold 28.4% and Chairman Shin holds 12.4% of Hanmi Science shares, totaling 40.8%. For most companies, this would be an overwhelmingly large stake, enabling easy transactions with private equity funds.

However, industry insiders assess that Hanmi Science's shares are not reassuring due to the company's unique circumstances. An investment industry official said, "Just two months ago, one side of the family attempted a unilateral share transfer, which was canceled. While the company itself is an attractive asset, it is difficult to invest in a ticking time bomb situation where management disputes can erupt at any time." If the brothers proceed with a unilateral share sale, the mother and daughter side could resist by framing it as a 'one-sided sale' and rally support, potentially causing the OCI merger collapse to be replayed as a 'change of guard.' To raise the amount of funds the family aims for, they must sell shares at a high price with a significant management premium, making family consensus on the sale price essential.

It is known that the eldest son, Lim Jong-yoon, a director at Hanmi Science, is currently opposed to the plan to dismiss Chairman Song as CEO, with these complex circumstances underlying his stance. This is because forcibly dismissing a major shareholder and company representative would clearly constitute a management dispute. Many private equity funds have a principle of not investing in companies undergoing management conflicts, making it even harder to attract investment under such conditions. Therefore, there is a possibility that the dismissal proposal for Chairman Song could be rejected at this board meeting. However, if that happens, it could trigger a 'brothers' rebellion' following the 'mother and son rebellion,' plunging Hanmi Pharmaceutical's future into even greater uncertainty.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.