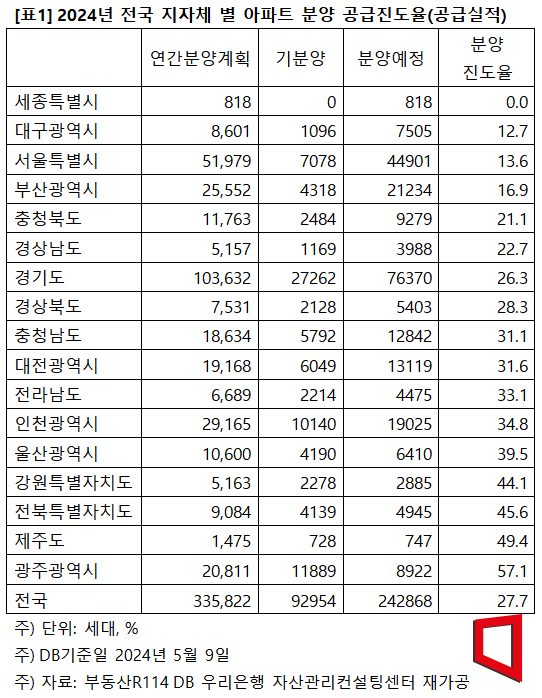

Clear Regional Disparities in Sales Progress Rates

Impact of Rising Construction Costs and Unsold Inventory Backlog

Daegu (12.7%), Seoul (13.6%), and Busan (16.9%) Remain Low

Nationwide apartment sales performance has fallen short of 30% of the planned target. In Seoul, it was only 14%. Rising construction costs, high interest rates, and unsold inventory are creating challenging conditions that are hindering the sales market.

The government announced that it will freeze the actualization rate of publicly announced real estate prices at the 2020 level. The photo shows a newly built apartment complex in Seoul on the 21st. Photo by Jinhyung Kang aymsdream@

The government announced that it will freeze the actualization rate of publicly announced real estate prices at the 2020 level. The photo shows a newly built apartment complex in Seoul on the 21st. Photo by Jinhyung Kang aymsdream@

According to a survey by Woori Bank's Asset Management Consulting Center on the 14th, as of the 9th of this month, the supply performance (sales progress rate) of nationwide apartment sales volume compared to the plan was 27.7%. The planned sales volume at the beginning of the year was 335,822 units, but only 92,954 units were sold. This means that less than one-third of the planned sales volume has actually been subscribed to as the first half of the year comes to an end.

There was also a large gap in sales progress rates by region. Gyeonggi-do (26.3%) led, followed by Gyeongnam (22.7%), Chungbuk (21.1%), Busan (16.9%), Seoul (13.6%), Daegu (12.7%), and Sejong (0%), all showing low progress rates. In regions such as Daegu and Gyeonggi-do, concerns about oversupply have arisen due to prolonged unsold inventory, and subscription competition rates for previously sold projects are low. As of March, the unsold inventory in Daegu reached 9,814 units, and in Gyeonggi-do, 8,340 units. In Busan, the first-priority subscription competition rate was 0.72 to 1, and in Gyeongnam, it was 0.39 to 1, indicating weak subscription competition.

In Seoul, although there is demand waiting for subscriptions within the region, conflicts over construction costs between redevelopment project implementers and constructors have increased, making it difficult to coordinate supply timing, resulting in sluggish sales. This year, Seoul’s first-priority subscription competition rate has recorded 124.85 to 1.

On the other hand, Gwangju, which had the highest sales progress rate (57.1%), completed sales of 11,889 units out of 20,811 units. Jeju (49.4%), Jeonbuk (45.6%), and Gangwon (44.1%) also showed high progress rates. Following these were Ulsan (39.5%), Incheon (34.8%), Jeonnam (33.1%), Daejeon (31.6%), Chungnam (31.1%), and Gyeongbuk (28.3%), all exceeding the national average (27.7%).

With rising interest rates, cooling of PF (Project Financing) loans, increases in raw material prices, and unsold inventory, sales prices are rising, leading to polarization in subscription demand by region.

Ham Young-jin, head of Woori Bank’s Real Estate Research Lab, analyzed, "The summer sales off-season is approaching soon, so even if there is considerable subscription demand waiting within regions, it is difficult to expect a rapid expansion of apartment supply due to various factors. Until the autumn sales peak arrives, it will not be easy for prospective buyers holding subscription savings accounts to make subscription choices while watching the sales market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)