Fund Investment Contract Signing and Capital Injection in May

Specialized credit finance companies, including capital firms, have decided to establish a second fund to normalize real estate project financing (PF).

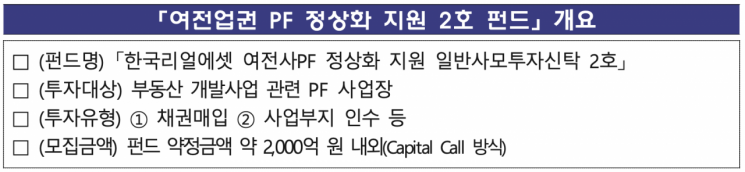

The Korea Federation of Specialized Credit Finance Associations announced on the 12th that it will promote the "2nd Specialized Credit Finance Industry PF Normalization Support Fund" with a scale of 200 billion KRW to respond to real estate PF risks. The specialized credit finance industry plans to complete fund investment contracts within this month and begin investing to normalize project sites. The fund management company is selecting PF project sites to receive additional funding.

The reason the specialized credit finance industry is creating a second fund is that the first fund, established in September last year, has mostly been exhausted. The first fund was used to restructure projects by changing the existing sales method to long-term general private rental housing projects. Currently, about 120 billion KRW out of the 160 billion KRW capital has been executed, and the entire amount is expected to be used in the future.

This second fund is also expected to be used to acquire land of PF projects that can be normalized and to purchase bonds. This will not only improve the soundness of specialized credit finance companies but also expand liquidity supply, accelerating the normalization of real estate PF.

Jung Wankyu, chairman of the Korea Federation of Specialized Credit Finance Associations, said, "In addition to the financial authorities' efforts to stabilize the real estate PF market, the market itself has voluntarily united to solve the problem." He added, "We hope this case will spread throughout the entire financial sector and lead to a soft landing of real estate PF through the activation of private investment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)