Q1 Operating Profit Up 92% Year-on-Year 'Solid Performance'

Brokerage Firms Say "No Additional Upside Momentum Seen"

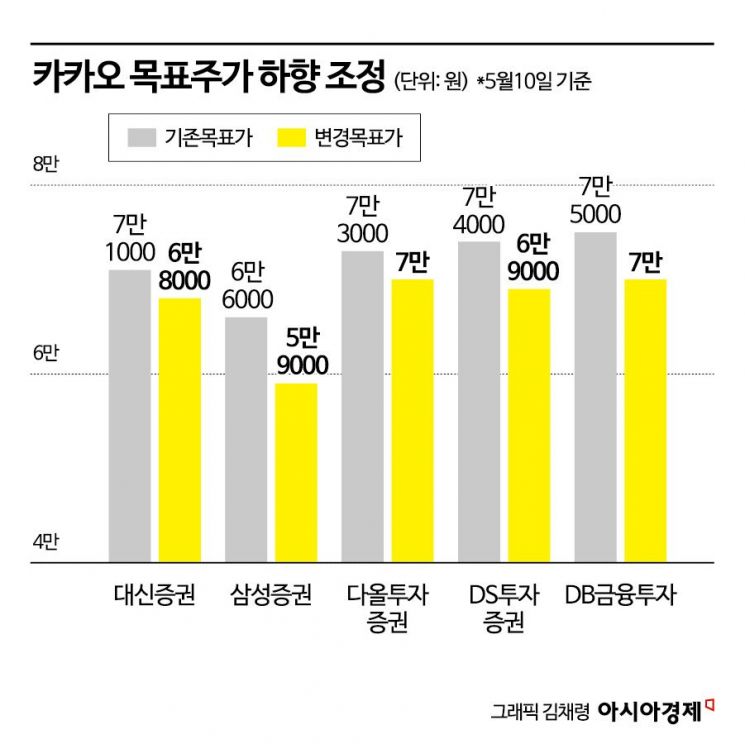

Despite Kakao announcing solid results for the first quarter of this year, the securities industry has consecutively lowered its target price. This is due to the insufficient presentation of strategies to drive further growth and the uncertainty surrounding the artificial intelligence (AI) business, leading to the judgment that the adjustment period may be prolonged.

According to the financial investment industry on the 11th, Kakao closed at 47,800 won on the 10th, down about 23% from the peak in January. This is a sluggish performance compared to the KOSPI index, which rose 7.3% during the same period. It is interpreted that the consecutive lowering of target prices in the securities market influenced this outcome.

On the 9th, Kakao announced its first-quarter earnings for this year, reporting sales of 1.9884 trillion won, a 22% increase compared to the same period last year, and an operating profit of 120.3 billion won, up 92% year-on-year. By business segment, platform and content increased by 13% and 33%, respectively, compared to the same period last year. All sectors, including the advertising business through KakaoTalk called Talk Biz, mobility, pay, and media, showed balanced growth.

However, the market's reaction was lukewarm. First, although Kakao's performance grew compared to last year, industry analysis suggests it was not an 'earnings surprise' that met market expectations. There is also a strong skeptical view regarding sustained growth. Lee Ji-eun, a researcher at Daishin Securities, explained, "The results were moderate, and momentum is expected to fade for the time being. Although the advertising sector continues steady growth from the benefit of Chinese commerce advertising reflected from the first quarter, it is difficult to expect additional growth beyond that from the second quarter." She added, "Commerce is also expected to see a continuous decline in transaction volume after the peak season effect. Depending on the possibility of increased investment related to the AI business, there may be further downward revisions to consolidated operating profit in the future."

There are also disappointing evaluations of the new management team replaced after the judicial risks arising from Kakao Group's acquisition of SM Entertainment last year. Oh Dong-hwan, a researcher at Samsung Securities, said, "There were expectations for the presentation of new growth strategies in the first earnings announcement by the new management, but unfortunately, this was not presented in the recent conference call. Although they announced the integration of AI development organizations and the launch of new services based on this, it will require significant time and resource investment before this leads to profit generation." He added, "Since they are currently facing various challenges such as discovering new growth engines, company-wide cost efficiency, and resolving judicial risks, it will take time before a full-fledged stock price rebound."

Meanwhile, Kakao announced in the recent conference call that it will change the revenue recognition of the 'Gift' function from the payment point to the voucher usage point. Regarding this, Na Min-wook, a researcher at DS Investment & Securities, evaluated, "Due to this accounting standard change, profit estimates are being lowered. Now, revenue recognition for Gift will be delayed to the voucher usage point, while revenue-linked costs such as commissions will occur at the payment point, which will impact profits."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)