‘Recent Insurance Industry Status and Growth Strategies Focused on 3NEW’ Report

“Increase New Products, Expand New Businesses like Care Services... Must Expand Overseas New Markets”

Due to factors such as the introduction of the new accounting standard (IFRS17), domestic insurance companies recorded their highest ever net profit last year, but their growth has stagnated externally for a long time since 2010. In response, there are claims that new growth strategies are needed, such as segmenting consumer groups to expand new products, pioneering new businesses like nursing care services, and increasing the proportion of overseas markets.

Samil PwC announced on the 10th that it published a report titled ‘Recent Insurance Industry Status and Growth Strategies, Focusing on 3NEW’ containing these details.

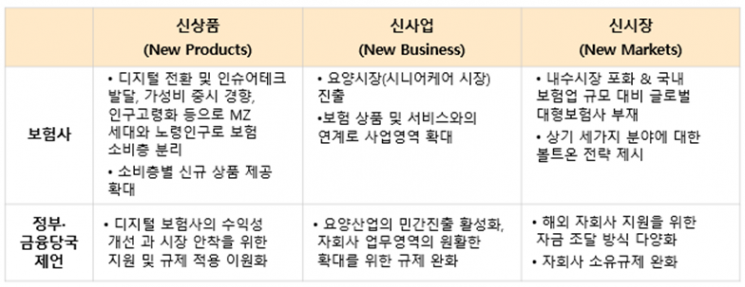

The report presented the growth strategies for insurance companies to overcome limitations as 3NEW, namely New Products, New Business, and New Markets. It also proposed “expanding new products and services that consider consumer segments by segmenting insurance demand groups according to environmental changes such as digitalization and aging.” Representative examples include embedded insurance (a service where insurance company products are embedded and provided when purchasing or using non-insurance company products and services), micro short-term insurance (mini insurance), digital insurance, and customized insurance targeting the 2030 generation who are familiar with digital consumption and pursue rational consumption.

It is also noteworthy that recently insurance companies have actively entered the nursing care business while growing new businesses such as healthcare and asset management investment. The report emphasized, “This is effective in terms of growth potential and business expansion because it mitigates the unique longevity risk that insurance companies have and can be linked with existing products and services.”

To expand the proportion of overseas markets, strategies such as targeting emerging markets like Southeast Asia and bolt-on strategies (additional mergers and acquisitions of similar companies) in advanced markets were also suggested. In the case of the bolt-on strategy, large Japanese non-life insurance companies have grown their scale through aggressive mergers and acquisitions in the US, Europe, and other regions since the mid-2010s.

The report called for two strategies to efficiently promote the 3NEW areas. The barbell strategy involves simultaneously having both ‘scaling up and organizing’ and ‘developing products and services reflecting trends.’ The synergy strategy means leveraging each company’s strengths and utilizing the infrastructure of affiliated companies to rapidly advance new businesses.

Yoo Jin Lee, Insurance Industry Leader (Partner) at Samil PwC, explained, “If the non-insurance business area expands and the results of the bolt-on strategy in overseas markets become visible, it is expected to contribute to the value-up of domestic insurance companies. For this, quick corporate responses, further deregulation by the government, and risk management from a soundness perspective are required.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)