Classys and PI Advanced Materials Stocks Rise After Earnings Announcement

Q1 Results Confirm Potential for Performance Improvement This Year

Since KOSPI reached its highest level of the year on March 26, volatility in the domestic stock market has increased. This is due to the fluctuations in the semiconductor sector, which has emerged as the market leader this year. As the timing of the U.S. interest rate cuts remains uncertain, a preference for safe assets has spread. Market experts advise focusing on companies with improving earnings as volatility increases. As first-quarter earnings announcements from December fiscal year-end companies continue, stocks of listed companies that have reported 'surprise earnings' are maintaining their upward rally.

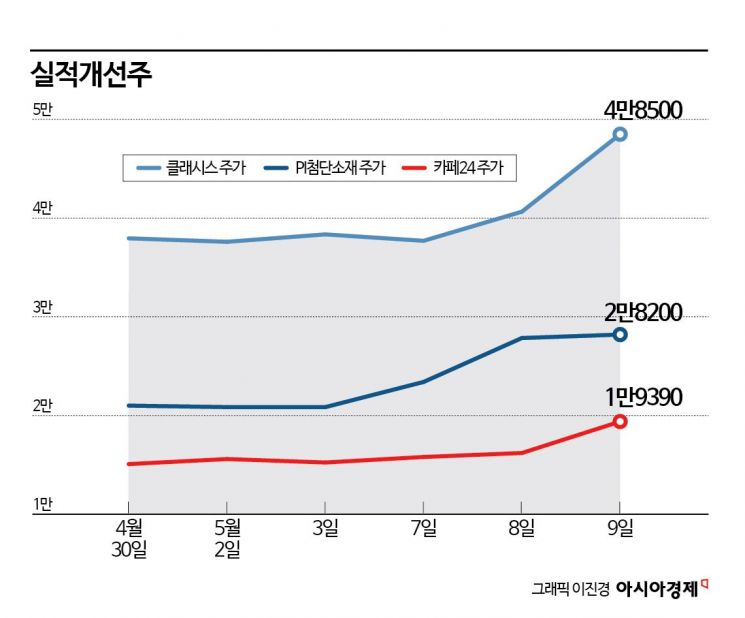

According to the financial investment industry on the 10th, Classys' stock price has risen 27.8% since the beginning of this month. During the same period, the KOSPI and KOSDAQ indices have been flat.

Classys recorded sales of 50.4 billion KRW and operating profit of 26.5 billion KRW in the first quarter of this year. These figures represent increases of 29% and 33%, respectively, compared to the same period last year.

Park Jong-hyun, a researcher at Daol Investment & Securities, explained, "Due to inventory adjustments at the Brazilian agency, overseas equipment sales increased by 15% year-on-year," adding, "Overseas consumables sales rose 66% as free consumables were depleted." He continued, "We estimate sales of 61.7 billion KRW and operating profit of 30.1 billion KRW in the second quarter of this year," and added, "Regarding the high-frequency (RF) skin lifting device 'VoluNer,' which received approval from the U.S. Food and Drug Administration (FDA) last month, a contract with a partner company is expected to be signed in the second half of this year."

After confirming Classys' first-quarter performance, securities firms have successively raised their target prices. Daol Investment & Securities raised the fair price from 46,000 KRW to 60,000 KRW, Samsung Securities adjusted it from 43,000 KRW to 48,000 KRW, and DB Financial Investment and Shinhan Investment Corp. also increased their targets.

The stock price of PI Advanced Materials, which recently announced its first-quarter earnings, rose 34.3% this month. There is growing confidence in the recovery from last year's slump starting from the first quarter. PI Advanced Materials recorded sales of 51.8 billion KRW and operating profit of 2.5 billion KRW in the first quarter. Sales increased by 21.5% year-on-year, and operating profit turned positive. Jang Jung-hoon, a researcher at Samsung Securities, analyzed, "The increase in sales volume due to long-term contracts for heat dissipation sheets and improved profitability has created momentum for performance improvement," adding, "The increase in sales of high-margin heat dissipation sheets will enhance the effect of improved operating rates." He set the target price at 27,000 KRW, up 12.5% from before, and upgraded the investment opinion to 'Buy.'

Kim Kwang-soo, a researcher at Ebest Investment & Securities, said, "As raw material prices stabilize and operating rates rise, the speed of profitability improvement is faster than initially expected," and predicted, "The operating rate will increase from 50% in the first quarter to the 60% range in the second quarter."

Cafe24, which had a sluggish stock price this year, succeeded in rebounding following its first-quarter earnings announcement. Cafe24 achieved consolidated operating revenue of 66.9 billion KRW and operating profit of 2.2 billion KRW in the first quarter of this year. Sales increased by 1.6% compared to the same period last year, and operating profit turned positive. The stock price rose nearly 20% the day after the earnings announcement. There is a positive outlook for future profitability improvement as the company actively utilized artificial intelligence (AI) technology to efficiently manage labor costs while increasing productivity.

Lee Junho, a researcher at Hana Securities, explained, "They actively introduced AI technology into business and internal work processes to minimize resource input," adding, "They are also expanding AI-based customer services." Cafe24 provides AI-based product matching and content creation apps. Kim Aram, a researcher at Shinhan Investment Corp., also analyzed, "Cost efficiency efforts are entering the final stage, and labor costs this year are unlikely to increase significantly from the quarterly level of 25 billion KRW," and added, "YouTube shopping appears to be progressing smoothly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.