Total 77.7 GWh... 15.7% Growth Compared to Previous Year

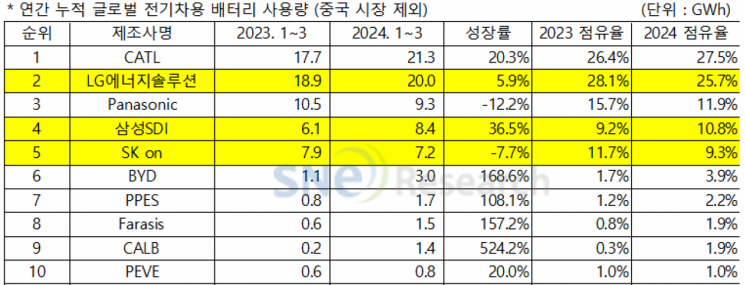

The total battery usage of electric vehicles sold globally (excluding China) from January to March this year reached approximately 77.7 GWh, marking a 15.7% increase compared to the same period last year. The market share of the three domestic companies fell by 3.1 percentage points compared to the same period last year, recording 45.9%.

According to SNE Research, an energy-focused market research firm, all three domestic companies ranked within the top five in global electric vehicle battery usage excluding the Chinese market. LG Energy Solution grew by 5.9% (20.0 GWh) compared to the same period last year, securing 2nd place. Samsung SDI showed the highest growth rate among the three domestic companies at 36.5% (8.4 GWh). SK On recorded a negative growth rate of -7.7% (7.2 GWh).

Looking at battery usage based on the electric vehicle sales of the three companies, Samsung SDI showed steady sales in Europe with BMW i4·5·X, Audi Q8 e-Tron, and PHEVs (Plug-in Hybrids). In North America, strong sales of Rivian R1T·R1S contributed to continued high growth. SK On saw increased sales of Ford F-150, Hyundai Ioniq 5, and Kia EV9 in North America, but recorded negative growth due to sluggish sales of key models Hyundai Ioniq 5 and Kia EV6 in Europe and Asia (excluding China). However, steady sales of the Mercedes EQ lineup and expanding global sales of the Kia EV9 are expected to turn growth back on. LG Energy Solution’s growth was driven by strong sales of best-selling vehicles in Europe and North America such as Tesla Model 3·Y, Ford Mustang Mach-E, and GM Lyriq.

Japan’s Panasonic recorded battery usage of 9.3 GWh this year, showing a 12.2% decline compared to the same period last year. Panasonic is one of Tesla’s major battery suppliers. The partial facelift of the Model 3 caused a slowdown in sales, which was a major factor in the decline. Meanwhile, battery usage for Tesla Model Y in the North American market accounted for a significant portion of Panasonic’s total battery usage. Panasonic is expected to expand its market share centered on Tesla in the future by launching improved 2170 (21mm diameter · 70mm length) and 4680 (46mm diameter · 80mm length) cells.

China’s CATL, which is rapidly expanding its market share even in non-Chinese markets, maintained its leading position with continuous high growth of 20.3% (21.3 GWh). CATL’s batteries are installed in major automakers’ vehicles including Tesla Model 3·Y (Chinese-made units exported to Europe, North America, and Asia), BMW, MG, Mercedes, and Volvo. CATL batteries are also installed in Hyundai Motor Group’s Kona and Niro, and Kia Ray EV, gradually increasing the influence of Chinese companies in the domestic market.

SNE Research stated, "Since the end of last year, the global electric vehicle market has slowed down, and major OEMs such as Tesla, Mercedes, Volkswagen, and GM are withdrawing or postponing their electric vehicle-related plans." They added, "Although there are concerns about the market due to relaxed fuel efficiency regulations and reduced subsidies in various countries, this only slows the pace and does not cast doubt on the transition to electric vehicles." Furthermore, they noted, "The U.S. market, which has relatively less competition with China, is the most important market for Korean battery companies," and "Expansion of market share through joint ventures with OEMs producing locally in North America is expected in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.