9.1% Increase YoY

Balanced Growth Across All Sectors

Increase in Deposits and Loans... Housing Loans Up by 2.7 Trillion

Low-Cost Deposits Up by 4 Trillion

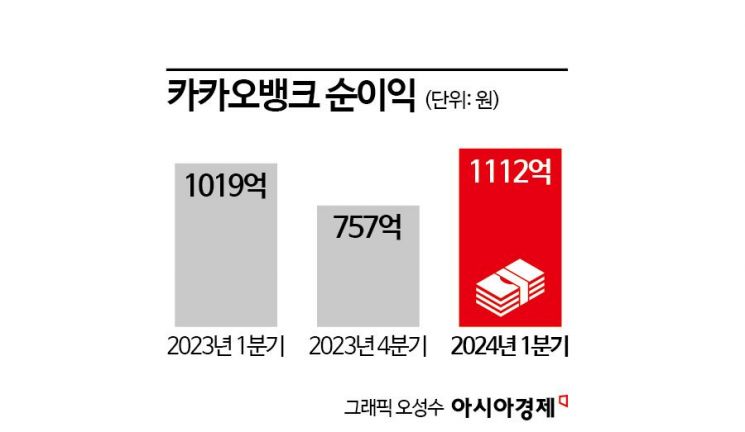

KakaoBank announced on the 8th that its net profit for the first quarter reached 111.2 billion KRW. This represents a 9.1% increase compared to the previous year and a 46.9% growth compared to the previous quarter, marking the largest quarterly figure to date.

KakaoBank's operating profit was 148.4 billion KRW, an 8.8% increase year-over-year. A KakaoBank representative explained, "Based on continuous customer inflow and traffic expansion, we achieved balanced growth across all sectors including deposits, loans, fees, and platform revenue." KakaoBank plans to continue practicing inclusive finance for financially vulnerable groups such as middle- and low-credit customers and small business owners, based on its steady growth.

Continuous Inflow of New Customers... Monthly Active Users (MAU) Surpass 18 Million

The number of KakaoBank customers as of the first quarter was recorded at 23.56 million. More than 700,000 new customers joined in the last quarter alone, showing a continuous upward trend. According to KakaoBank, 80% of people in their 20s and 30s and more than half of those in their 40s and 50s are using KakaoBank.

Customer activity also strengthened. MAU exceeded 18 million for the first time, and weekly active users (WAU) reached 13.22 million. The average time KakaoBank customers spent using the app doubled compared to the previous year. The number of transfers between accounts at different banks using the open banking service within the KakaoBank app also doubled within a year.

Increase in Loans and Deposits... 'Switching Effect' Boosts Mortgage Loans by 2.7 Trillion KRW

KakaoBank's loan balance reached 41.3 trillion KRW as of the first quarter, driven by growth centered on refinancing. This is an increase of 2.6 trillion KRW compared to the end of last year. Specifically, the mortgage loan balance was 11.8 trillion KRW at the end of the first quarter, up 2.7 trillion KRW from 9.1 trillion KRW at the end of last year. The balance of jeonse and monthly rent loans increased by 200 billion KRW from 12.2 trillion KRW to 12.4 trillion KRW during the same period.

It was also analyzed that many people sought KakaoBank for refinancing purposes in the first quarter to reduce interest costs. Last year, 50% of new mortgage loan originations were for refinancing, and this proportion rose to 62% in the first quarter of this year. The refinancing ratio for jeonse and monthly rent deposit loans also reached 45%.

KakaoBank's deposit balance in the first quarter increased by 5.8 trillion KRW from the previous quarter to 53 trillion KRW. In particular, demand deposits increased by more than 4 trillion KRW. The balance of group accounts rose sharply by about 1 trillion KRW compared to the previous quarter, driving the expansion of low-cost deposits. Due to the increase in demand deposits, low-cost deposits accounted for 56.8% of KakaoBank's deposits in the first quarter.

The platform business also grew. Fee and platform revenue in the first quarter was 71.3 billion KRW, showing a 12.8% year-over-year increase and an improving trend. The 'Compare Credit Loans' service, an expansion of the existing 'Linked Loan Service,' grew rapidly, strengthening KakaoBank's position as a loan platform. The number and amount of loans executed through partner financial institutions on the KakaoBank app more than doubled compared to the same period last year.

Expansion of Middle- and Low-Credit Loans... Slight Decline in Delinquency Rate

KakaoBank was the only internet-only bank last year to achieve its goal of expanding loans to middle- and low-credit customers, and it maintained a balance ratio of over 30% in the first quarter. As of the first quarter, the average balance and ratio of credit loans to middle- and low-credit customers were approximately 4.6 trillion KRW and 31.6%, respectively.

The delinquency rate in the first quarter fell by 0.02 percentage points from the previous quarter to 0.47%. The net interest margin (NIM) was 2.18%. The cost-to-income ratio (CIR) improved from 37.3% at the end of last year to 35.2%. A KakaoBank representative said, "Through risk management capabilities reflecting changes in internal and external conditions and the advancement of the credit scoring system (CSS), we have simultaneously achieved the 'two rabbits' of inclusive finance and soundness. We will continue sustainable growth together with our customers based on coexistence and inclusive finance."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.