Hansome, Hansome Life & Stock 4.2 Billion 'Impairment Loss'

Cumulative Net Loss Since 2020 Acquisition

Hansome Q1 Operating Profit 32.5 Billion...Down 40% YoY

Hansome's cosmetics subsidiary, Hansome Life &, has become a 'sore spot.' Since Hansome's acquisition in 2020, the company has continued to post negative earnings. Although it entered the cosmetics market to complement the fashion sector, which is highly volatile depending on economic conditions, Hansome Life & recorded impairment losses on its shares for the first time last year due to disappointing profits.

According to the Financial Supervisory Service's electronic disclosure system on the 8th, Hansome recognized an impairment loss of 4.2 billion KRW on its shares in Hansome Life &, stating that the estimated recoverable amount was below the book value. As a result, the book value of Hansome Life & plummeted from 7.1 billion KRW to 2.8 billion KRW. This means the value of Hansome's holdings in Hansome Life & has decreased.

In May 2020, Hansome entered the cosmetics market by acquiring 51% of Hansome Life & (formerly Cleanzen Cosmeceutical) shares for 5.3 billion KRW. Until then, Hansome had imported and introduced overseas cosmetics but did not have its own cosmetics brand. However, as fashion consumption sharply declined due to the COVID-19 pandemic, the company sought a breakthrough by acquiring a cosmetics company. At that time, the fact that competitor Shinsegae International defended profits in cosmetics and perfume sectors also influenced the decision.

After acquiring the cosmetics company, Hansome applied the premium image it had built in the women's clothing market to cosmetics and launched the luxury skincare brand 'Oera,' priced between 300,000 KRW and 1 million KRW. In 2022, the product line expanded to include entry-level items such as cushions, masks, and hand creams. The number of Oera stores increased from 4 in 2021 and 6 in 2022 to 13 as of May 2024.

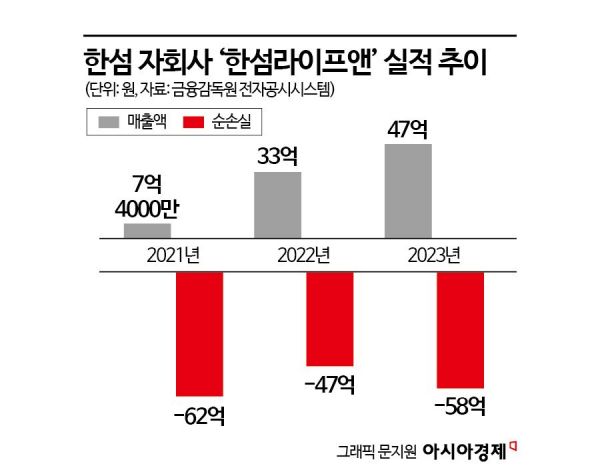

However, Hansome Life &'s performance did not follow suit. In 2021, when the Oera business was officially launched, the company posted sales of 740 million KRW and a net loss of 6.2 billion KRW. In 2022, sales were 3.3 billion KRW with a net loss of 4.7 billion KRW, and last year, sales reached 4.7 billion KRW with a net loss of 5.8 billion KRW. Although sales slightly increased, the net loss widened.

As losses expanded, the financial structure also became precarious. As of the end of last year, Hansome Life &'s liabilities jumped from 8.7 billion KRW to 12.9 billion KRW, and total equity recorded a capital loss, dropping from 600 million KRW to -5.2 billion KRW. Consequently, the amount of money borrowed from the parent company Hansome increased. Loans stood at 5 billion KRW in 2022 but rose by 4 billion KRW last year to 9 billion KRW. In November last year, some loan maturities were also extended. An industry insider said, "The cosmetics market has low entry barriers, but to succeed, you need a killer product. Although Hansome positioned itself in the luxury market targeting VIPs of Hyundai Department Store Group, the fact that repurchases are not frequent suggests it is not at a level to beat competitors like Gallant and La Mer."

The poor performance of the cosmetics subsidiary has led to a deterioration in Hansome's overall results. As of the first quarter of this year, Hansome recorded sales of 393.6 billion KRW and operating profit of 32.5 billion KRW, down 3% and 40.2%, respectively, compared to the same period last year. These figures fall short of the securities industry's estimates of 404.5 billion KRW in sales and 38.3 billion KRW in operating profit. The company explained that the prolonged economic downturn has slowed the recovery of the fashion market.

Additionally, costs related to Hansome's flagship fashion brands System and Time entering the Paris market (such as flagship store operations) are also analyzed to have lowered profitability. Since last year, Hansome has expanded imported brands to recover sales, but their contribution to sales remains below 5%. A Hansome representative said, "The US street brand 'KITH' store opened in May, which may improve performance. There are also forecasts that economic conditions will improve in the second half, so the fashion market could be positively affected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)