Major Manufacturers' Sales and Operating Profit Increase Year-on-Year

Cost Rise Impact, Signs of Price Hikes

Government and Consumer Groups Likely to Intensify Pressure

Major domestic food manufacturers recorded strong performances in the first quarter of this year. This was largely due to achievements in overseas markets despite adverse domestic and international factors such as high inflation and rising raw material prices. Following last month's general election, the food industry has raised or announced price hikes for products citing increased costs including raw materials, and based on these companies' business results, it is expected that government and consumer groups will intensify their scrutiny.

Citizens are shopping at the processed food and snack section of a large supermarket in downtown Seoul. [Image source=Yonhap News]

Citizens are shopping at the processed food and snack section of a large supermarket in downtown Seoul. [Image source=Yonhap News]

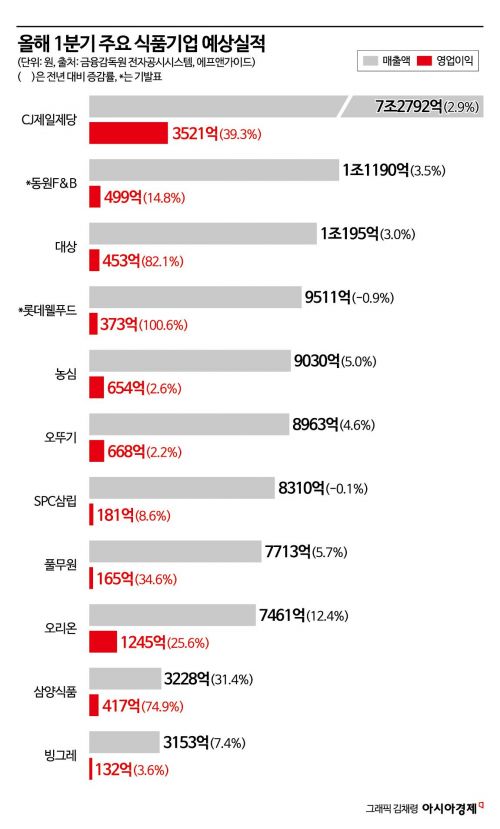

According to the Financial Supervisory Service's electronic disclosure system and the securities industry on the 7th, Lotte Wellfood's consolidated operating profit for the first quarter of this year was tentatively estimated at 37.3 billion KRW, more than doubling (100.6%) compared to the same period last year. Sales decreased slightly by 0.9% to 951.1 billion KRW, but net profit increased significantly to 20.1 billion KRW. A Lotte Wellfood official stated, "In the domestic business, profits increased due to the depletion of high-cost inventory, and in the global business, operations in India and Kazakhstan performed well." The company also explained that profitability improved as international oil prices stabilized.

Dongwon F&B also saw its first-quarter operating profit rise 14.8% year-on-year to 49.9 billion KRW, with sales increasing 3.5% to 1.119 trillion KRW. The company attributed the improved performance to increased sales of practical gift sets during the Lunar New Year holiday and a rise in demand for home meal replacements (HMR) as consumers preferred home-cooked meals over dining out amid high inflation.

Confectionery, Bakery, and Processed Foods Take Off Overseas

Consensus forecasts for manufacturers yet to announce first-quarter results are also positive. For example, CJ CheilJedang, the top food company, is expected to report a 39.3% increase in first-quarter operating profit to 352.1 billion KRW compared to the same period last year. Sales are projected to rise 2.9% to 7.2792 trillion KRW. This is attributed to the overseas popularity of the food business led by the 'Bibigo' brand and improved market conditions in the bio business sector, including lysine. Daesang is also expected to record a first-quarter operating profit of 45.3 billion KRW, up 82.1% year-on-year, driven by expanded exports of 'Jongga' kimchi and improved lysine market conditions similar to CJ CheilJedang. Sales for the same period are forecast to increase 3.0% to 1.0195 trillion KRW.

With first-quarter K-ramen exports reaching a record high of 273.03 million USD (approximately 371.2 billion KRW), the outlook for the three major ramen companies?Nongshim, Ottogi, and Samyang Foods?is bright. Samyang Foods showed particularly rapid growth in sales and operating profit. Thanks to the global popularity of Buldak Bokkeum Myun, first-quarter sales are estimated at 322.8 billion KRW, a 31.43% increase from a year earlier. Operating profit for the same period is estimated to have grown 74.86% to 41.7 billion KRW. Although the domestic market was sluggish, the company exceeded expectations overseas, including in G2 countries such as China and the United States. Among first-quarter sales, Samyang Foods' ramen exports are estimated at 220.8 billion KRW, up 42.6% from 154.9 billion KRW the previous year.

Nongshim's first-quarter sales are expected to increase 4.95% year-on-year to 903 billion KRW. Operating profit for the same period is estimated to have risen 4.5% to 66.6 billion KRW. Although the rapid growth in exports to the United States and China last year slowed, increased ramen demand in Europe and Southeast Asia helped drive first-quarter results, according to the securities industry.

Ottogi, which recorded its highest-ever sales last year at 3.4545 trillion KRW, is also estimated to have first-quarter sales up 4.61% year-on-year to 896.3 billion KRW. Operating profit is expected to increase 2.19% to 66.8 billion KRW. Although its overseas sales ratio is lower compared to Nongshim and Samyang Foods, growth in the United States and Vietnam is believed to have driven performance.

Additionally, snack, bakery, and ice cream manufacturers such as Orion, SPC Samlip, and Binggrae are also expected to report improved first-quarter results compared to the same period last year.

Post-Election Price Hikes Continue... "Concerns Over Consumption Slump"

Following the general election and entering the second quarter, price hikes in the food industry are becoming more active. Lotte Wellfood plans to raise prices of major products such as Ghana chocolate and Pepero by an average of 12% next month. The company states that price increases are inevitable as the price of cocoa (processed from cacao beans), the main ingredient in chocolate, has reached an all-time high.

Seasoned seaweed manufacturers are also raising prices due to the sharp rise in the price of raw seaweed (kim). Following specialized companies with top market shares such as Gwangcheon Kim, Seonggyeong Food, and Daecheon Kim raising product prices by 10-20% last month, CJ CheilJedang also increased seaweed prices by 11.1% at supermarkets and online starting from the 2nd.

While competitors are weighing the timing and possibility of price hikes, the Ministry of Agriculture, Food and Rural Affairs recently held meetings with food companies, repeatedly requesting restraint on price increases to stabilize prices.

The Korea Consumer Organization also expressed regret, stating, "Food companies enjoyed profits without lowering consumer prices during periods when raw material and exchange rates were falling, yet they immediately decide to raise prices whenever raw material and price increase causes arise." They added, "While it is fully understood that companies face difficult environments due to various cost increases, passing all short-term cost burdens onto consumers could lead to a consumption slump, creating a vicious cycle harmful to everyone." They urged food companies to adopt a more cautious approach to pricing decisions from a long-term perspective.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)