Hyundai Card, Kakao, and Others as Financial Investors Supporting

Affinity, the PEF Industry's 'Unbeatable Myth'

Series of Korean Partners Resign Amid Investment Deterioration

Atmosphere of Increasing Influence from Chinese Partners

"Just as all companies experience birth, aging, sickness, and death, private equity fund (PEF) management firms share the same fate. The core of a management firm is talent management. If done well, they become like Blackstone, but right now, Affinity seems to be at a crossroads."

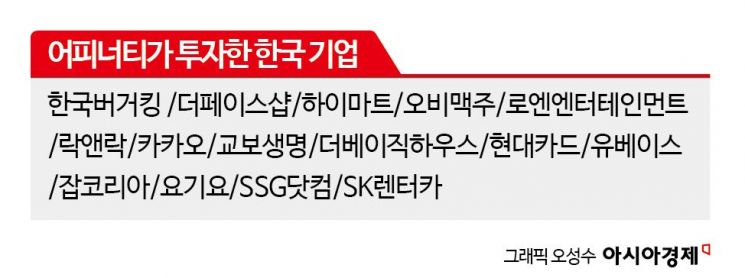

This is a harsh assessment from an industry insider regarding Affinity Equity Partners (Affinity), a Hong Kong-based private equity fund that has drawn intense attention from the business community and capital markets amid ongoing conflicts with major domestic conglomerates and minority shareholders. Affinity, which has participated as a financial investor (FI) in major companies such as Kyobo Life Insurance, Shinsegae, Hyundai Card, and Kakao, and was once hailed as an invincible legend in the PEF industry, is now struggling to exit investments due to deteriorating market conditions. Internally, Korean partners at Affinity have been resigning one after another while Chinese partners' influence is growing. Meanwhile, conflicts with portfolio companies have surfaced externally, causing Affinity's reputation to plummet from a 'strategic ally' of conglomerates to a 'grim reaper.'

Affinity was founded in 2004 when former chairman Park Young-taek, a Samsung Electronics alumnus, teamed up with Tang Kok-yu, a Malaysian Chinese founding chairman, to spin off from UBS Capital Asia's investment organization and establish the PEF management firm. From 2005, Affinity invested in controlling stakes of companies such as OB Beer, Hi-Mart, The Face Shop, and Loen Entertainment, selling them for up to six times the original value, making history in the PEF industry. The firm had a strong Korean presence, with five out of ten partners being Korean. However, former Korean representative Lee Cheol-joo left the company in 2021 to join the UK-based PEF CVC Capital, and founder Park Young-taek retired in March last year. Moon Young-joo, former CEO of BKRL Korea who managed Burger King for ten years as a professional manager, also moved to become CEO of Twosome Place, owned by rival PEF Carlyle Group. As key figures who were the backbone of Affinity stepped down, the atmosphere is said to be shifting toward stronger leadership by Chinese partners.

Affinity Shows Signs of 'Put Option' Dispute with Shinsegae Following Kyobo Life... Reputation Falls from Conglomerate 'Ally' to 'Grim Reaper'

Recently, Emart and Shinsegae have been negotiating with Affinity and BRV Capital, financial investors of SSG.com, over the conditions of a put option but have yet to reach a conclusion. The conflict stems from differing views on the validity of the put option. Shinsegae argues that SSG.com's total transaction volume in 2022 exceeded 5.7 trillion KRW, meeting the conditions that prevent FIs from exercising the put option. Conversely, Affinity claims that the total transaction volume was overstated because it included gift card transactions. The put option exercise period is from May 1, 2023, to April 2027. Affinity has not yet taken a clear stance but stated, "We will sincerely discuss with Shinsegae and do our best to resolve the issue."

Previously, Affinity and BRV signed an investment agreement with Shinsegae Group in 2018, investing a total of 1 trillion KRW?700 billion in 2019 and 300 billion in 2022?securing 15% stakes each in SSG.com. The agreement included a put option clause allowing FIs to request Shinsegae to buy all their shares if SSG.com's gross merchandise volume (GMV) did not exceed 5.16 trillion KRW by 2023 or if multiple investment banks did not confirm readiness for an initial public offering (IPO). Due to poor performance and worsening market conditions delaying SSG.com's IPO, Affinity has leaned toward early recovery of its investment. If Affinity exercises the put option, Shinsegae Group would have to pay about 1 trillion KRW. The shareholder agreement also stipulates that if the purchase price is not paid, the major shareholder and acquirer can demand the sale of all shares they own, making legal battles inevitable.

This is not Affinity's first put option dispute. The firm has been embroiled in a six-year conflict with Kyobo Life Insurance chairman Shin Chang-jae over the put option exercise price. In 2012, Daewoo International, Kyobo Life's second-largest shareholder, decided to sell its 24% stake to secure business funds. Affinity acquired the stake at 249,000 KRW per share, with a promise from Shin's side to recover the investment through a stock market listing within three years. If the IPO did not occur as planned, Affinity was allowed to exercise the put option to resell the shares to Shin. When the listing promise was not fulfilled by the deadline, conflicts intensified. In 2018, Affinity notified its intention to exercise the put option at 410,000 KRW per share through Anjin Accounting Firm, but Shin's side rejected it as an unreasonable price. The dispute has continued in court since then.

Burger King's Iconic 'Whopper' Sales Halted... Lock&Lock Delisting and Other Issues Stir Consumer and Minority Shareholder Discontent

Recently, Affinity has also caused turmoil in the operations of several portfolio companies, including Burger King and Lock&Lock. BKRL, the operator of Burger King, suddenly stopped selling its flagship product, the Whopper, a symbolic menu favored by Korean consumers. BKRL explained it as marketing for the launch of the New Whopper, but industry insiders criticized it as a desperate measure. In 2016, Affinity acquired the Korean and Japanese management rights of Burger King from domestic PEF VIG Partners for about 220 billion KRW. After the COVID-19 pandemic, at the end of 2021, Affinity put Burger King up for sale in the M&A market. However, the sale has stalled. Last year, Burger King's sales decreased by about 2% year-on-year, but operating profit tripled, which analysts attribute to cost-cutting measures compensating for the sales gap.

Lock&Lock, the leading domestic airtight container specialist, is pursuing voluntary delisting. Affinity, the largest shareholder with a 69.94% stake, plans to acquire the remaining shares through a public tender offer and proceed with delisting. Under current law, a major shareholder holding more than 95.0% can decide on voluntary delisting. Minority shareholders strongly oppose this, citing the tender offer price as excessively low. Affinity's tender offer price is 8,750 KRW per share, about 6.9% higher than the closing price of 8,180 KRW the day before the announcement. The stock price, which soared to around 28,000 KRW immediately after Affinity's acquisition, has been declining steadily, and many shareholders face confirmed losses if delisting occurs. This has led to minority shareholder movements online to block the tender offer. Affinity's focus on recovery through dividends and capital reductions, regardless of performance, has also fueled criticism.

Will Affinity Become an 'Aging Fund' Focused Only on Recovery, Losing Its Former Glory?

‥New CEO Min Byung-chul's 'Role Theory'‥ Affinity at a Critical Crossroads

Affinity is widely regarded as having lost its former prestige after facing difficulties in recovering investments in minority stakes such as Kyobo Life and Hyundai Card, as well as failures in controlling investments in Lock&Lock, Burger King, and Ubase. Despite investments in companies like JobKorea, Yogiyo, and SSG.com, prospects remain bleak. The departure of previous management responsible for investment failures and the ensuing generational change and investment strategy shifts have caused various internal frictions.

A private equity fund CEO said, "Affinity is very concerned about its reputation in Korea. While they do not want to take aggressive actions, there were certainly aspects where litigation was the only way to resolve issues."

Whether Affinity will continue on a path of decline after losing its past reputation or create an opportunity for resurgence depends on the role of newly appointed CEO Min Byung-chul, who took office as Korea's head last year. Min recently joined the Kyobo Life Insurance board of directors. Unlike previous management, Min is known to seek improved relations with Kyobo Life. While past executives were hardliners willing to endure prolonged disputes to secure sufficient profits, Min is considered a pragmatist. The negotiation process with Shinsegae is also a point to watch.

A senior official from another private equity fund commented, "PE firms need to respond more flexibly when issues arise, but there is also a general need to improve the practice of conglomerates making competitive promises they cannot keep."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)