Financial Supervisory Service Announces Interim Results of Illegal Short Selling Investigation

Most Causes of Illegal Short Selling Due to Poor Balance Management

Discussion on Illegal Short Selling Cooperation with Hong Kong Scheduled for May

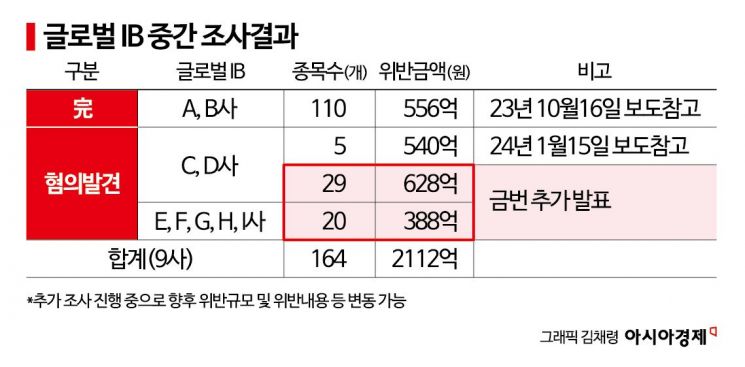

It has been revealed that nine global investment banks (IBs) conducted illegal short selling worth 211.2 billion KRW (covering 164 stocks) in the domestic stock market. The causes of illegal short selling were inadequate procedures for returning loaned stocks, submitting short selling orders before confirming borrowings, and overall poor internal inventory management.

On the 6th, the Financial Supervisory Service (FSS) announced the "Interim Investigation Results and Future Plans on Illegal Short Selling by Global IBs." The FSS first detected large-scale illegal short selling activities by global IBs in October last year. Following this, the "Special Short Selling Investigation Team" was launched to conduct a full investigation of illegal short selling by 14 global IBs.

According to the interim investigation, five additional global IBs were newly found to be involved. They were caught conducting illegal short selling worth 38.8 billion KRW across 20 stocks.

Previously, the FSS imposed fines totaling 26.5 billion KRW on two companies (BNP Paribas and Hong Kong HSBC), which were the first to be caught for illegal short selling, and completed prosecution referrals to the Financial Services Commission’s Securities and Futures Commission. Companies C and D, detected earlier this year, were found to have conducted illegal short selling worth 54 billion KRW across five stocks, but further investigation revealed illegal short selling worth 62.8 billion KRW across 29 stocks.

The causes of illegal short selling can be summarized mostly as "poor inventory management," including △inadequate procedures for returning loaned or collateral-provided stocks △submission of short selling orders before borrowings are confirmed △poor inventory management between internal departments △manual input errors.

Ham Yong-il, Deputy Governor in charge of Capital Markets and Accounting at the FSS, explained, "To prevent recurrence of illegal short selling, we have requested the establishment of effective measures such as improving the short selling order process and inventory management methods."

The FSS plans to strengthen international cooperation with overseas financial authorities such as those in Hong Kong and Singapore regarding investigations into illegal short selling, leveraging the full investigation of global IBs. They will establish practical cooperation channels to continuously discuss key issues related to investigations and hold video conferences with Hong Kong regulators semiannually.

As part of this effort, in May, the FSS will hold a local meeting with major global IBs in Hong Kong to explain the Korean short selling system and ongoing improvements to the IT system. They will also consider feedback from foreign investors to help improve the short selling system.

The FSS stated, "We will promptly proceed with illegal short selling investigations on the remaining five companies," and added, "We will also carry out improvements to the short selling system, including resolving the tilted playing field and computerizing short selling, without delay."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.