Korean Tire 3 Companies All Achieve Triple-Digit Operating Profit Growth in 1Q

Significant Growth Beyond Sales... Profitability Improvement

'Hyoja' Electric Vehicle Tires... Replacement Cycle Also Faster

On the 6th, Hyundai Motor's 'Ioniq 5' was exhibited at 'EV Trend Korea' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On the 6th, Hyundai Motor's 'Ioniq 5' was exhibited at 'EV Trend Korea' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

Domestic tire companies achieved record-breaking performance in the first quarter of this year. Unlike the sluggish demand for new car purchases, sales of high-priced products such as electric vehicle tires and high-inch tires were solid, thanks to the combined effects of exchange rates and stabilization of raw material costs.

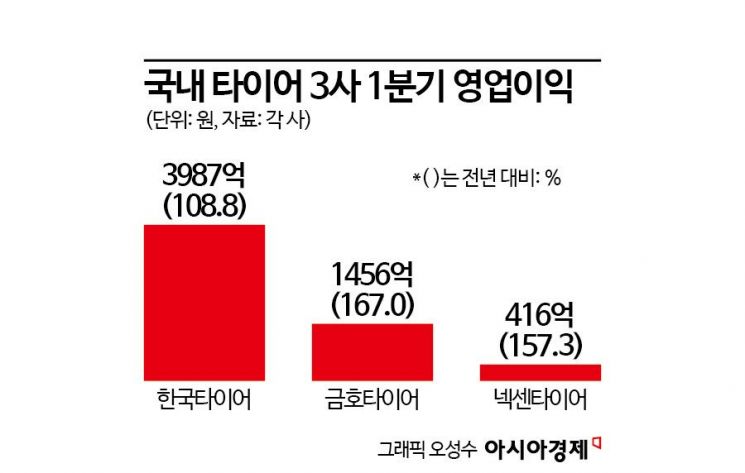

According to the industry on the 3rd, all three domestic tire companies recorded triple-digit growth rates in operating profit for the first quarter of this year. Nexen Tire posted an operating profit of 41.6 billion KRW on a consolidated basis in the first quarter, up 157.3% from the same period last year. Kumho Tire also achieved strong results, with an operating profit of 145.6 billion KRW in the first quarter, a 167.0% increase compared to the same period last year. This is the highest record in 10 years for the first quarter. Korea Tire & Technology, the senior player in the domestic tire industry, also reached 398.7 billion KRW, growing 108.8% year-on-year.

It is interpreted that high-value-added products with high unit prices, such as electric vehicle tires and high-inch tires, boosted profitability. Although all three companies’ sales growth rates were in the single digits (1.1?6.0%), operating profits more than doubled. Rather than growth in sales volume itself, the increase in sales of higher-priced products significantly improved profit margins. High-inch tires are typically mounted on sport utility vehicles (SUVs), and electric vehicles also use separate dedicated tires. This is because they must withstand heavier bodies and the tire wear rate is faster. This is also why Korea Tire and Kumho Tire quickly launched their own electric vehicle tire brands.

Since exports account for a large proportion, the continued high exchange rate of the Korean won against the US dollar and normalization of logistics costs also contributed to improved profitability. Since the first quarter, the exchange rate has remained in the mid-to-high 1,300 KRW per dollar range, increasing overseas sales settled in dollars, while domestic labor costs paid in won relatively decreased in proportion. Although prices of some raw materials such as natural and synthetic rubber rose, overall material costs are stabilizing. Maritime freight rates, which were a concern due to geopolitical risks in the Middle East such as the ‘Red Sea risk,’ are still based on last year’s contracted prices. It is expected that the impact will not be significant until the first half of the year.

Moreover, as the tire replacement cycle for electric vehicles introduced so far is expected to begin in earnest around 2025, stable performance is anticipated for the time being. An industry insider explained, "Electric vehicle tires are trending to increase in size from a basic 18 inches to up to 22 inches to withstand the heavy battery," adding, "The replacement cycle for electric vehicle tires is 2 to 3 years, about half that of regular tires, so as electric vehicle adoption increases, the performance scale of tire companies will fundamentally change."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)