Losses Due to Poor Performance of Local Acquiring Companies and Corporations

Green Cross Holdings Records the Largest Loss

Dong-A ST and JW Jungwoo Also Suffer Losses

SK Biopharm and Hanmi Pharm Show Positive Results

Major domestic pharmaceutical companies attempt to expand overseas by establishing foreign subsidiaries or acquiring local pharmaceutical companies. However, except for a few companies that brought their self-developed drugs abroad, most have struggled with accumulated losses.

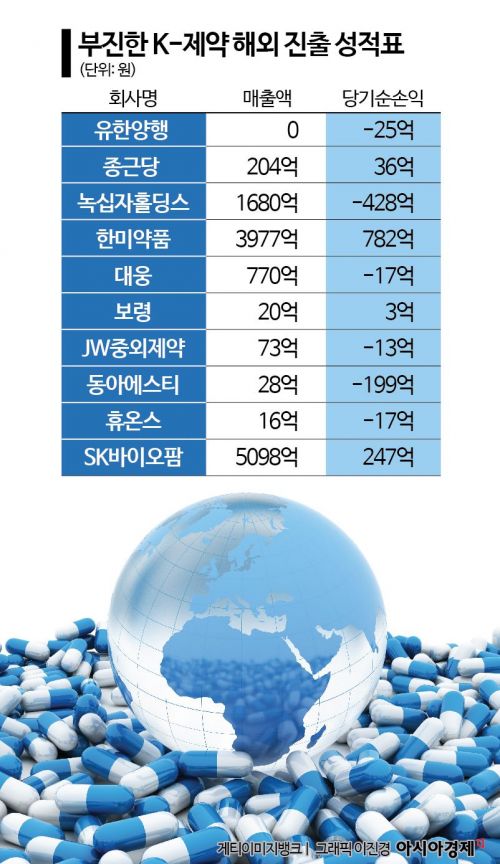

On the 6th, Asia Economy investigated the business reports of the top 10 pharmaceutical companies by sales operating overseas subsidiaries or affiliates, and found that six of them recorded losses in their overseas businesses last year. These include Yuhan Corporation, Green Cross Holdings, Daewoong Pharmaceutical, JW Pharmaceutical, Dong-A ST, and Huons Global. Most of them incurred losses after acquiring local companies or establishing local sales subsidiaries in the U.S., China, or Southeast Asia. Some companies even turned to losses at their headquarters due to poor overseas business performance.

The pharmaceutical company that suffered the largest loss overseas was Green Cross Holdings, the holding company of the GC Green Cross Group, which recorded a net loss of 42.8 billion KRW. Biocentric, a U.S.-based contract development and manufacturing organization (CDMO) affiliate and a major shareholder along with GC Cell, posted a net loss of 25.9 billion KRW last year. This loss tripled compared to the previous year's net loss of 8.5 billion KRW. This is attributed to a significant contraction in the global CDMO market. Biocentric focuses on producing clinical trial drugs rather than commercial pharmaceuticals, and the reduction in U.S. biotech investment led to a sharp decline in early-stage new drug pipelines, delivering a direct blow to Biocentric.

In addition, overseas affiliates such as the U.S. cancer diagnostic company Genis Health (net loss of 9.5 billion KRW), the U.S. local subsidiary GC Biopharma USA (4.5 billion KRW), and the China subsidiary (3.3 billion KRW) all recorded losses last year. The company explained that GC Biopharma USA's losses were due to investments in building a direct sales network for the blood product Aliglo, which is scheduled to launch in the U.S. in July.

Dong-A ST's U.S. subsidiary, Neurob Pharmaceuticals, acquired in 2022, continues to post losses. Although the company set a goal to make it a global research and development (R&D) forward base, it has yet to have any suitable products and is only generating losses. This situation is even negatively affecting Dong-A ST's overall performance. Neurob posted a net loss of 20.1 billion KRW last year, and Dong-A ST's performance turned to a net loss of 9.6 billion KRW last year from a net profit of 12.8 billion KRW in 2022. Currently, Neurob is conducting Phase 2 clinical trials for liver disease treatments and Phase 1 clinical trials for obesity treatments in the U.S.

JW Pharmaceutical's Vietnamese subsidiary Ubipharm, acquired in 2019, has been in the red for five consecutive years, including a net loss of 1.3 billion KRW last year. JW Pharmaceutical's owner has shown enthusiasm by purchasing 100% of the company's shares to incorporate it as an affiliate, but the plan to produce its own drugs locally in Vietnam and sell them in Southeast Asia reportedly did not progress properly from the initial stages.

The Huons Group established Huons USA in 2020 and started exporting COVID-19 prevention supplies and lidocaine injections, but it has continued to post net losses. However, the company stated that due to increased sales in the U.S. last year, it turned to operating profit on an operating income basis. Daewoong Pharmaceutical recorded a net loss of 1.7 billion KRW last year related to overseas businesses, including losses from Liaoning Daewoong Pharmaceutical Co., Ltd. (2.4 billion KRW).

Yuhan Corporation's overseas subsidiaries in the U.S., Uzbekistan, Hong Kong, Australia, and New Zealand all recorded net losses without any sales. However, the company explained that these losses are "natural." A company official said, "These subsidiaries were established for open innovation through cooperation with local companies overseas," adding, "Even if they achieve results such as technology exports and imports, all related performance is recorded as the headquarters' performance, so accounting losses are natural."

Jung Yoon-taek, CEO of the Pharmaceutical Industry Research Institute, said, "From the perspective of future investment, overseas subsidiaries may not contribute to performance immediately," but added, "However, if losses continue in reality, it can become a significant burden for the parent company." In fact, Dong-A ST liquidated its Brazilian subsidiary, which had been posting losses, last year. Jung advised, "Before expanding overseas, it is necessary to precisely set targets and create sufficient scenarios," and recommended, "Initially, seek partners, then proceed with joint ventures (JV) type partnerships, and subsequently approach step-by-step through direct establishment of subsidiaries or mergers and acquisitions (M&A)."

SK Biopharm President Lee Dong-hoon attended a local sales meeting held in Tampa, Florida, last January, sharing the local performance and vision of Cenobamate with SK Biopharm and SK Life Sciences employees.

SK Biopharm President Lee Dong-hoon attended a local sales meeting held in Tampa, Florida, last January, sharing the local performance and vision of Cenobamate with SK Biopharm and SK Life Sciences employees. [Photo by SK Biopharm]

On the other hand, some pharmaceutical companies have achieved significant results with their overseas subsidiaries. SK Biopharm's U.S. sales subsidiary, SK Life Science, recorded sales of 490.7 billion KRW and a net profit of 24.2 billion KRW last year. This was thanks to the strong sales of its self-developed new drug Cenobamate in the U.S. market. Riding on this success, SK Biopharm turned to operating profit in the fourth quarter of last year and aims for an annual profit this year.

Hanmi Pharmaceutical's subsidiary, Beijing Hanmi Co., Ltd., recorded its highest-ever performance since its founding last year, with sales of 397.7 billion KRW and a net profit of 78.7 billion KRW, boosting the parent company's performance. Locally tailored drugs such as the pediatric cough and expectorant Itanjing and the constipation medicine Litong all posted good results. Boryung recorded profits in the U.S. and China combined, and Chong Kun Dang recorded profits in Indonesia.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.