Financial Services Commission Unveils Corporate Value-Up Program

Key Financial Indicators Include ROIC and Treasury Stock Cancellation

Enhancing Common Shareholders' Rights and Audit Independence Also Key Items

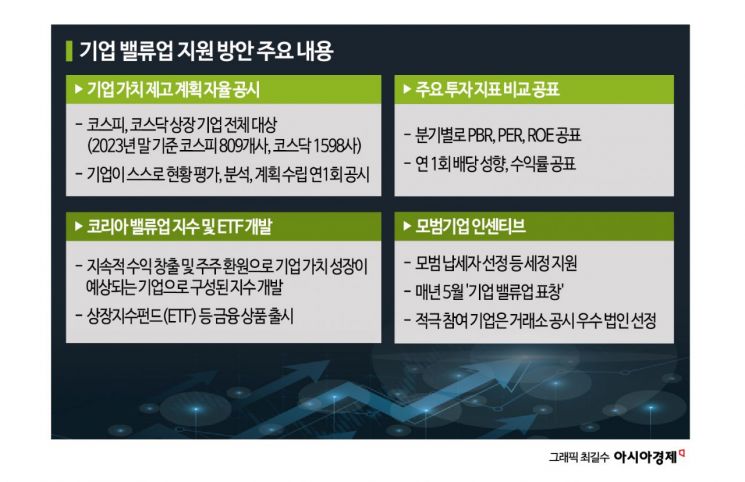

On the 2nd, the Financial Services Commission (FSC) revealed the 'Corporate Value Enhancement Plan (Corporate Value-Up) Guidelines,' notably mentioning capital profitability (Return on Invested Capital·ROIC, Return on Equity·ROE) in the disclosure of financial indicators. This is interpreted as an intention to change the existing perception that the cost of shareholder capital is '0.' Furthermore, it is also characteristic that governance improvement plans must be specified in non-financial indicators. This is expected to help resolve the Korea Discount (undervaluation of the Korean stock market).

Features of Capital Efficiency Indicator Disclosure... Active Communication of Shareholder Return Plans

According to the Corporate Value Enhancement Plan Guidelines, listed companies must voluntarily select key indicators (financial and non-financial) for enhancing corporate value and disclose specific implementation plans once a year. The purpose is for companies to communicate their mid- to long-term plans with the market.

The key indicators are divided into 'financial indicators' and 'non-financial indicators.' The main financial indicators consist of △market evaluation △capital efficiency △shareholder return △growth △other items. The market's focus is on the 'capital efficiency' category. Listed companies will be required to present capital profitability targets such as ROE and ROIC going forward.

ROIC is an indicator that assesses whether the capital and assets invested in business operations are being used efficiently. Like ROE, a higher ROIC is interpreted as the company generating profits well. Shareholder capital costs (COE) and weighted average cost of capital (WACC), related to capital costs, must also be disclosed as financial indicators.

A representative of an activist private equity firm commented, "Specifying capital efficiency items as part of corporate value enhancement measures will help change the perception of those who think shareholder capital is '0' cost."

Additionally, shareholder return plans must be included in the disclosure content. The FSC recommended subdividing shareholder return items into dividends, treasury stock, etc. Regarding dividends, details such as dividend amount, payout ratio, and dividend yield must be included. For treasury stock, detailed disclosures of treasury stock holdings, new acquisitions, and cancellations are required. Total Shareholder Return (TSR) and shareholder return rate must also be specified.

Moreover, improvements in market evaluation indicators such as Price-to-Book Ratio (PBR) and Price-to-Earnings Ratio (PER) must be fundamentally included. Growth indicators such as sales growth rate, operating profit growth rate, and asset growth rate are also included.

Disclosure of Governance Improvement Plans... Communication with Shareholders Needed in Cases of Split Listings and Tunneling Controversies

Notably, the guidelines recommend disclosing 'governance improvement plans' as non-financial indicators. Governance has been the area with the greatest difference in perspective between the business community (listed companies) and the capital market. This is why the FSC guidelines are considered more progressive than Japan’s, which focuses on disclosing corporate value enhancement plans centered on financial indicators.

Governance improvement plans should create indicators focusing on issues of high interest to market participants, such as enhancing the rights of common shareholders, board accountability, and auditor independence.

Park Min-woo, Director of the Capital Market Bureau at the FSC, explained, "Non-financial factors are important parts to consider for enhancing corporate value in the mid- to long-term. In particular, governance, which is cited as a cause of undervaluation in the domestic stock market, is a representative non-financial factor."

As examples related to this, the FSC cited overlapping listings of parent and subsidiary companies (split listings) and issues of controlling shareholders holding unlisted private companies. Split listings involve spinning off core business units into subsidiaries and newly listing them, which lowers the parent company's corporate value and damages the equity value of existing shareholders.

A representative case is the sharp drop in LG Chem’s stock price immediately after the listing of its subsidiary LG Energy Solution in 2022. When governance issues like these cause market concerns, it is possible to explain the exact facts to resolve conflicts of interest between major shareholders and common shareholders.

Controlling shareholders holding unlisted private companies have also often led to 'tunneling' issues (acts of diverting company profits for the controlling shareholder’s private benefit). If investors raise concerns that the owner family is funneling orders to companies they own large stakes in and paying dividends mainly to those companies, listed companies will likely need to engage in communication with shareholders.

Meanwhile, the FSC plans to finalize and announce the Value-Up Guidelines and explanatory materials within this month after collecting opinions. Companies can then proceed with voluntary disclosures as they become ready.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.