"Problems with Valuation Standards, Bond Recovery Plans, and Funding Sources"

"No Objective Criteria for Fair Valuation"

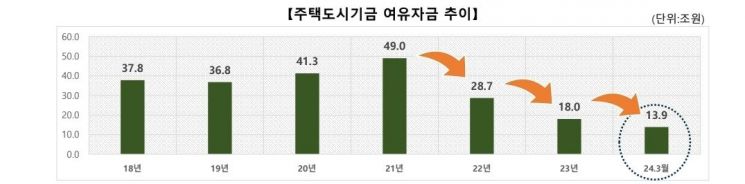

Housing and Urban Fund Surplus Funds Decrease from 49 Trillion Won to 13.9 Trillion Won

The Korea Housing & Urban Guarantee Corporation (HUG) has opposed the amendment to the "Special Act on Support for Jeonse Fraud Victims and Residential Stability" (Jeonse Fraud Special Act), which includes a 'preliminary relief and subsequent recovery' plan for victims of jeonse fraud. While agreeing with the purpose of supporting victims, HUG pointed out that the bill lacks practicality. They emphasized that sufficient discussions on the valuation of tenant deposit refund claims, recovery methods, and funding sources must take place before the amendment is passed.

Photo from the seminar "The Role of HUG in Protecting Victims of Jeonse Fraud" held on the 30th at the FKI Tower Conference Center in Yeouido, Seoul.

Photo from the seminar "The Role of HUG in Protecting Victims of Jeonse Fraud" held on the 30th at the FKI Tower Conference Center in Yeouido, Seoul. Photo by Park Seung-wook

On the 30th, at the 'HUG's Role in Protecting Jeonse Fraud Victims' seminar held at the FKI Tower Conference Center in Yeouido, Seoul, Kim Taek-seon, Head of HUG's Compliance Support Division, stated, "The amendment only presents an abstract standard of fair valuation without concrete criteria for valuation," adding, "Objective evaluation standards must be clearly defined to ensure that institutions purchasing tenant deposit refund claims conduct fair valuations." The amendment to the Jeonse Fraud Special Act stipulates that when purchasing tenant deposit refund claims, "a fair valuation may be conducted according to the method prescribed by Presidential Decree."

HUG also raised concerns about the method of recovering the purchase price after acquiring the claims. Kim said, "The amendment anticipates recovery through both purchase and sale and through dividend procedures, so additional steps are needed not only to calculate the purchase price but also to decide whether to pay the full purchase price upfront or pay part of it and settle the remainder later."

Trends in Surplus Funds of the Housing and Urban Fund. [Image provided by Housing and Urban Guarantee Corporation (HUG)]

Trends in Surplus Funds of the Housing and Urban Fund. [Image provided by Housing and Urban Guarantee Corporation (HUG)]

They also pointed out that the Housing and Urban Fund, which finances the 'preliminary relief,' is shrinking. The main revenues of the Housing and Urban Fund come from subscription savings and housing bonds. Subscription savings have turned negative since 2022 due to reduced subscription incentives and lower interest rates compared to the private sector. Housing bonds have also recorded negative net inflows since last year as housing market transactions have contracted.

The Housing and Urban Fund's total expenditures are increasing due to demand concentration caused by lower interest rates compared to the market and policy demands such as responding to low birth rates. However, as the housing market shrinks, available funds are decreasing. The fund's surplus has steadily declined from 49 trillion won in 2021 to 13.9 trillion won as of March this year.

During the discussion, it was also raised that even if the amendment to the Jeonse Fraud Special Act is introduced, it is difficult to confirm the amount of senior tenant deposit claims. Choi Woo-seok, Team Leader of HUG's Jeonse Fraud Victim Auction Support Center, said, "Legally, it is possible to check the status of household registrations and issuance of fixed dates, but since reporting of lease contracts is not mandatory, it is difficult to grasp the amount of tenant deposits. For places where auctions have not started and lease contracts have not been reported, it is impossible to know the amount of senior claims."

There was also discussion about HUG's losses when purchasing tenant deposit refund claims. Kim Kyung-sun, Deputy Head of the Guarantee Research Team at HUG's Housing and Urban Finance Research Institute, said, "Even if HUG purchases claims under the 'preliminary relief and subsequent recovery' scheme, it may face losses due to difficulties in claim recovery," adding, "Looking at HUG's actual guarantee claim recovery rates, even with a recovery period of 4 to 5 years, 100% recovery is difficult, and the recovery rate is gradually declining."

Participants from the Ministry of Land, Infrastructure and Transport, HUG, and others at the seminar agreed that thorough discussions are necessary before the amendment is passed. Lee Jang-won, Director of Victim Support at the Ministry of Land, Infrastructure and Transport, said, "Considering that the Housing and Urban Fund was originally created from subscription savings, it is questionable whether using it to support victims aligns with its nature. Moreover, since it has turned negative since 2022, more thorough deliberation and discussion are needed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.