Memory Semiconductor Sales Reach 17 Trillion Won

High-Value Product Demand Drives Performance

Q2 Performance Expected to Increase Due to AI Effect

HBM Supply Scale to More Than Triple This Year

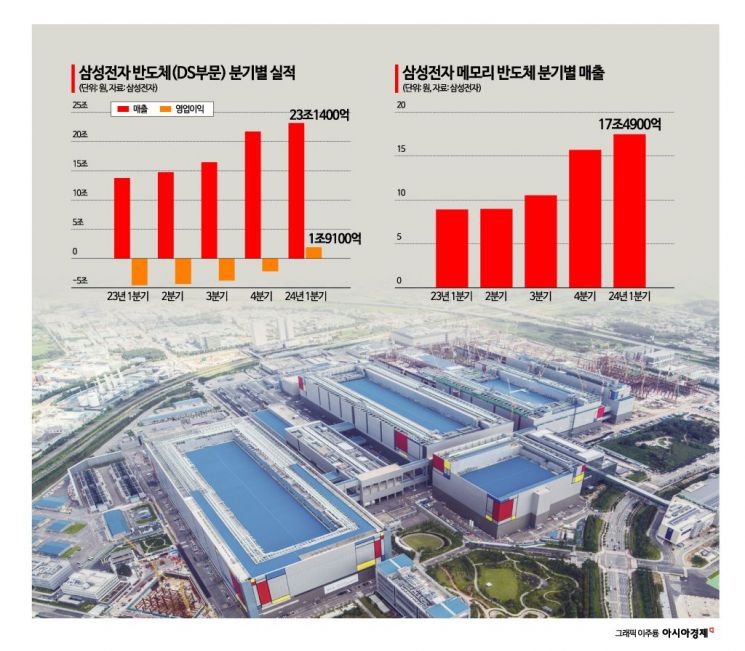

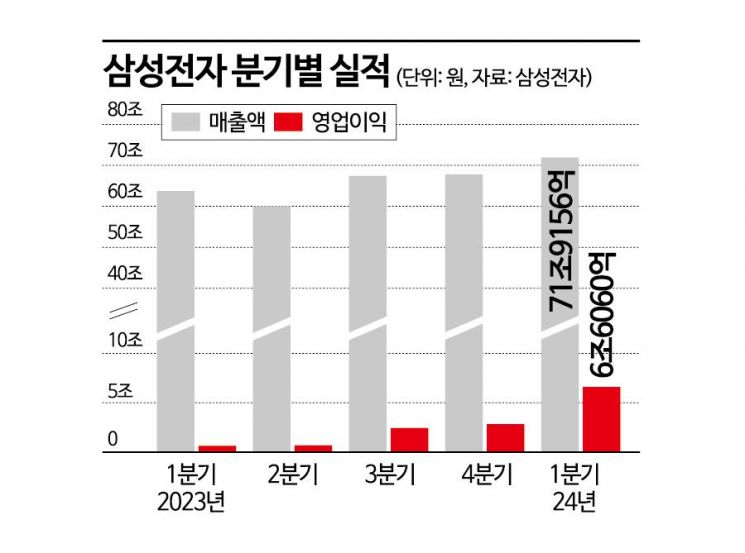

Samsung Electronics' Semiconductor (DS) division succeeded in a revival in the first quarter of this year. Following a return to profitability after five quarters, it drove the company's performance to the extent of accounting for 29% of the total operating profit. In particular, as the memory semiconductor market entered a recovery phase, related business sales reached the 17 trillion won level.

Samsung Electronics expects semiconductor performance to continue increasing in the second quarter due to factors such as rising memory prices. To actively respond to artificial intelligence (AI) demand, it plans to mass-produce the 5th generation high-bandwidth memory (HBM) HBM3E 12-stack product within the second quarter. The supply scale of HBM this year will be increased more than threefold compared to last year.

Expansion of HBM3E Mass Production Amid Rising Memory Prices

The DS division, which had continued negative growth with losses close to 15 trillion won last year, recorded an operating profit of 1.91 trillion won in the first quarter, achieving a turnaround to profitability after five quarters. Although the System LSI and Foundry business units, which operate the system semiconductor business, showed sluggish performance, the memory business unit led the overall semiconductor performance with market recovery.

Samsung Electronics increased profitability in the first quarter by increasing the reversal of inventory valuation loss provisions due to rising prices of memory products such as DRAM and NAND flash. Additionally, demand for high-value-added memory such as HBM, Double Data Rate (DDR)5, and high-capacity solid-state drives (SSD) also increased, driving performance. Memory sales within Samsung Electronics' DS division reached 17.49 trillion won in the first quarter, approximately 96% higher than the same period last year.

The positive performance trend is expected to continue into the second quarter. On the 30th, Kim Jae-jun, Vice President of Samsung Electronics' Memory Business Division, said during the first-quarter conference call, "The continuous increase in AI server supply and the expansion of cloud services will increase demand not only for HBM directly affected by AI but also for general servers and storage," forecasting that memory prices will continue to rise.

Samsung Electronics plans to mass-produce and ship to customers a 1b nanometer 32-gigabit (Gb) DDR5-based 128-gigabyte (GB) product in the second quarter. It will also develop and provide samples of an ultra-high-capacity 64-terabyte (TB) SSD in the same quarter. Notably, Samsung Electronics began initial mass production of the HBM3E 8-stack product this month and has announced plans to mass-produce the 12-stack product within the second quarter.

Market research firm TrendForce forecasts that the DRAM market sales this year will increase by 62.25% year-on-year to $84.15 billion, with HBM accounting for 20.1% of this. Samsung Electronics plans to expand HBM production capacity (CAPA) and accelerate production of the HBM3E 12-stack product. The company explained that by the end of the year, the proportion of HBM3E in total HBM sales will increase to more than two-thirds.

Vice President Kim said, "This year, the supply scale of HBM is being increased more than threefold in terms of bits compared to last year, and the corresponding volume has already been agreed upon with customers," adding, "Next year, we plan to supply at least twice as much as this year, and we are smoothly negotiating with customers regarding that volume as well."

The System LSI business unit will focus on stably supplying flagship system-on-chip (SoC) and sensors in the second quarter, supported by a recovery in smartphone sales. It also expects to ship new wearable products based on advanced processes.

The Foundry business unit expects double-digit sales growth in the second quarter compared to the previous quarter as customer inventory adjustments conclude and line utilization improves. With an increase in the proportion of advanced processes below 5 nanometers (nm; one billionth of a meter), it expects sales this year to exceed market growth rates.

Second Quarter Household Appliance Sales Expected to Increase

Samsung Electronics faces a challenging situation in the second quarter TV business (VD division) due to a slowdown in demand in emerging markets but plans to focus on finding sales expansion opportunities through global sports events. It aims to increase sales of strategic products through the launch of differentiated new models such as Neo QLED and OLED and secure profitability through operational efficiency.

In the household appliance business, it expects sales growth in the second quarter by expanding sales of new Bespoke AI products such as all-in-one washer-dryers and hybrid refrigerators, and strengthening air conditioner sales as it enters the seasonal peak. In the second half of the year, it plans to expand premium product sales while focusing on business structure improvement and cost efficiency centered on high-value-added businesses such as system air conditioners and built-in appliances.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.