Shinhan, Kookmin, Hana Show Strong Performance... We Alone Face Negative Growth

"Must Create New Growth Engines Alongside Cost Efficiency"

Card companies under bank holding companies experienced mixed results amid prolonged high interest rates. Companies that efficiently managed costs while focusing on discovering new revenue streams were able to drive net profit growth.

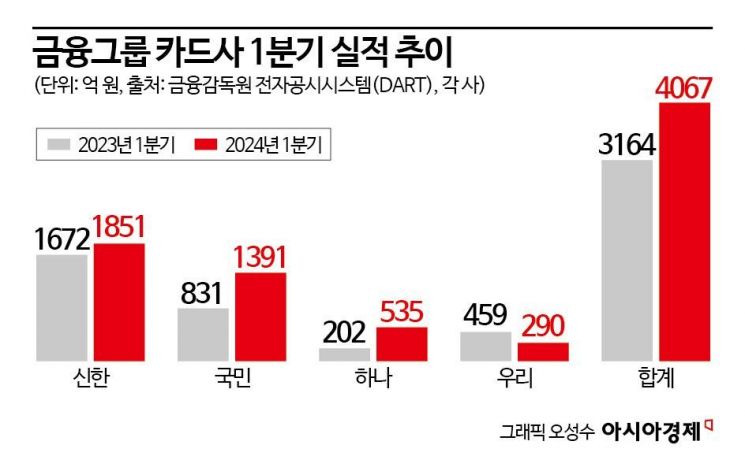

According to the financial sector on the 29th, the net profit of the four major financial holding companies' card firms (Shinhan, KB Kookmin, Hana, and Woori) in the first quarter of this year totaled 406.7 billion KRW. This represents a 29.2% increase compared to 314.9 billion KRW in the same period last year.

The results varied by card company. Shinhan Card, the number one credit card company, recorded a net profit of 185.1 billion KRW in the first quarter, an 18.3% increase year-on-year. KB Kookmin Card achieved a net profit growth of 69.6%, reaching 139.1 billion KRW, and Hana Card followed with a 164.9% increase to 53.5 billion KRW. On the other hand, Woori Card saw a 36.6% decrease in net profit to 29.0 billion KRW during the same period, marking the only decline among bank-affiliated card companies.

The industry cited cost efficiency and new revenue streams as the main reasons for the performance gap among card companies. Shinhan Card, KB Kookmin Card, and Hana Card collectively stated that despite the overall worsening business environment, including funding costs, they were able to generate stable profits through cost efficiency. In contrast, a Woori Card representative explained that "the continued high interest rate environment increased funding and bad debt costs, leading to a decrease in net profit compared to the same period last year." The total administrative expenses of the four financial holding company-affiliated card firms in the first quarter amounted to 467.3 billion KRW, a slight 0.8% increase from 463.4 billion KRW in the same period last year. Notably, KB Kookmin Card effectively controlled costs and reduced administrative expenses. While KB Kookmin Card's administrative expenses were 159.3 billion KRW in the first quarter of last year, they decreased by 9.4% to 144.3 billion KRW in the first quarter of this year.

Card companies that found new revenue streams also posted strong performances. Shinhan Card's operating revenue in the first quarter reached 1.53 trillion KRW, a 12.1% increase from 1.365 trillion KRW in the same period last year. Other operating revenues, excluding credit card, installment finance, and leasing, rose 17.4% from 405 billion KRW to 475.3 billion KRW. Shinhan Card reported that sales from platforms and data sales increased by 21.4% and 31.3%, respectively. KB Kookmin Card also drove revenue growth through new businesses that could replace its core payment services. Other operating revenues, excluding card, installment finance, and leasing, amounted to 172.6 billion KRW in the first quarter, a 10.3% increase from 156.5 billion KRW in the same period last year. Total operating revenue during the same period was 1.3519 trillion KRW, up 5.8% from 1.2777 trillion KRW in the first quarter of last year.

With the timing of the first interest rate cut being delayed, card companies expect the unfavorable environment to continue into the second quarter. Accordingly, they plan to emphasize profitability-focused efficient management and actively pursue revenue generation through new businesses. Card companies are concentrating on comprehensive financial platforms such as ‘Shinhan SOL Pay’ (Shinhan Card), ‘KB Pay’ (KB Kookmin Card), ‘OneQ Pay’ (Hana Card), and ‘Woori WON Card’ (Woori Card). Additionally, they are developing data products and services using their members' data to discover new revenue models.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.