K-Pass 20~53% Discount

Credit Card Public Transport Discounts 10~20%

If You Use 'Altteul Card', You Should Switch to K-Pass

Starting from the 1st of next month, the government's K-Pass project will officially begin. Ten partner card companies collaborating with the Ministry of Land, Infrastructure and Transport have already started issuing K-Pass cards. Since the public transportation discount amounts vary depending on the card company and whether it is a credit or debit card, analyzing your spending patterns before applying for a card can help maximize your benefits.

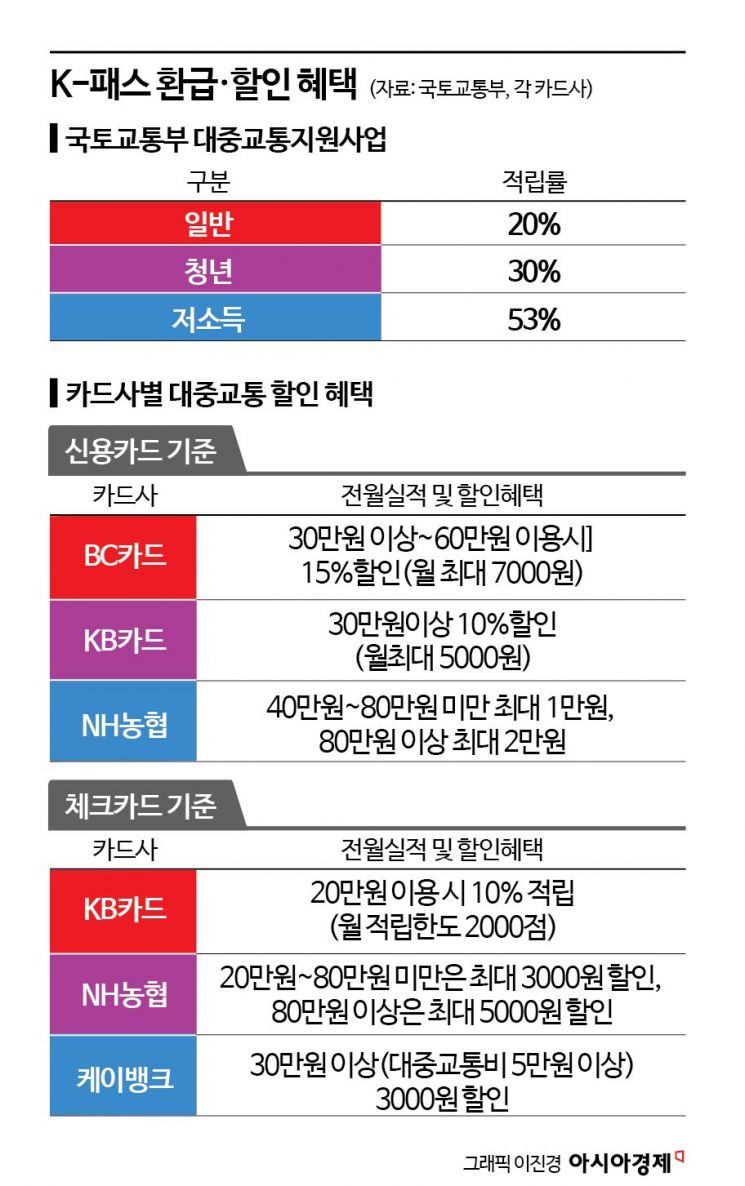

According to the Ministry of Land, Infrastructure and Transport, K-Pass is a transportation card that refunds a certain percentage of expenses the following month if you regularly use public transportation such as city and village buses, subways, intercity buses, and GTX more than 15 times a month. The refund rates are 20% for the general public, 30% for youth, and 53% for low-income groups.

Existing users of the Altteul Transportation Card can receive the same benefits by converting to K-Pass membership through the Altteul Transportation Plus app by the 30th of this month without additional membership registration or card issuance. New users can sign up through the K-Pass app, which will be launched on the 1st of next month, or via the website (korea-pass.kr).

Choose Card Company and Credit/Debit Card Based on Spending Patterns

K-Pass cards are issued by 10 card companies including KB Kookmin, NH Nonghyup, BC (BC Baro, Gwangju Bank, IBK Industrial Bank, K-Bank), Samsung, Shinhan, Woori, Hana, Hyundai, DGB U-Pay, and Idong-ui Jeulgeoum (Mobile E-Zul, KakaoPay Mobile Transportation Card). Public transportation discounts range from 10% to 20%, and combined with government refund support (20% to 53%), the burden of transportation costs is further reduced.

However, to enjoy the public transportation discount benefits from the card companies, you must meet a minimum monthly spending requirement of over 300,000 KRW. For example, BC Card's 'BC Baro K-Pass Card' offers different discount limits depending on the previous month's spending, but if you spend between 300,000 KRW and less than 600,000 KRW, you can receive a 15% discount on public transportation (up to 7,000 KRW per month). KB Kookmin K-Pass Card offers a 10% discount on public transportation (up to 5,000 KRW per month) if you spend over 300,000 KRW the previous month. NH Nonghyup K-Pass Card offers up to 10,000 KRW discount for monthly spending between 400,000 KRW and less than 800,000 KRW, and up to 20,000 KRW for spending over 800,000 KRW.

If you use a credit card, you also have to pay an annual fee. For BC Card's 'BC Baro K-Pass Card,' the annual fee is 6,000 KRW for domestic use only and 6,000 to 7,000 KRW for international use. KB Kookmin K-Pass Card has an annual fee of 8,000 KRW, while NH Nonghyup charges 13,000 KRW for domestic use and 15,000 KRW for international use.

If the annual fee is a burden, using a debit card is another option. Debit cards offer smaller discounts on public transportation and other expenses compared to credit cards but have no annual fees and generally lower monthly spending requirements. KB Card's K-Pass debit card requires a monthly spending of 200,000 KRW and offers 10% points accumulation on public transportation (up to 2,000 points per month). NH Nonghyup offers up to 3,000 KRW discount for monthly spending between 200,000 KRW and less than 800,000 KRW, and up to 5,000 KRW for spending over 800,000 KRW. K-Bank's MY debit card provides up to 3,000 KRW benefits for monthly spending over 300,000 KRW (with public transportation expenses over 50,000 KRW).

Meanwhile, users of the Altteul Transportation Card, the predecessor of the K-Pass card, should hurry to convert to K-Pass. If you do not convert by the 30th of this month, you may miss out on refund benefits until you switch membership.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.