Domestic and International Institutions Gradually Raise South Korea's Growth Forecast for This Year

Concerns Over Declining Growth Momentum in the Second Half Due to One-Off Factors

Surprise Growth May Delay Timing of Base Interest Rate Cut

With South Korea's economic growth rate in the first quarter far exceeding expectations, the market is steadily revising upward its growth forecasts for this year. The continued strong performance in exports, along with growing expectations that domestic demand may improve faster than anticipated, are driving this optimism. However, concerns remain about the persistence of high interest rates and inflation into the second half of the year, casting some doubt on the sustainability of the recovery.

South Korea's Growth Forecasts for This Year Are Being Revised Upward One After Another

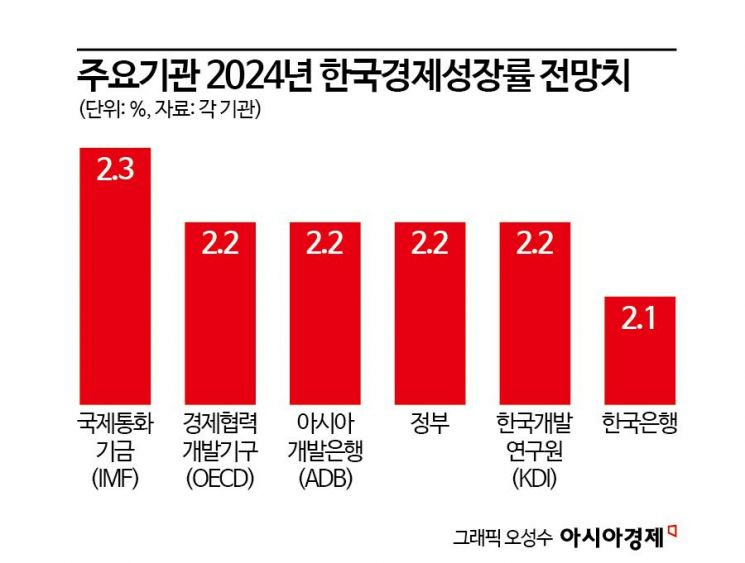

According to industry sources on the 26th, major domestic and international private investment institutions are significantly raising their economic growth forecasts for South Korea this year. This follows the Bank of Korea's announcement on the 25th that the preliminary real GDP growth rate for the first quarter reached 1.3%, far surpassing previous expectations.

Global investment bank (IB) JP Morgan sharply raised its forecast for South Korea's economic growth rate this year from 2.3% to 2.8% after the Bank of Korea's announcement, stating that "first-quarter net exports and manufacturing growth were solid as expected, and domestic demand also showed strength, leading to the upward revision of the growth rate." Barclays revised its forecast up from 1.9% to 2.7%, Goldman Sachs from 2.2% to 2.5%, and BNP from 1.9% to 2.5%.

UBS had already raised its forecast from 2.0% to 2.3% ahead of the first-quarter growth announcement, while Citi increased its forecast from 2.0% to 2.2%, and HSBC from 1.9% to 2.0%. With the first-quarter growth rate exceeding expectations, these IBs are also expected to raise their growth forecasts further.

Domestic investment institutions are also revising their economic growth forecasts upward following the Bank of Korea's announcement. Samsung Securities raised its forecast from 2.4% to 2.7%. Hi Investment & Securities increased its forecast from 2.0% to 2.6%, Eugene Investment & Securities from 2.1% to 2.5%, and Meritz Securities from 2.1% to 2.4%.

Park Sang-hyun, a researcher at Hi Investment & Securities, said, "The first-quarter economic growth was a surprising surprise that rendered market expectations meaningless as both domestic demand and exports grew simultaneously," adding, "This growth rate was recorded in a situation with almost no base effect or stimulus effect." Jung Sung-tae, chief economist at Samsung Securities, stated, "Exports centered on semiconductors and automobiles drove first-quarter growth," and "Reflecting the better-than-expected first-quarter growth rate, the annual economic growth forecast was also revised upward."

The government also highly evaluated South Korea's economy in the first quarter and predicted that the growth trend would expand going forward. Sung Tae-yoon, policy chief at the Presidential Office, said in a briefing the previous day, "The first-quarter growth rate is a very clear green light for our economic growth trajectory," emphasizing, "This year's economic growth rate will exceed the government's initial forecast of 2.2%."

First-Quarter Growth Includes One-Off Factors; Some View Sustainability of Growth as Uncertain

However, some in the market believe that the surprise growth in South Korea's economy in the first quarter was partly due to one-off factors. There are concerns that high interest rates and inflation will continue beyond the second quarter, causing growth momentum in domestic demand to weaken as the year progresses.

Jeon Gyu-yeon, an economist at Hana Securities, said, "The main drivers of the surprise growth in the first quarter were domestic demand such as private consumption and construction investment," but added, "Although construction investment increased due to a rise in construction starts at the beginning of the year, this is temporary, and recovery will be limited going forward." Jeon also noted, "Private consumption and facility investment are expected to gradually recover, but the pace will be moderate due to the dual burden of high interest rates and inflation."

Ha Geon-hyung, an economist at Shinhan Investment Corp., also said, "Behind the surprise growth in the first quarter was a strong rebound in domestic demand due to the government's early budget execution, making it difficult to be confident about sustainability," adding, "The slow stabilization of domestic and international prices and the delayed timing of interest rate cuts could also limit investment recovery." Lee Seung-hoon, an economist at Meritz Securities, diagnosed, "The improvement in construction investment in the first quarter reflected early budget execution factors, so it seems difficult for the momentum to continue into the second half of the year."

The Bank of Korea also hinted at raising its economic growth forecast for this year but maintained a cautious view on the growth path in the second half. Shin Seung-chul, director of the Bank of Korea's Economic Statistics Department, said at a press conference after the first-quarter growth announcement, "Looking at the first quarter alone, the contribution of private consumption and construction investment to growth was quite high, so domestic demand showed signs of recovery," but he drew a line by saying, "We need to observe the sustainability." Regarding construction investment, Director Shin emphasized, "There is still uncertainty related to real estate project financing (PF), and the negative impact of poor construction-related indicators may fully emerge, possibly leading to a sluggish trend."

High inflation is still ongoing, and the first-quarter growth rate exceeding expectations is also a burden on the South Korean economy as it pushes back the timing of interest rate cuts. Bank of Korea Governor Lee Chang-yong said at a press conference after the policy rate was held steady on the 12th, "It is difficult to predict the possibility of rate cuts in the second half." Following Governor Lee's remarks, the market delayed expectations for the Bank of Korea's policy rate cuts. Lee Jung-hoon, an economist at Eugene Investment & Securities, predicted, "With growth coming in higher than expected, the Bank of Korea's policy rate cut is likely to be delayed from the third quarter to the fourth quarter," adding, "Our economy may also see growth slow again starting in the second quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.