Seoul Apartment Transactions Reach Highest Since August 2021

Supply Shortage, Jeonse Crisis, and Newborn Special Loan Impact

51 Deals at Helio City and 32 at Parkrio Since March

Banpo Ja-i Prices Rise from 3.2 Billion KRW in February to 3.5 Billion KRW in March

The volume of apartment transactions in Seoul in March reached the highest level since August 2021, continuing the recovery trend in Seoul's transaction volume. This is interpreted as real demand buyers entering the market due to a shortage of new apartment supply, rising jeonse (long-term deposit lease) prices, and the implementation of special newborn loans. However, due to Middle East risks and other factors, the timing of interest rate cuts is expected to be delayed beyond initial expectations, which may cause the increase in transaction volume to slow down after May.

According to the Seoul Real Estate Information Plaza on the 26th, the number of apartment sales in Seoul last month was recorded at 3,964 transactions, marking the highest volume since August 2021 (4,065 transactions). Last month's transaction volume increased by 1,453 transactions (57.9%) compared to February (2,511 transactions). As of now, the volume of apartment transactions in Seoul for April stands at 1,301 transactions, with data collected until the end of May.

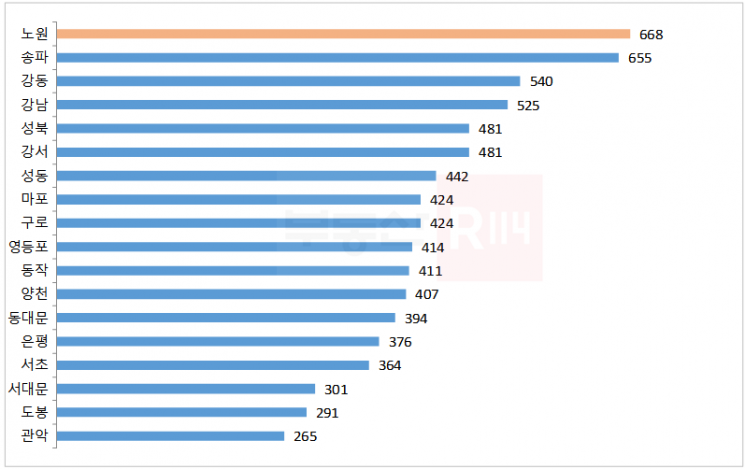

Thanks to the implementation of special newborn loans for apartments priced under 900 million KRW, areas with many listings in this price range saw high transaction volumes. According to Real Estate R114, the district with the highest transaction volume in Seoul during the first quarter of this year was Nowon-gu (668 transactions). Nowon-gu has over 80% of apartments priced under 900 million KRW. Following that were Songpa-gu (655 transactions), Gangdong-gu (540 transactions), and Gangnam-gu (525 transactions), where high-priced area transactions were also significant.

Over the past two years, the accumulated urgent sale listings in the market have gradually been resolved, leading to a recovery in transaction volume. Yoon Ji-hae, senior researcher at Real Estate R114, said, "From the perspective of real demand buyers, the continuously rising jeonse and monthly rent prices over the past year, along with the increased burden of new construction prices (due to construction cost inflation), have reduced their options. They are likely to switch from the jeonse and monthly rent market to sales within affordable levels, mainly focusing on urgent sale listings in mid-to-low priced areas of Seoul."

Apartment Sales Volume by Autonomous District in Seoul for Q1 2024. As of April 24. (Data provided by Real Estate R114, Source: Seoul Real Estate Information Plaza)

Apartment Sales Volume by Autonomous District in Seoul for Q1 2024. As of April 24. (Data provided by Real Estate R114, Source: Seoul Real Estate Information Plaza)

Seoul apartment prices have been rising for five consecutive weeks. According to the weekly apartment price trend survey released by the Korea Real Estate Board, Seoul's prices rose by 0.03% as of the fifth week of April. In the northern part of Seoul, Seongdong-gu (0.13%), Mapo-gu (0.10%), and Yongsan-gu (0.07%) saw significant increases. In the southern part, Seocho-gu (0.07%), Yangcheon-gu (0.05%), Yeongdeungpo-gu (0.04%), and Dongjak-gu (0.04%) showed notable upward trends. The Real Estate Board explained, "Despite sellers raising their asking prices in preferred areas or complexes, buyer inquiries have been maintained, and intermittent transactions have occurred, resulting in mixed trends by region and complex, but overall price increases have been sustained."

In the past two months, some complexes have recorded over 50 transactions. According to the real estate big data platform Asil, from the 1st of last month to the 25th of this month, the number of transactions in major complexes in the Gangnam area were: Helio City in Garak-dong, Songpa-gu with 51 transactions; Parkrio in Sincheon-dong, Songpa-gu with 32; Resentz in Jamsil-dong, Songpa-gu with 23; Banpo Xi in Banpo-dong, Seocho-gu with 17; Seocho Hills in Umyeon-dong, Seocho-gu with 11; and Dogok Rexle in Dogok-dong, Gangnam-gu with 11.

In the northern part of Seoul, Mapo Raemian Prugio in Mapo-gu recorded over 20 transactions from March to the 25th of this month. Following that were: Mokdong Central i-Park Weave in Yangcheon-gu with 19 transactions; E-Pyeonhan Sesang Oksu Park Hills in Seongdong-gu with 17; Hangaram in Yongsan-gu with 13. In Nowon, Dobong, and Gangbuk districts, SK Bukhan-san City in Mia-dong, Gangbuk-gu had 23 transactions; Junggye Green in Junggye-dong, Nowon-gu had 17; and Dobong Hanshin in Dobong-dong, Dobong-gu had 16.

For Helio City 84㎡ units, actual transaction prices this month ranged from the low 2.1 billion KRW to mid-2.1 billion KRW. Until the end of last year, transactions were in the 1.8 to 2.0 billion KRW range, gradually rising and narrowing the price gap to about 200 million KRW compared to the previous peak (2.38 billion KRW). Banpo Xi 84㎡ units were traded at 3.55 billion KRW on the 11th and 3.525 billion KRW on the 13th of last month. Until February, transactions were in the 3.2 billion KRW range, but prices increased by 200 to 300 million KRW before changing hands. The highest price was 3.9 billion KRW in September 2022.

The government announced that the actualization rate of publicly announced real estate prices will be frozen at the 2020 level. The photo shows a newly built apartment complex in Seoul on the 21st. Photo by Jinhyung Kang aymsdream@

The government announced that the actualization rate of publicly announced real estate prices will be frozen at the 2020 level. The photo shows a newly built apartment complex in Seoul on the 21st. Photo by Jinhyung Kang aymsdream@

In Mapo-gu, Ahyeon-dong, Mapo Raemian Prugio 59㎡ units saw four transactions in the 1.4 billion KRW range for mid to upper floors this month. In February and March, excluding lower floors, transactions were in the mid to high 1.3 billion KRW range, rising by nearly 100 million KRW within a month. SK Bukhan-san City 84㎡ in Mia-dong was traded at 680 million KRW on the 21st of last month. This is the highest price since transactions at 660 million KRW in January and February. It is about 200 million KRW lower than the highest price recorded in November 2021 (890 million KRW).

The increase in transaction volumes of high-priced apartments in Gangnam and mid-to-low priced apartments in northern Seoul raised the overall transaction volume. Kim Gyu-jung, head of the Asset Succession Research Institute at Korea Investment & Securities, explained, "High-tier buyers, relatively free from loan regulations and interest rate impacts, are leading transactions in regions where real estate prices are rising, following the peak. For apartments priced under 900 million KRW, non-homeowners with real demand have moved due to rising jeonse prices and other factors. In the second quarter, the expected sale price of standard-sized apartments in northern Seoul is around 1.5 billion KRW, which could attract real demand buyers looking for competitively priced apartments."

From April onward, the increase in transactions may slow due to external factors. Kim said, "The timing of U.S. interest rate cuts has been postponed to after the fourth quarter, leading to a somewhat cautious stance this month. It will be difficult for transaction volumes in April and May to match the increase seen in March." However, he added, "Although conditions are not favorable for active transactions of homes highly dependent on loans, real demand buyers can consider entering the market if jeonse demand is stable and policy loans are sufficiently utilized."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.