Net Profit of 9 Insurance Companies Expected at 2 Trillion Won, Down 25%

Non-life Insurance Down 1.57%, Life Insurance Down 47.5%

Accounting Issues Arise in Some Life Insurance Companies

The performance of life and non-life insurance companies is expected to diverge in the first quarter of this year. Although they are quickly adapting to the new International Financial Reporting Standard (IFRS17), now in its second year since introduction, some life insurers have faced one-time cost issues due to the regulatory changes. Life insurers increased new contracts by raising the refund rate for short-term whole life insurance early this year, but chronic industry problems such as aging and population decline seem to have held them back.

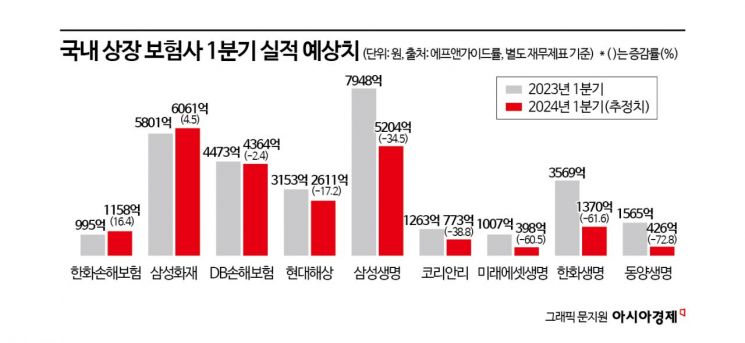

According to financial information analysis firm FnGuide on the 25th, the consensus net income (market average forecast) for the first quarter of this year based on separate financial statements of nine listed domestic insurance companies (Samsung Life, Hanwha Life, Dongyang Life, Mirae Asset Life, Samsung Fire & Marine, Hyundai Marine & Fire, DB Insurance, Hanwha General Insurance, and Korean Re) was estimated at 2.2364 trillion KRW. This is expected to decrease by 24.9% compared to the first quarter net income of last year (2.9775 trillion KRW).

The situation varies by sector. Excluding Korean Re, a reinsurance company, the net income of the four non-life insurers is expected to decrease by 1.57% year-on-year, while the four life insurers are expected to see a 47.5% decline. Despite the surge in new contracts due to the short-term whole life insurance sales boom earlier this year, the securities industry has analyzed life insurers' performance more pessimistically.

Among life insurers, Dongyang Life's net income is expected to be 42.6 billion KRW, down 72.8% year-on-year. Hanwha Life is forecasted to decrease by 61.6% to 137 billion KRW. Samsung Life and Mirae Asset Life are estimated to decline by 34.5% and 60.5%, with net incomes of 520.4 billion KRW and 39.8 billion KRW, respectively.

However, the poor performance of life insurers is partly due to a large amount of one-time costs related to changes in the Incurred But Not Reported (IBNR) loss reserves being reflected in the first quarter of this year. IBNR refers to the amount for which the insurer has an obligation to pay insurance claims due to occurred insurance incidents but has not yet been claimed by the policyholder. Insurers must estimate this and record the payable insurance amount as a liability called the reserve for outstanding claims. To calculate IBNR, the Loss Development Factor (LDF), an estimate of future insurance payments, must be identified. Under the previous IFRS17 system, insurers could choose the accident date as either the cause accident date (actual date of occurrence) or the payment reason date. Non-life insurers mainly chose the cause accident date, while life insurers mostly selected the payment reason date. However, at the end of last year, financial authorities mandated that, unless there are special reasons, all insurers unify to the cause accident date.

Large non-life insurers already applied the changed accounting standards in the fourth quarter of last year. However, some life insurers postponed this to the first quarter of this year, resulting in expected reduced earnings. According to KB Securities, Samsung Life (50 billion KRW), Hanwha Life (60 billion KRW), and Dongyang Life (20 billion KRW) are expected to recognize hundreds of billions of KRW in IBNR-related costs in the first quarter of this year. Seol Yong-jin, a researcher at SK Securities, said, "Although new contracts increased due to last-minute marketing ahead of the April experience life table adjustment, the costs related to the IBNR issue are significant," adding, "The life insurance industry as a whole is expected to record poor underwriting results (the difference between expected and actual insurance premiums)."

Life insurers performed worse than non-life insurers in various indicators, including last year's results. Last year, the life insurance sector's net income was 5.0952 trillion KRW, a 37.6% increase from the previous year, but the non-life insurance sector recorded a higher 8.2626 trillion KRW, up 50.9%. In terms of earned premiums (sales), non-life insurers surpassed life insurers for the first time last year. Non-life insurers collected 118.5974 trillion KRW in earned premiums, about 6 trillion KRW more than life insurers' 112.4075 trillion KRW. Considering that life insurers' total assets amount to 880 trillion KRW, 2.5 times more than non-life insurers' 343 trillion KRW, this performance gap is painful from the life insurers' perspective.

For non-life insurers, Hanwha General Insurance's net income for the first quarter of this year is estimated at 115.8 billion KRW, a 16.4% increase year-on-year. Samsung Fire & Marine is expected to increase by 4.5% to 606.1 billion KRW. In contrast, DB Insurance and Hyundai Marine & Fire are forecasted to decline by 2.4% and 17.2%, with net incomes of 436.4 billion KRW and 261.1 billion KRW, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)