63% and 67% Negative Responses to Real Economy and Real Estate Market

Hana Financial Management Research Institute

2024 Korea Wealth Report Published

Wealthy individuals holding financial assets worth over 1 billion KRW are reducing the proportion of real estate in their asset portfolios while increasing investments in financial assets such as deposits, stocks, and bonds.

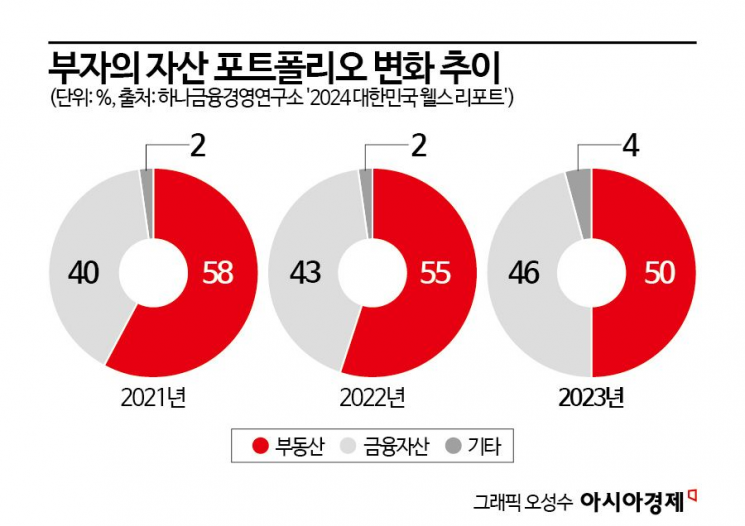

According to the "2024 Korea Wealth Report" by Hana Bank's Hana Financial Management Research Institute, which analyzed the financial behavior of wealthy Koreans on the 25th, real estate accounts for half (50%) of the total asset portfolio of the wealthy, but this is a decreasing trend compared to 58% in 2021 and 55% in 2022. Meanwhile, financial assets increased from 40% in 2021 and 43% in 2022 to 46% last year. The Hana Financial Management Research Institute attributed this to the continued decline in real estate prices last year, resulting in a slow recovery.

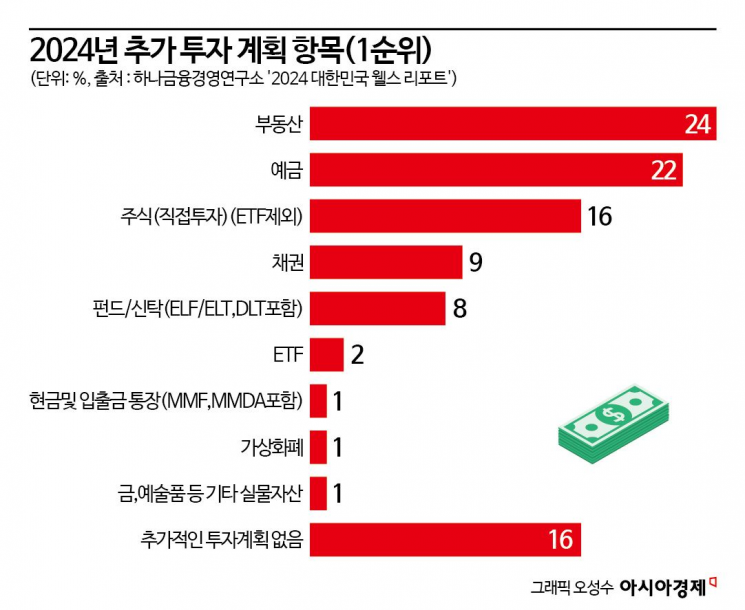

Although real estate was the asset with the highest additional investment intention this year among the wealthy, the response rate decreased by 8% from 32% last year to 24%, narrowing the preference gap with deposits (22%). Nine out of ten wealthy individuals own real estate, with small- to medium-sized apartments being the most preferred for purchase. Land and small office buildings followed. Among wealthy individuals aged 30 and under, overseas real estate purchase intentions were high after apartments. Stocks (16%) were the next most preferred investment product after deposits. About 16% of the wealthy had no plans for additional investment.

The proportion of those with a negative view of the real economy and real estate market has decreased but still remains in the 60% range. Those with a negative outlook on the real economy accounted for 63%, and those with a negative view of the real estate market accounted for 67%. The proportion of those with a positive outlook on the real estate market increased by 17 percentage points to 33% compared to 16% last year. For the real economy, 37% of wealthy individuals had a positive outlook, an increase of 16 percentage points compared to last year's survey.

Based on these economic forecasts, seven out of ten wealthy individuals plan to maintain their asset portfolios as they are this year. This is an increase in cautious stance compared to last year's survey, where five out of ten held this view. The proportion of those planning to increase financial assets decreased by 10 percentage points, but the proportion of those intending to increase real estate holdings slightly increased, showing cautious expectations for a recovery in the real estate market.

Among the 746 wealthy individuals who participated in the survey, about two-thirds earned positive (+) returns through financial asset management. In the high-interest-rate environment last year, deposits (42%) were cited as financial assets that positively influenced returns. More than half of wealthy individuals holding 3 billion KRW in financial assets invested in bonds, which the institute explained was to enjoy the dual benefits of capital gains and tax savings. Management of foreign currency assets such as overseas stocks and real assets like gold also increased.

Meanwhile, wealthy individuals were found to sleep less and read regularly. The average sleep duration of the wealthy was 7.3 hours, 30 minutes shorter than the general public. They actively utilized their mornings with light breakfasts, reading newspapers, and exercising. The larger the asset size, the higher the rate of reading newspapers and news, especially the economic sections. They read about 10 books per year on average, while those with financial assets exceeding 10 billion KRW read about 20 books, twice as many.

Hwang Seon-gyeong, a research fellow at Hana Financial Management Research Institute, said, "While it is important to examine the asset management practices and changes of the wealthy through the Korea Wealth Report, it is also meaningful to closely observe their attitudes toward life. We confirmed that the 'life attitudes of the wealthy,' who rationally face situations, trust themselves, and pursue goals rather than being conscious of others' evaluations, can build wealth and further enhance overall life satisfaction."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)