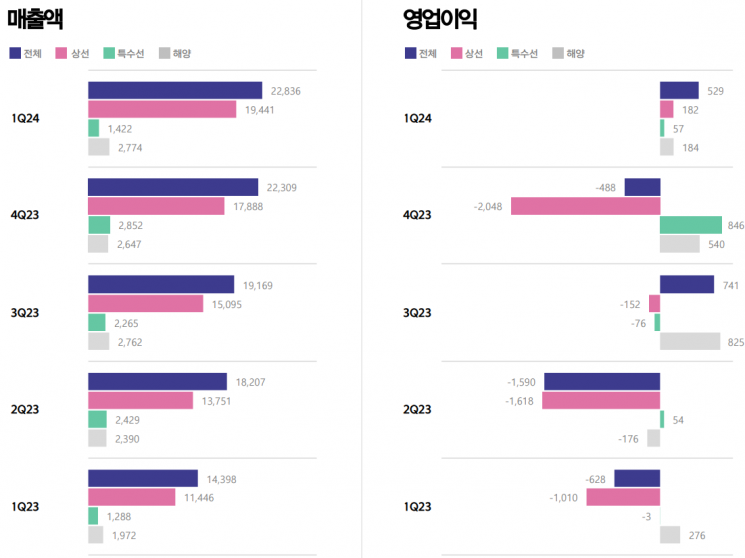

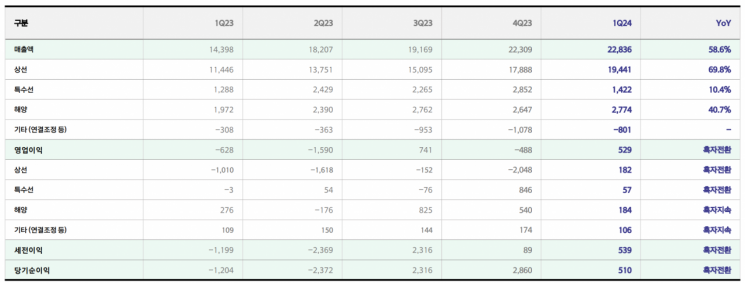

Q1 Operating Profit 52.9 Billion KRW

Sales Up 58% Year-on-Year

Hanwha Ocean announced on the 24th that it recorded an operating profit of 52.9 billion KRW in the first quarter of this year, successfully turning profitable.

Sales in the first quarter of this year increased by 58.6% year-on-year to 2.2836 trillion KRW, and net profit turned positive at 51 billion KRW. All three business sectors?merchant ships, special ships, and offshore?achieved both increased sales and profitability.

Hanwha Ocean explained that its performance improved due to orders focused on high-priced vessels combined with favorable exchange rate effects.

Shin Yong-in, Vice President and Chief Financial Officer of Hanwha Ocean, said during a conference call that "the company's performance improved more than expected." He added, "The increase in construction volume and the higher proportion of sales from high-priced LNG carriers contributed positively, along with close process management and frequent compliance checks stabilizing production."

Vice President Shin stated, "The exchange rate rose by 57.4 KRW compared to the previous quarter, resulting in an exchange rate effect of about 35 billion KRW impacting operating profit." He also noted, "Costs related to production stabilization and an increase of about 18 billion KRW in material unit prices for some items raised planned costs. Profitability of ongoing projects also improved somewhat, enabling all business divisions to realize operating profits." He added, "The annual trend of turning profitable remains unchanged."

Performance by Business Division

Looking at the merchant ship division, which accounts for 85% of total sales in the first quarter, it recorded sales of 1.9441 trillion KRW and an operating profit of 18.2 billion KRW. Sales increased by 69.8% year-on-year, and operating profit turned positive. Hanwha Ocean stated, "This year, with the construction of more than 20 LNG carriers and large container ships, the merchant ship division is expected to maintain over 80% of the company's total sales. Regarding profitability, many large container ships ordered at low prices are scheduled for delivery in the first half of this year, which is expected to result in an annual profit turnaround."

The special ship division posted sales of 142.2 billion KRW and an operating profit of 5.7 billion KRW in the first quarter. Sales slightly increased from 128.8 billion KRW in the same period last year but decreased by 50% compared to 285.2 billion KRW in the previous quarter. Hanwha Ocean explained, "This is a temporary sales decline period due to a drop in cost inputs," but added, "Despite this, operating profit was achieved." Regarding business outlook, it said, "From the second quarter, new construction projects will accelerate, leading to an upward trend in quarterly sales this year. Annual performance is expected to continue the profit trend with increased sales mainly from submarines and submarine maintenance."

The offshore division recorded sales of 277.4 billion KRW and an operating profit of 18.4 billion KRW. Sales increased by 40.6% year-on-year, while operating profit decreased by 33%. Hanwha Ocean noted, "There were no one-time factors such as lawsuit recoveries." It added, "The offshore division is expected to account for about 10% of the company's total annual sales this year, and we will continue efforts to stabilize production."

Record High 22 LNG Carriers to be Constructed This Year... Expecting Additional Orders from Qatar

Hanwha Ocean simultaneously constructing four LNG carriers at Geoje shipyard Dock No.1

Hanwha Ocean simultaneously constructing four LNG carriers at Geoje shipyard Dock No.1 [Photo by Hanwha Ocean]

Hanwha Ocean secured orders for a total of 17 vessels worth 3.39 billion USD this year, including 12 LNG carriers, 2 VLCCs, 2 VLACs, and 1 VLGC. Hanwha Ocean stated, "We expect to maintain an order backlog of about 2.5 to 3 years until the end of the year, securing orders within this range."

This year’s management performance will fully reflect the construction of LNG carriers ordered at high prices. Hanwha Ocean will build a record-high 22 LNG carriers this year, with 24 LNG carriers scheduled for construction next year.

Regarding the LNG carrier market and order outlook, it said, "Due to concerns about oversupply from large orders in 2022 and 2023, the total number of orders is expected to decrease compared to the previous year. However, in the mid to long term, demand for new LNG carriers remains strong due to environmental regulations, increased U.S. LNG exports, and replacement demand for aging steam turbine LNG carriers."

Regarding the Qatar project, it said, "We have already finalized contracts for 12 vessels and expect additional orders related to Qatar’s production increase within this year. Qatar is currently inquiring with shipbuilders, and if contracts are concluded, we plan to maximize profitability by reflecting market prices separately from existing order agreements (DOA)."

Shipping Industry’s New Technology Vessels as a 'Platform Business' Concept... U.S. MRO Business to Become Visible in the First Half

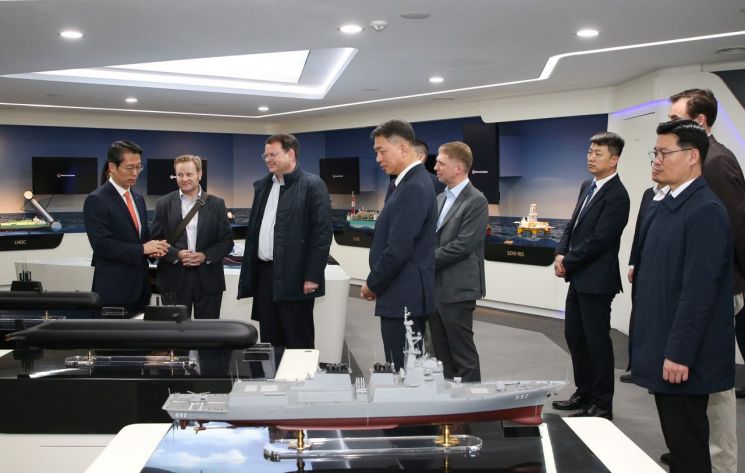

On the 5th, Jeong Seung-gyun, Head of Overseas Business Division at Hanwha Ocean (first from the left), guided key military officials from the United States and Australia, including Michael Jacobson, Director of the Australian Submarine Command (second from the left), and Nolan Barkhouse, U.S. Consul in Busan (third from the left), through the Jangbogo-III Batch-II construction site, as well as the Jangbogo-I/II overhaul and performance improvement sites, introducing Hanwha Ocean's shipbuilding competitiveness.

On the 5th, Jeong Seung-gyun, Head of Overseas Business Division at Hanwha Ocean (first from the left), guided key military officials from the United States and Australia, including Michael Jacobson, Director of the Australian Submarine Command (second from the left), and Nolan Barkhouse, U.S. Consul in Busan (third from the left), through the Jangbogo-III Batch-II construction site, as well as the Jangbogo-I/II overhaul and performance improvement sites, introducing Hanwha Ocean's shipbuilding competitiveness. [Photo by Hanwha Ocean]

Hanwha Ocean is exploring various investment opportunities in shipping and drilling through 'Hanwha Ocean USA Holdings Corporation' established in the U.S. Hanwha Ocean explained, "In shipping, this is not a full-scale or large-scale shipping business but a platform business using Hanwha Ocean vessels equipped with new technologies. It means demonstrating differentiated vessels." Recently, Hanwha Ocean announced the establishment of a shipping company named 'Hanwha Shipping.' It added, "Although not finalized, the drilling business is similar. We are reviewing it using drilling vessels owned by Hanwha Ocean and will inform through disclosures if confirmed."

Regarding the U.S. MRO (Maintenance, Repair, and Overhaul) business, it said, "The U.S. Navy intends to perform MRO business using companies based in the U.S. and allied countries. The MRO volume is expected to focus more on support ships than combat ships." It added, "The visibility of Hanwha Ocean’s MRO business could come as early as the first half of this year," and "when new orders are received, we plan to offer an MRO package solution proposing lifecycle management from the construction stage to create additional business opportunities."

Regarding the acquisition of overseas shipbuilders, it said, "As reported in the media, we have made an acquisition proposal for Australia’s Austal and are continuously reviewing and negotiating government approvals. Due to the sensitivity of negotiations, we ask for your understanding that we cannot provide detailed information."

Participating in Various Defense Projects Including Submarines and Surface Ships... "Committed to Improving Profitability through Cost Efficiency since Launch"

Hanwha Ocean is currently involved in overseas submarine projects in Poland, Saudi Arabia, Canada, and the Philippines, and overseas surface ship projects in Thailand and Australia. Hanwha Ocean said, "Many are interested in the Canadian submarine project. We expect to sign a contract in 2026. Since the Request for Information (RFI) and Request for Proposal (RFP) are still in preparation, we will be able to confirm specific schedules and scope once related information is disclosed."

It added, "Poland is expected to sign a contract earlier than Canada, in 2025. The RFI was issued at the end of last year, and we have responded. We are actively promoting locally in Poland. Since the RFP is in preparation, we will update specific project schedules and scope once information is available."

Hanwha Ocean expects its financial position to improve from 2025 with increased LNG carrier deliveries, gradually reducing borrowings (total borrowings of 3.4281 trillion KRW as of the first quarter). A Hanwha Ocean official said, "Since the launch of Hanwha Ocean, we have focused on improving profitability through continuous selective order strategies and cost efficiency innovations across all business sectors. We will do our best to expand sales in each business sector based on ongoing innovation activities to maintain the solid performance trend seen in the first quarter."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.