Domestic CEO · Global PEF Leaders Participate in Survey

"Deal to be Pursued Within 1 Year" Responses Reach 36%

"PEF Influence to Increase in M&A Market"

Domestic and international experts expect an increase in 'mega deals' in the mergers and acquisitions (M&A) market this year.

On the 24th, EY-Parthenon, EY Hanyoung's strategy consulting specialized organization within the global accounting and consulting firm EY, released the results of the 'EY CEO Outlook Pulse' survey of Korean CEOs. This report contains survey results from 1,200 CEOs of companies across 21 countries worldwide. Additionally, a separate survey was conducted targeting 300 private equity fund (PEF) leaders from 20 countries.

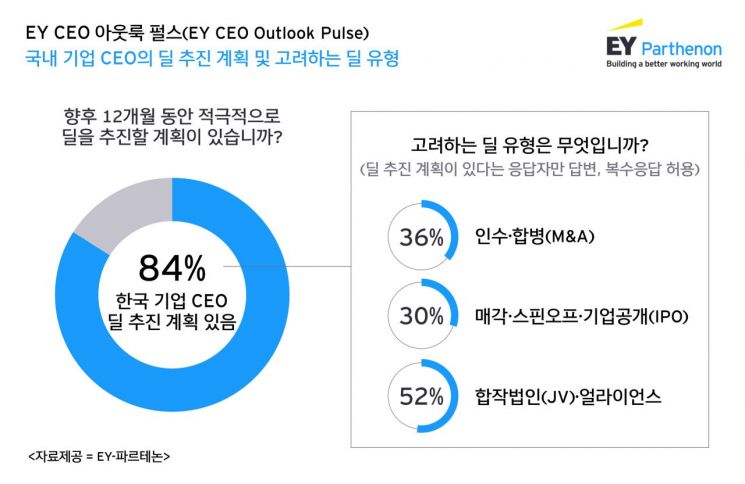

Among domestic respondents, 78% of CEOs and 71% of PEF leaders anticipated an increase in M&A mega deals exceeding $10 billion this year. Furthermore, 84% of domestic CEOs reported plans to pursue deals within one year. Among those planning deals this year, 36% considered M&A, while 30% intended to pursue sales, spinoffs, or initial public offerings (IPOs). The positive response rate toward M&A increased by 26 percentage points compared to the same survey last year, though it remains below the 10-year average of 42%. Singapore and Malaysia were identified as target countries for M&A.

Additionally, 96% of domestic CEOs stated they are readjusting strategic investment plans due to geopolitical issues. They are considering measures such as asset relocation (44%), postponement of investment plans (38%), supply chain restructuring (36%), withdrawal from specific businesses (34%), and suspension of investment plans (22%).

Meanwhile, 70% of private equity fund leaders forecast an increase in corporate sales or carve-out (sale of specific business units) activities this year compared to the previous year, and 66% expect the scale of market exits through IPO activities to grow. While CEOs are enhancing business resilience by relocating assets and postponing investments in response to geopolitical issues, PEFs are boldly initiating withdrawal and exit from specific businesses.

Byun Dong-beom, head of EY-Parthenon at EY Hanyoung, stated, “If the domestic stock market recovers, a virtuous cycle will be created where the IPO market, portfolio adjustments by large corporations and PEs, and activation of the exit market naturally lead to an increase in large deals.” He added, “There is a growing trend of PEF-led deals recently, and aggressive capital raising and a significant increase in dry powder (unspent funds) over the past two years will enhance PEF’s influence in the M&A market going forward.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)