Survey of Top 600 Companies by Sales According to Hankyung Association

May BSI Forecast 94.9

Manufacturing (95.5) and Non-Manufacturing (94.1) Both Show Weakness

The Business Survey Index (BSI) for May saw its upward trend halted due to instability in the Middle East region.

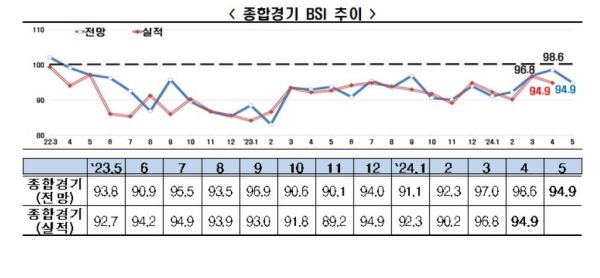

According to a survey conducted by the Korea Economic Association on the 600 largest companies by sales on the 24th, the BSI outlook for May recorded 94.9, falling below the baseline of 100. This represents a 3.7-point decrease compared to the previous month (98.6).

The Korea Economic Association stated, "The BSI outlook had been on the rise since February this year, approaching the baseline of 100 last month (98.6), but the recent deterioration of the Middle East situation is estimated to have caused a decline in the index due to worsening business sentiment." The actual BSI for April was 94.9, down 1.9 points from the previous month (96.8).

In May, the BSI by industry showed weakness in both manufacturing (95.5) and services (94.1). The manufacturing BSI fell below the baseline for two consecutive months after exceeding 100 in March 2024 (100.5). The non-manufacturing BSI recorded 94.1, a 4.8-point drop from the previous month (98.9). The decline in non-manufacturing BSI has continued for five consecutive months since January.

Among the 10 detailed manufacturing sectors, Food & Beverage and Tobacco (110.0), entering the peak season (due to increased holidays and public holidays), showed a favorable outlook. Except for three sectors hovering around the baseline (Wood, Furniture & Paper; Metals & Metal Products; Electronics & Telecommunications Equipment), the remaining six sectors are expected to experience poor business conditions. Due to a global decrease in electric vehicle demand, General & Precision Machinery and Equipment, which includes secondary batteries, showed a sharp decline of 30.5 points from the previous month (120.0), turning negative at 89.5.

Among the seven detailed non-manufacturing sectors, Leisure, Accommodation & Dining (128.6) showed the highest expectation for favorable business conditions due to the Family Month in May, followed by Professional, Scientific & Technical and Business Support Services (107.1) which are expected to improve. The other five sectors, including Wholesale & Retail (96.4), are expected to face poor business conditions.

The BSI for all surveyed sectors in May is expected to deteriorate. This continuous decline across all sectors has persisted for 20 consecutive months since October 2022. In particular, the triple decline in domestic demand, exports, and investment has continued for 23 months since July 2022. However, the export BSI (99.5) has improved since February (93.7) despite the instability in the Middle East, approaching the baseline of 100.

Lee Sang-ho, Head of the Economic and Industrial Division at the Korea Economic Association, stated, "Companies are facing zero visibility in management uncertainty due to the triple challenges of high interest rates, high inflation, and high exchange rates, along with the worsening Middle East situation." He emphasized, "To stabilize business sentiment, efforts to strengthen countermeasures against external risks and stabilize prices and exchange rates must be intensified."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)