Increase in the Proportion of Men and Basic Livelihood Security Recipients for Three Consecutive Years

Last year, 8 out of 10 Seoul citizens who filed for personal bankruptcy were aged 50 or older. In addition, it was confirmed that the proportion of men, basic livelihood security recipients, and single-person households among bankruptcy applicants was high.

The Seoul Financial Welfare Counseling Center of the Seoul Welfare Foundation announced on the 24th the "2023 Bankruptcy Discharge Support Status," which analyzed 1,361 valid data cases out of 1,487 personal bankruptcy applications received by the center last year.

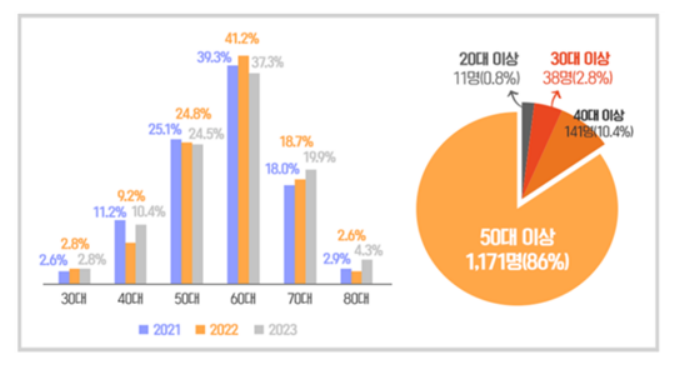

According to the analysis, 86.0% of personal bankruptcy applicants last year were aged 50 or older. It was found that the older the person, whose economic activity decreases, the more bankruptcy applications increase due to lack of repayment ability. By household type, single-person households accounted for the largest share at 63.5%, followed by two-person households at 19.3%, and three-person households at 9.0%.

The proportion of male applicants and basic livelihood security recipients increased over the past three years. Male debtors increased from 57.5% in 2021 and 61.6% in 2022 to 64.4% last year. The proportion of recipients also rose from 79.9%, 81.7%, to 83.5% during the same period.

The most common cause of debt was lack of living expenses (48.8%). The proportion citing business failure as the cause reached 21.5%. The main reasons leading to bankruptcy were "principal and interest exceeding income" (35.7%), followed by unemployment (23.6%) and business closure due to worsening management conditions (13.2%).

Among applicants, the unemployed accounted for the majority at 89.1% (1,213 people). In contrast, the proportions of regular employees and self-employed were 5.3% (73 people) and 1.1% (15 people), respectively, indicating the need for welfare service linkage for job search and employment after resolving debt issues, according to the city.

At the time of bankruptcy application, 91.3% had total assets including deposits, lease deposits, real estate, vehicles, and insurance valued under 10 million KRW. This amount is below the exempt property range of 11.1 million KRW, which is the living expense allowance for six months permitted by the court during personal bankruptcy proceedings. Regarding total debt, 59.5% of applicants had less than 100 million KRW, and 23.4% were in the average range of 50 million KRW to less than 100 million KRW, confirming that debt was excessive compared to assets.

The Seoul Financial Welfare Counseling Center provides comprehensive counseling and education to prevent the expansion of malignant debt for citizens struggling with household debt, as well as public debt adjustment counseling to resolve household debt. Since its opening in 2013, it has supported legal discharge of malignant debt amounting to 3.0809 trillion KRW for 12,231 people in Seoul alone.

Kim Eun-young, director of the Seoul Financial Welfare Counseling Center at the Seoul Welfare Foundation, said, "Among personal bankruptcy discharge users, 10.9% are repeat bankruptcies with previous discharge experience, and among them, men in their 60s account for 27.7%." She added, "We plan to strengthen tailored welfare service linkage support such as housing, jobs, and medical care to break the vicious cycle of debt and help people recover."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.