Former PBOC Governor Yi Gang Emphasizes in Recent Speech

"Both Tightening and Easing Should Leave Room"

Voices are emerging within China warning against the prolonged low interest rates, the resulting moral hazard in the financial market, and the institutionalization of subsidies. Given the solid economic recovery in the first quarter, it is interpreted as a call to avoid excessive government intervention or support.

According to the 22nd report by the Chinese economic media outlet Caijing, Yi Gang, former governor of the People's Bank of China, stated in his keynote speech at the 15th anniversary general meeting of the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University, "Monetary policy should be autonomous (以我爲主, meaning independent monetary policy), fully consider complex factors, and carefully balance both tightening and easing measures while leaving room for maneuver."

Yi, who is also a standing committee member of the Chinese People's Political Consultative Conference, deputy director of the Economic Committee, and chairman of the board of the China Finance Association, pointed out that "interest rates are the core of monetary policy," adding, "If interest rates remain too low for a long time, it distorts the allocation of financial resources, causing problems such as overinvestment, overproduction, inflation, asset price bubbles, and capital circulation without investment (funds floating in the market without being invested)." He further explained, "For these reasons, it is difficult for an ultra-low interest rate policy to persist for a long period."

He self-assessed that over the past 30 years, China has fundamentally formed a market-oriented interest rate system through continuous reforms and has achieved goals such as liquidity adjustment and fund allocation through monetary policy tools. He repeatedly emphasized the policy direction of "being autonomous," noting that China has not followed the interest rate fluctuations of major advanced countries.

He continued, "Authorities should use monetary control tools cautiously and often leave room rather than implementing strong stimulus policies," stressing, "Policy tools should advance and retreat, moral hazard must be guarded against, and the institutionalization of subsidies or unfairness should be avoided." He also emphasized, "While the central bank provides various incentives to financial institutions, each financial institution should make independent decisions and bear risks regarding lending."

He also evaluated that the People's Bank of China's monetary policy has yielded good results so far. As of the end of last year, China's yuan loan balance exceeded 230 trillion yuan (approximately 43,700 trillion won), growing to four times that of 2012, and the social financing scale balance also increased fourfold to over 370 trillion yuan during the same period.

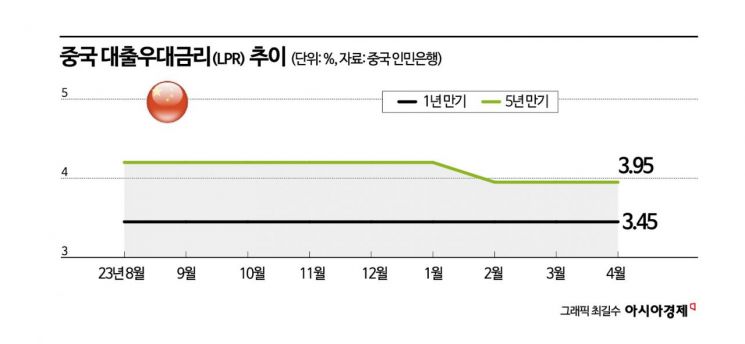

The market is also forecasting that since China's interest rates have recently remained at low levels, there is little room for additional rate adjustments in the short term. On the 21st, the People's Bank of China announced that it would keep the Loan Prime Rate (LPR), which effectively serves as the benchmark interest rate, unchanged at 3.45% for the one-year term and 3.95% for the five-year term. Won Bin, chief economist at Minsheng Bank, explained, "Loan interest rates have sharply declined this year, and banks' net interest margins continue to be pressured," adding, "There is no room for further short-term cuts to the LPR."

Wang Qing, chief macro analyst at the Chinese credit rating agency Dongfang Jincheng, diagnosed, "Banks' net interest margins have fallen to low levels in the first quarter, indicating a lack of motivation for interest rate cuts," and "the macroeconomy continues to rebound, showing upward momentum." Considering current inflation and economic trends, he predicted that the Medium-term Lending Facility (MLF) rate could be cut in the third quarter, with LPR adjustments possibly following afterward. He added, "Subsequently, the interest burden on enterprises and homebuyers will continue to decrease, which will also be favorable for resolving local government bond risks."

The LPR is calculated by aggregating the loan interest rate trends of the best customers from 18 designated banks. Local financial institutions use it as a benchmark for lending, so it effectively functions as China's benchmark interest rate. The one-year rate affects general loans, while the five-year rate impacts mortgage loans. The People's Bank of China lowered the five-year LPR from 4.20% by 0.25 percentage points in February and kept both the one-year and five-year rates unchanged in March. The one-year rate has remained at 3.45% for eight months since it was lowered by 0.1 percentage points from 3.55% in August last year.

The market views that China's gross domestic product (GDP) growth rate in the first quarter reached 5.3%, exceeding domestic and international forecasts in the high 4% range, boosting confidence in economic recovery. This reflects expectations that urgent intervention by monetary authorities is unnecessary and that the current recovery trend in domestic demand and exports can continue.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.