SK Hynix Q1 Earnings Expected to Increase

Samsung's Expectations Grow for Nvidia HBM Supply

Positive Outlook for HBM and AI Despite Market Concerns

SK Hynix is expected to have recorded an operating profit in the range of 1.8 trillion KRW in the first quarter, driven by key products such as High Bandwidth Memory (HBM). Despite recent concerns about an AI bubble and worries within the HBM industry, the demand and market size related to HBM are anticipated to grow, according to industry evaluations. Not only AI servers but also the outlook for upstream industries shows an upward trend.

According to the semiconductor industry on the 23rd, SK Hynix is expected to have increased both sales and operating profit ahead of its first-quarter earnings announcement scheduled for the 25th. Financial information provider FnGuide aggregated securities firms' forecasts and reported that SK Hynix's first-quarter sales are expected to reach 12.1575 trillion KRW, a 138.94% increase compared to the same period last year. Operating profit is projected at 1.8551 trillion KRW, likely expanding after turning profitable with 346 billion KRW in the fourth quarter of last year.

Inside and outside the industry, it is believed that SK Hynix achieved these results by increasing sales of high-value-added DRAM products such as HBM for AI and Double Data Rate (DDR)5, as well as successfully turning NAND flash profitable. Kim Seok-woo, a researcher at Meritz Securities, said, "Seasonal demand is expected to increase from the second quarter," and forecasted, "SK Hynix's operating profit will expand from 4.2 trillion KRW in the second quarter to 6.6 trillion KRW by the third quarter of next year."

As the memory market recovery becomes visible and the effect of HBM grows, Samsung Electronics is also expecting to expand its HBM business. Industry insiders predict that Samsung Electronics, following SK Hynix and US-based Micron, could supply HBM3E to major US player Nvidia, a significant buyer in the HBM market, earlier than expected in the second quarter. Market research firm TrendForce stated, "(Samsung Electronics') HBM3E verification will be completed soon," and predicted, "Samsung Electronics could reduce the market share gap with SK Hynix and reshape the competitive landscape."

Recent concerns regarding the HBM market need to be monitored. The stock prices of major semiconductor companies such as Nvidia have fallen, sparking debates about an AI bubble. Consequently, the stock prices of Samsung Electronics and SK Hynix, which produce HBM, have also experienced recent declines. Additionally, as more companies join the HBM market, which was virtually led by SK Hynix, there are forecasts that intensified competition could lead to price drops for HBM products.

The semiconductor industry interprets that the high attention on AI may have caused expectations to be excessively reflected in stock prices. However, since demand for AI semiconductors continues to grow, the market potential for HBM, which is used alongside them, remains significant. Typically, when a new generation of DRAM products is first introduced, prices are high but later decrease, leading to increased market usage and sales volume; a similar trend is expected for HBM.

An industry insider said, "Whenever there is a hot topic, investments pour into AI-related companies, causing some bubble," adding, "Combined with interest rate issues and geopolitical risks, there have been many factors causing stock price volatility." However, the insider also noted, "Industry outlooks on AI semiconductors and infrastructure markets remain positive," and predicted, "Although many companies are currently considered AI beneficiaries, this correction phase will help distinguish the major players and solidify their positions."

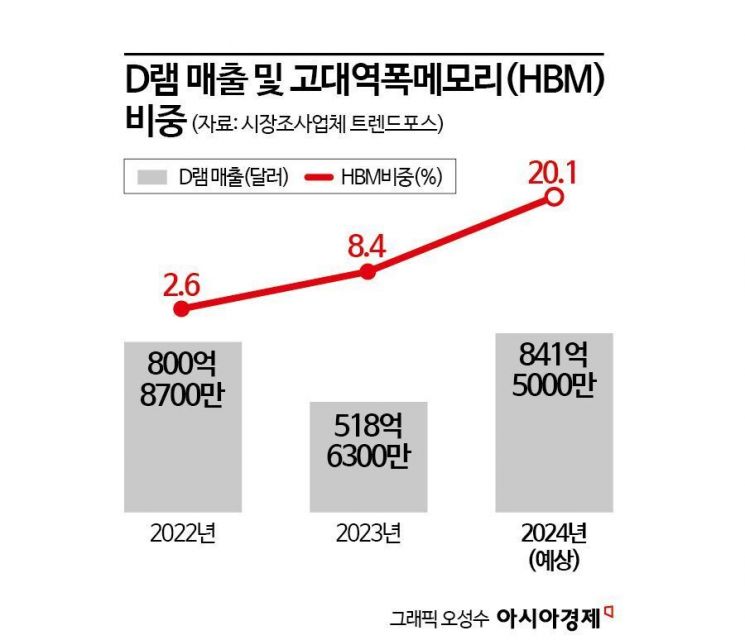

The Deloitte Group recently forecasted in a report that AI semiconductors will account for 11% of the total semiconductor market ($576 billion) this year. In particular, the generative AI semiconductor market size is expected to grow from over $50 billion this year to between $110 billion and $400 billion by 2027. The HBM market is also expected to expand. TrendForce projected that the DRAM market size will reach $84.15 billion this year, with HBM's market share rising to 20.1%, more than doubling from 8.4% last year.

Positive outlooks for the upstream market have also emerged. Shinhan Investment Corp. explained, "Although AI and semiconductor earnings face short-term skepticism, the performance momentum of platforms purchasing AI servers and chips upstream is soaring." They added, "Improvement in platform earnings is a factor that encourages the extension of the AI capital expenditure (CAPEX) cycle." With the upcoming earnings announcements from big tech companies, which are core to AI demand, there is an expectation that positive comments related to CAPEX could alleviate related concerns.

Demand for AI servers is increasing. Dell Technologies, the world's number one server market company, announced that AI server orders in the fourth quarter of fiscal year 2024 (November 2023 to January 2024) increased by about 40% compared to the previous quarter. The AI server backlog (orders received but not yet shipped) stands at $2.9 billion, nearly doubling from the previous quarter. A server industry insider said, "We feel that corporate interest and investment in AI are not decreasing but rather growing," and predicted, "The AI server market will grow even larger this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)