Five Major Insurers' Auto Insurance Loss Ratio at 79.2%... Up 2.1 Percentage Points Year-on-Year

Impact of Premium Reductions, Weather Deterioration, and Increased Outings

In the first quarter of this year, the loss ratios of automobile insurance for major non-life insurance companies worsened compared to the previous year. This is attributed to factors such as last year's premium reductions and an increase in outing travelers.

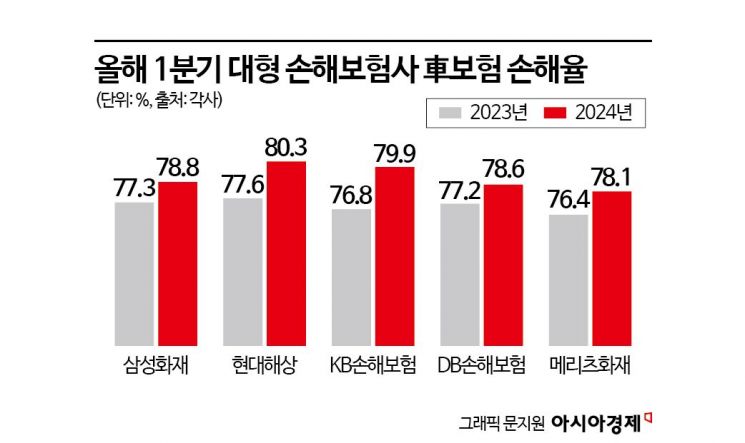

According to the non-life insurance industry on the 22nd, the average automobile insurance loss ratio (simple average of 5 companies) of the five major companies?Samsung Fire & Marine Insurance, Hyundai Marine & Fire Insurance, DB Insurance, KB Insurance, and Meritz Fire & Marine Insurance?was 79.2% in the first quarter of this year, up 2.1 percentage points from 77.1% in the same period last year.

The loss ratio is the proportion of insurance claims paid to victims in the event of an accident out of the premiums received by the insurer. When the loss ratio worsens, the insurer's profits decrease and losses increase. The non-life insurance industry considers a loss ratio of 80% as the breakeven point for automobile insurance.

Looking at the first quarter loss ratios by insurer, all showed an increase: Samsung Fire & Marine Insurance (77.3→78.8%), Hyundai Marine & Fire Insurance (77.6→80.3%), KB Insurance (76.8→79.9%), DB Insurance (77.2→78.6%), and Meritz Fire & Marine Insurance (76.4→78.1%).

Among the nine non-life insurers selling automobile insurance, MG Non-Life Insurance recorded the highest loss ratio in the first quarter at 109.1%. Meritz Fire & Marine Insurance had the lowest loss ratio at 78.1%. As of March, MG Non-Life Insurance's loss ratio was the highest at 91.6%, while Hyundai Marine & Fire Insurance was the lowest at 74.8%. An industry insider said, "Last month, the increase in traffic volume and accident cases due to the 3.1 Independence Movement Day holiday and cherry blossom festivals led to a rise in the loss ratio," adding, "There are concerns that the cumulative effect of premium reductions will reduce premium income and cause the overall loss ratios of non-life insurers to rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)