Will Loan Interest Rate Burden Increase?

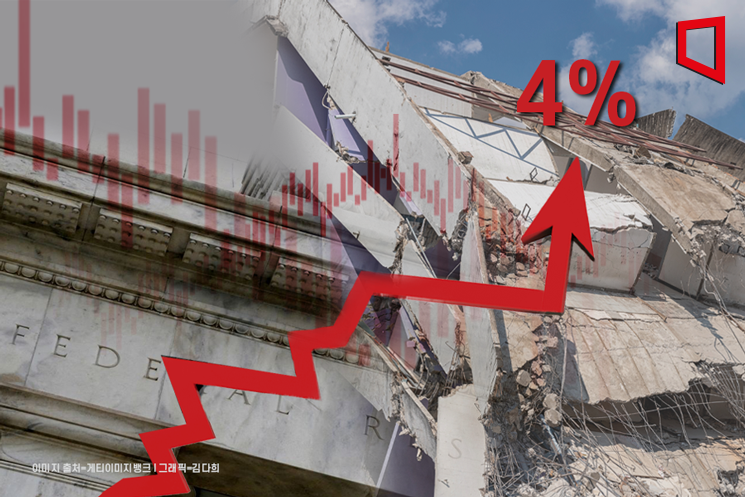

Bank bond yields are heading back toward the 4% range amid strong external pressures. This is due to the military conflict between Iran and Israel and the delayed interest rate cuts by the U.S. Federal Reserve (Fed). As bank bond yields rise, domestic loan interest rates, which had been declining, are also expected to either increase or remain flat for the time being.

According to the Korea Financial Investment Association on the 23rd, the yield on 5-year bank bonds was recorded at 3.905% as of the 19th. This is an increase of 0.174 percentage points compared to early this month (3.731%). The 5-year bank bond yield is generally used as a benchmark interest rate for fixed (or mixed) type mortgage loans. Therefore, the rise in bank bond yields can lead to an increase in loan interest rates.

The 5-year bank bond yield had been soaring, reaching 4.733% as recently as early November last year, but it steadily declined after the Fed hinted at possible rate cuts in November. Since the beginning of this year, except for late February, it had hovered around 3.7% to 3.8%. However, the upward trend has become more pronounced since mid-month.

Despite high interest rates, household debt has risen to a record high as mortgage loans increased by more than 15 trillion won. On the 21st, a banner related to apartment group loans was hung at a commercial bank in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

Despite high interest rates, household debt has risen to a record high as mortgage loans increased by more than 15 trillion won. On the 21st, a banner related to apartment group loans was hung at a commercial bank in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

The main reason behind the rise in bank bond yields is the influence of external factors. The U.S. March Consumer Price Index (CPI) and retail sales significantly exceeded market expectations, leading the Fed to signal a delay in rate cuts. Additionally, the military conflict between Iran and Israel and the ongoing Middle East tensions have not subsided. The U.S. 10-year Treasury yield, which had maintained a level of 4.0% to 4.4% this year, has shown a clear upward trend since mid-month, reaching 4.6540% as of yesterday afternoon.

Consequently, mortgage loan interest rates, which had been declining for some time, are now showing a slight increase. Banks are slightly raising loan interest rates to manage household loans, and external pressures are also having an impact. The fixed-rate mortgage interest rates at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) ranged from 3.22% to 5.62%, showing an increase of more than 10 basis points (1bp = 0.01%) on both the lower and upper ends compared to early this month (3.05% to 5.73%).

As expectations for interest rate cuts have somewhat calmed, financial consumers face more complex choices. According to the Bank of Korea, the proportion of fixed-rate mortgage loans among new loans at deposit banks, which was only 39.7% in November last year, has steadily increased to 49.7% in February. During the same period, the share of variable-rate loans declined from 60.7% to 50.3%.

A representative from a commercial bank said, "Although the possibility of rate cuts in the second half of the year is still higher, some speculate that due to the U.S. economic boom, the presidential election, and the resulting inflation intensification, rates might actually rise." He added, "Rather than having vague expectations that rates will 'go down,' it is necessary to make loan decisions considering future uncertainties and the recently activated refinancing loan infrastructure."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.